Calculation of Pension

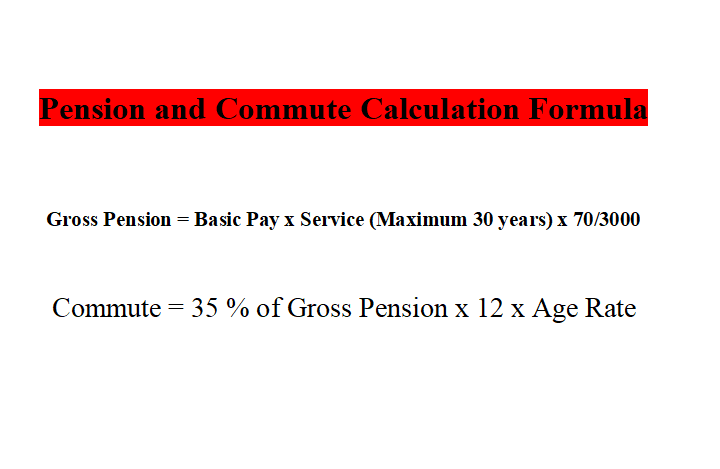

The calculation of Pension and Commute is very simple. An employee can calculate his/her pension and commute himself/herself. The main things in pension calculation are basic pay and total service at the time of retirement. The formula for pension calculation is as under:

Gross Pension = Basic Pay x Service (Maximum 30 years) x 70/3000

If you don’t want to calculate the pension and commute manually, then you can simply use the Pension Calculator 2019-20 and this calculator is updated every year just after 1st May after the revision of pay scales or increase in pension and adhoc allowance.

Basic Pay

The basic pay is taken the pay at the time of retirement the individual is drawing. If an employee retires from service on 1st June or after it then 1x Usual Increment is added in his/her basic pay for the pension purpose only. If an employee is drawing PP (Personal Pay), it is also included in his/her basic pay. Same is the case with Special Pay.

Service

The maximum length of service for the pension purpose is 30 years. If an employee has a service more than 30 years then only 30 years service is considered for the pension purpose.

Ordinary Pension

Here is to mention that 65 % of the Gross Pension is taken as Ordinary Pension and the remaining 35 % is taken for the Commute purpose.

Ordinary Pension = Gross Pension x 65 %

Calculation of Commute

Use the following formula for the calculation of commute.

Commute = 35 % of Gross Pension x 12 x Age Rate

Don’t Forget: Calculate Pension & Commute in Just 5 Seconds by Calculator

Age Rates

Age rates according to the Revised Pay Scale 2001 are as under:

| Age Next Birthday | No. of Years Purchased |

| 20 | 40.5043 |

| 21 | 39.7341 |

| 22 | 38.9653 |

| 23 | 38.1974 |

| 24 | 37.4307 |

| 25 | 36.6651 |

| 26 | 35.9006 |

| 27 | 35.1372 |

| 28 | 34.3750 |

| 29 | 33.6143 |

| 30 | 32.8071 |

| 31 | 32.0974 |

| 32 | 31.3412 |

| 33 | 30.5869 |

| 34 | 29.8343 |

| 35 | 29.0841 |

| 36 | 28.3362 |

| 37 | 27.5908 |

| 38 | 26.8482 |

| 39 | 26.1009 |

| 40 | 25.3728 |

| 41 | 24.6406 |

| 42 | 23.9126 |

| 43 | 23.1840 |

| 44 | 22.4713 |

| 45 | 21.7592 |

| 46 | 21.0538 |

| 47 | 20.3555 |

| 48 | 19.6653 |

| 49 | 18.9841 |

| 50 | 18.3129 |

| 51 | 17.6526 |

| 52 | 17.0050 |

| 53 | 16.3710 |

| 54 | 15.7517 |

| 55 | 15.1478 |

| 56 | 14.5602 |

| 57 | 13.9888 |

| 58 | 13.4340 |

| 59 | 12.8953 |

| 60 | 12.3719 |

| 61 | 11.8632 |

| 62 | 11.3684 |

| 63 | 10.8872 |

| 64 | 10.4191 |

| 65 | 09.9639 |

| 66 | 09.5214 |

| 67 | 09.0914 |

| 68 | 08.6742 |

| 69 | 08.2697 |

| 70 | 07.8778 |

| 71 | 07.4983 |

| 72 | 07.1314 |

| 73 | 06.7766 |

| 74 | 06.4342 |

| 75 | 06.1039 |

| 76 | 05.7858 |

| 77 | 05.4797 |

| 78 | 05.1854 |

| 79 | 04.9030 |

| 80 | 04.6321 |

Madam Shumaila please guide me about my pension and commutation and minimum pension.

DOB= 06-06-1961

DOA= 14-10-2009

DOR= 05-06-2021

LBP Rs.20490/-

Qualifying Service is 12 years.

Age 60 years

BPS 11

Mam please tell me what will be my pension and how can i get minimum pension benefit.

Kindly email me all these details.

Respected Madam, i m working as Teacher BPS-19 in Cadet College which follows Sindh Govt Rules. my request is that i wish get early retirement. therefore, kindly tell me about my pension and rest benefits. my particulars are as under:

Associate Professor BPS 19

Date of Birth: 02-02-1971

Date of Appointment: 15-01-2001

Date of Retirement: 15-01-2024

current Basic Pay: 89710

Last Basic Pay: Rs.104710 till 2024

Usual Increment: Rs. 3005

Total: Rs. 23250

You can use the formula that I shared /Uploaded on my website.

Sir, It is submitted that voluntarily I retired on Retiring Pension after completing 26 years of service at the age of 51 years.I have completed 22 years of my retirement.

Kindly let me know if I am eligible to apply for restoration of my Pension after 22 years of drawing my pension.

My relevant particulars are given below ;-

Department ; Pakistan post Office

Date of Birth ; 20-06-1047

Date of Retirement; 19-06-1998

Length of Service ; 26 Years

Class of Pension ; Retiring

BPS ; 17

Gross Pension Calculated ; Rs. 4051.00

Commuted Portion ; Rs. 2025.50

Net Pension Payable monthly ; Rs. 2025.50

Commutation Calculated ; Rs.536331.33

Present Monthly Pension ; Rs. 29540.00

As per my estimate in /2022/2023ur pension will be restored.

salam, here anyone have new age rate table or new commutation rate table, if yes than kindly share it

Dear Mam!

If a person serve less than 1 year in previous organization as regular service and join another appoint through proper channel, his/her previous service less than one year (i.e on probation) can counted towards pension contribution or not? please guide me with rule reference.

Regards

Muhammad Arif

Yes it is countable

if a person dies after retirement before getting pension then his family pension will be calculated with 25 & 75 % or with the ratio 35 & 65 % please?

how i can found age rate with out table

please guide is this regard

thanks

AOA MADAM. If I donot take commutation than what will be my total pension??

date of birth 15.09.65

date of appointment 16.11.85

date of retirement 1.7.2020

basic pay 36000/-

AOA. MADAM . if i do not want to take commutation then what will be my total pension ???

DOB : 15-09-1965

DATE OF APPOINTMENT :16-11-1985

DATE OF RETIREMENT :05-07-2020

BASIC PAY :36000/-

I retired from wapda on 3-8-2007 .My salary was Rs.35030.00 in BPS 19. kindl calculate my yearl pension upto 1-7-2017 and commutation.

my faTher waS was lesco employe. died during service.

BPS 9

DOB 12 SEPTEMBER 1958

Date of joining 15 oct 1979

date of death 2 sep 2017

and basic pay is 30750

B.pay 27580.BPS 09 DOB.20.05.1970. DOI.01.11.1990 DOR.31.08.2018.Maher Shahid plz tell me how much I get the pension and commutation

Dear,

I served in a private limited firm almost eleven years. Can I eligible to get pension through EOBI.

Regards.

Tauqeer

Dear,

I have served in private limited firm and my monthly contribution was sent to EOBI till June,2017.

My service period with this firm was almost eleven years. Can I eligible to get pension through EOBI.

Regards.

Tauqeer Akhtar.

Federal govt.BPS.09 .BASIC PAY 28560. DOB.20.05.70. DOA.01.11.90.DOR.01.07.18.PLZ TELL ME PENSION AND COMMUTATION.

Dear Mahar just use the following link to calculate the pension.

http://www.glxspace.com/2017/07/17/revised-pension-calculation-sheet-2017-effect-01-07-2017/

Mahar Shahid dear sir I am searving at Fed govt BPS.09 DOB.20.05.70. DOA.01.11.90. DOR.01.07.18. Plz tell me obout net pension and commutation.

great, thanks for your early reply

i have already three time requested but still no reply. this is last time request pl inform my pension an commute

federal govt employee

grade 16

current basic pay 55390

date of birth 20-03-1961

date of appointment 05-02-1986

date of retirement 01-07-2018

Dear K Aziz the estimated details of you rpension and commute are as under, as there will be further change in pension, pay and commute with effect from 01-07-2018:

Gross Pension 39837.00

65% Pesnion 25894.05

35% Pension 13942.95

Commute 2247715.08

Pension without Medical 38733.94

Medical 6473.51

Net Home Take Pension 45207.45

federal govt employees scale 16 basic pay 55390 total service 31 years date of appointment 05-02-1986 date of birth 20-03-1961

pl inform net pension and commute

pl inform urgently pension an graguity ;

federal govt employees

grade – 16

basic pay 53870

service 31 years

date of birth 20-03-1961

date of enrollment 05-02-1986

Dear Khalid just get help from this post:

http://www.glxspace.com/2017/07/17/revised-pension-calculation-sheet-2017-effect-01-07-2017/

pl inform me urgently my pension and commutation as per following criteria ;

serving federal govt of pakistan

current basic pay ; 53870

date of birth ; 20-03-1961

current age ; 57 years

grade ; BPS – 16

total service ; 31 years

date of enrolment ; 05-02-1986

AOA. Any body tell me why GOP fixed the qualify service as 30 years?

Koi Athar Naeem ko batai ga kuin 30 years age hay?

so that extra burden on the national exchequer is avoided.

salam ser can you help me abut penson

Dear SIr,

My father retired on 16.01.1987. Date of birth 09.01.1941, The Gross Pension was 1167, half commuted 538,residual 538, Date of death 31.03.2016. Pension restored on 16.01.2012. Last drawn pension 17,385, now ordinary family pension calculated by the relevant Sub Pension Office is Rs.7888/- (45%) of last drawn pension of the deceased. My question is, whether the said office rightly calculated the pension, 75% Pension as per OM of Finance Division dated 5.07.2010 be calculate on gross pension i.e 1167 or net pension 538, and whether annual increment net pension only or at the rate of Gross Pension

Kindly help me

Thanks

Sadiq Nawaz

0331-5094639

If a person retires medically on june 10,2017…will he enjoy budget beneifts ??..plz reply

Dear Shumaila

I want to know about medical leave .Will the medical leave deducted from annual leave? Please reply. Thanks

Dear Majeed Medical Leave will be deducted from the annual leaves i.e earned leaves.

Can you explain the procedure how to calculate the pension of a pensioner who did not opt pay scale of 2001 and the accepted 1994 payscale.

Dear Salam … i need help

My father is in education department sindh

SO plz tell me commite and pensio n

Basic pay 82500

Lenght of service 31 years

AOA. I was upgraded from Dispensar bs-6 to pharmacy tech. Bs-12 on 24-11-2011. My pay was refixed as under. Pay on 23-11-2011 in bs-6=13140 pay on 24-11-2011 in bs-12=13500 next increment due on 1-12-2012. My query is wether one premature increment was granted in said refixation or not if not how my pay was to be refixed. Pl guide early as my pension case is in due process.Regards

AOA. I was upgraded from Dispensar bs-6 to pharmacy tech. Bs-12 on 24-11-2011. My pay as refixation was as under. Pay on 23-11-2011 in bs-6=13140 pay on 24-11-2011 in bs-12=13500 next increment due on 1-12-2012. My query is wether one premature increment was granted or not according to above refixation if not how should my pay was to be refined. Pl guide early as my pension case is in due process.Regards

AoA

I apply disable pension through medical board

DOB 11_4_1982

Date of appointment 10_2_2007

Bps 7

Basic pay 12790 (punjab police)

Kitne pension ho gae or commute kitna mile ga

Bhai apni pension aur gratuty ky bary main batain gy kitni mili…..

I am also trying for retirement after 10 years….

Dear mam,

What is the difference of

Net pension without allowances and with allowances

What are these allowances which are added in net 65% pension to take home pension??

Dear Sir,

My Mother was getting pension of Rs.13,588. then she applied for online pension, now she is getting Rs.10,800 pension per month. i want to ask you please tell me how is this possible? that i person who was getting 13588 but after applying online pension process they reduced her pension and saying, she was getting more pension then actual. Question is ? How? Are they bankers were MAD? how they prepared more pension then actual. please guide me what should i do for getting the same pension as she was getting earlier. i spoke so many times to the Account officer but every time he is not answering in a well manner and with justifications.

salam. mera bhai hy wo medical board par retier horaha hy, or os ka serves 14 saal hy os ka kia farmula hy?

Civil or belt?

Dear Sir/Madam, Aslamo-Alaikum. Our institution Pension now decided as Federal Govt Rules under Min of CAD. I retired on 04-04-2011, Service : 21 yrs 10 months 29 days. Age : 60 yrs

BPS-11

Date of Birth 05-04-1951

Date of Appointment 15-5-1989

Date of Retirement 04-4-2011 on completion of 60 years age

Last basic pay 9,890.00 (excluding others i.e adhoc relief,etc)

Please tell me about net pension, commutation and arear of pension from 05 April 2011 to to 31 Jan 2017.

Thank you very much

Dear Mamdam! Plz batana k agr koi Federal Govt servant 1st June ko retire ho to us ki B.Pay main aik increment shamil kar k us ki grass pension banaee jay gi jab k us malazim ne last 6 months service main one month E/Leave be avail ki ho.

Asalamoalaikum sir ye GP fund kaisay check ki jati hy.

Madam! Question k baad kitne din tak reply aa jati hai ?

Dear aslam o alikum meri total b pay bashmol increament 2016 Rs 32740 ha mari total service 27 year ha aur meri age 50 year ha main bps 12 se retired hoa hon meri pension aur comu bta den please . Ap ka page buhat regular dekhta hon ap ka buhat mashkor hon ga . DOB 01-01-1967 ha Date of ap 21-08-1989 aur date of retirement 31-08-2016 ha

AOA. Dear Madam! your service is very well for the Govt employees….

My Q. 25 years 06 months service 26 years count ho gi….ya 25 years for the purpose of pension.

26 year service will be counted.

A.O.A

can body help me to calculate the in service death

1.pension case

2.Commute

3.All other financial benefit

Clerk BPS -11

Basic pay. 25000

Net pay. 38000

service 30 years

Age 54 years..

Kindly tell me whether adhoc relief (increase in pension) in case of family pension (federal govt) shall be calculated on gross pension or net pension prior to 1999

respected madam,

mere papa ki death 57 years ki age m 26 oct 2016 ko ho gyi wo canara bank m karyaraat the. kya bank m mujhe unki jagah job mil skta h or meri mummy ko kitni pension milegi plz btayen

dob- 30-01-1959

date of appointment-30 july 1984

Dear Shumaila Kamal Sahiba,

I retired from PAF wef 1-1-1995 on completion of 25 years of service, My date of birth is 1-1-1951.

Please let me know when I will be due for full pension.

Shell I be entitled for 50% commuted pension equal-ant to my running pension.

Thanks and regards,

Khurshid

Sir mera walid 30-11-2016 ko retire ho rah hai aur us ke pension papers countersignture ke liye ajj behjen hain to wo office wale nahi le rhey hain is ke liye koi pension rule hai to ye meri mail p behj dain thanks

Madam my father was a pst but he died in service .qualifiying service 30 year and basic pay is about 25000.so much his pension.and if u know the other packages or financial assistance payable to the family so plc guide me

I need to know rule/policy as well as how to calculate commutation/pension of :

– Regular (unconfirmed)

– BPS-18 (Basic Pay 65490)

– 15 years of services in public sector organization in Pakistan.

– Date of Birth (31-08-1956)

– Date of Joining (01-04-2002)

– Date of Retirement (30-08-2016)

is it possible i draw full pension without cumutation

BS-16 ,basic pay 44000 age 57 years

Bs-16 Basic pay 44000 ,apoinment 1980 ,retirment 2016 , pension and cmmute?

Assalam o alaikum,

Meri mother BS-16 ki teachr hain 1980 ko apointment hui date of birth 1959 he Basic pay 44000 he Retirment 2016 kitni pension and commute bny gy

kya armd force kay liay ya formula istimal hota hai

Salam Sister

I state that my Father died on 14 june 2005 during service in bps-18 in Education department.My mother is taking pension since then I want to know that is she eligible for the new pension decision 50 to 75% or not.

Regards

Hamid

Dear Hamid, according to my knowledge it is 75% pension that ur mother getting.

mam, i have no received Group insurance and Financial Assistance till now, i have received just Gratuity amount,

mam , i am very much upset so please reply me as soon as possible , i want to talk by mobile so please send me your mobile number at my ID [email protected].

Aslam o Alikum. Respected mam,my case is relate to pension. i am govt servant , i am 33 years old , i am divorced . my father during service had been expire . my divorce year is 2009 even my father died in 2011. can i legible for pension ? pls solve my problem , i have need related documents. i will be very thankful to you so much

Dear Aneela, just email to Mr. Amir agha for the detail of the same. His contact detail is available at this site under the heading “Contact Us”

I mean leave encashment at age of 60 years =basic payx365 days or basic pay with allownces.

Dear Abdul Samad only basic pay. Basic Pay x 12 if 365 days leave in credit.

Dear Madam,At present I want to know that Leave encashment on retiring at the age of 60 years, retired official only basic pay and allownces or only basic pay.Leave accont certificate shows that 365 days leave encashmet with full pay in lieu of LPR is admissible.

Aslamo-Alaikum.

My father was a High School Teacher his particulars are:

BPS 19 (Time scale)

Date of Birth: 20-08-1954

Date of Appointment: 10-05-1980

Date of Retirement: 19-08-2014

Last Basic Pay: Rs.31000.

Please tell me about net pension and commutation.Thank You Very Much!

Dear Shoaib the pension and commute detail is as under:

Commute 1185772.38

Net Pension 31894.95

Let me know whether an any employee can be allowed pensionery dues beyond the services rendered above the 60 years. If not, under what circumstances and grounds. please quote notifications/circulars/guidelines/ orders issued by the provincial government of Sindh, Pakistan. Thanks.

Dear Shaaban, plz email to Mr. Amir Agha for the details of the same.

Dear Madam.Assalam o Alaikum.phley bhi ap ko send kr chuka hoon mgar jawab nhi mla hey.Merey teacher ney razakarana retirement 12-4-14 notification key lia ak mah phley kase DEO.Faisalabad dftar bheja lekan 19-5-14 ko teacher wafat pa gia.teacher ki bevi ney 27-5-14 ko DEO ko drkhast de ke merey khavnd ki razakarana retirement drkhast ko death retirement men tbdeel kia jai. is drkhast pr DEO ney obituary notification jari kr dia.bad men 27-7-14 ko Headmaster ney earned leave case 37 days(13-4-14 TO18-5-14), pension case DEO dftar bheja to DEO ney obituary notification waps la kr 12-4-14 sey razakarana notification jari kr dia. kia obituary notification bhal ho skta ha.is men mhkma ki ghlti hey ke teacher key fot hona sey phla razakarana notification nhi kia.is lia teacher doran e service fot hooa.please jawab jldi send kren.

Dear Saqib, Just email to Mr. Amir Agha for the detail of the same. His contact detail is available at this site under heading “contact us” Thanks

Hi,

Could you kindly tell if there was an increase in federal Govt pension from 1995 – 2003 and is % year wise, please.

1995= ________% increase in pension

1996=_________%

1997=__________%

1998=___________%

1999=___________%

2000=____________%

2001=_____________%

2002=______________%

2003=_______________%

Dear Ahmad plz email all these details to Mr. Amir Agha. U can see the contact detail of Mr. Amir Agha at this site under heading “Contact Us”.

Dear Miss Shumaila,

My question is, can a person avail Pension commutation after 8 months of retirement..i-e a person retired on 02.02.2012 and he apply for commutation on 12.12.2012..

is there specific time period under which an employee can avail pension commutation or full pension.plz advise.

thx

Dear Usman I think there is no specific time.

As Salaam o Alaikum

me aap se ye pochna chahta hon ke mere father ki death ho chuki hai unki pension mere mother ko mil rahi thi ab meri mother ki bhi death ho gayi hai.

ab government rule kya kehta hai pension kis ko milni chahiye hum 5 bhai or 4 behne hain

or sab shadi shuda hain kindly reply karden tafseel se…

Dear Nabeel agar koi brother under the age of 21 years hey to us ko pension transfer ho jai gi.

madam Shumaila Kamal I m very happy after visiting this website. You are helping in very tough problems, that are normally not explained by our clerical group.

May Allah bless u always.

Thanks Dear Muhammad Imran for appreciating mine efforts for all the employees of beloved Pakistan.

please post GPF subbscription RATES B-14 ,B-16

Dear Aman Ullah the same are available at this website. U can search the same by Typing “GP Fund” in the search engine at the top right site of this site.

Dear Sir,

My father, a retired Federal Govt employee (Pensioner) died in 2003. After his death my mother received 1/4th of the pension of my father. e.g if my father was getting Rs 10,000 / month, my mother started getting Rs 2500 /month . I searched rules and all rules say that the window of a retired govt servant who died after retirement is entitled to 50% of the pension drawn by the deceased.

Plz advise

Dear Ahmad According to my knowledge it is 50% pension. I think they are doing wrong. I suggest you to send all these details to Mr. Amir Agha whose contact details is available at this site under the heading “Contact Us”

Salam Sir,

sir actually i am civil servant and dealing Pension Section..last few days we faced a problem and didnt find any solution or rules regarding that problem..there was a person who applied for Commutation of Pension on his retirement..Due to financial Crunch, our dept was not able to pay his commuted amount..Then he filed a case in Federal Ombusman(Wafaqi e Mohtahsib) claiming that he dont need any Commutation and the Commuted amount should be restored in Pension i-e (after commutation it was Rs. 10,000/- and wihout commutation it was Rs.14000/-)..after that his Surrendered portion was restored ie- Rs.14000/- Now he again submitted an application that his pension should be commuted..

my question is after all this scenario, Can his Pension is again Commuted,Kindly plz give the reference of Rules..

Waiting for ur reply..thx so Mch

Sorry it was Public Servant..

Dear Usman, I have not the copy of the concerned rulings. However I think these might be available in ESTA CODE.

AoA. Agr koi 10 saal service krne k baad chorh day. Tu kiya ussy koi benefit mile ga.

Dear Ghulam Shabbir “No”

Respectable Madam

What is pension formula for the employees who retired before introduction of scales 2001 please.

Dear Hadayat Ullah prior to 01-12-2001, there was ratio of 50/50 for pension and gratuity.

Dear Sister Shumaila,

I am pleased to see your valuable efforts; may I ask a question regarding formula you mentioned in other related link i.e.

Gross pension = Basic pay X Service years X70/3000.

In case of death during service what value will be assumed for SERVICE YEARS

Details are

Basic 15000

date of birth Nov/1967

died in Sep/2012

Number of service 25years

Dear Waqar, plz email me all these details.

A.A.when will the Lab/Asstt be upgarded?because all of teachers,clerks and class IV servants have upgraded but only the lab Asstt were left un- upgraded

Dear Muhammad Faridoon, kuch bhi nahi kaha ja sakta. As there are no updates in this regard.

Dear Madam Assalam-o-Alaikum,

Masha Allah ap k comments perh kar mery ilm men buhat izafa hua aur buhat khushi hui k ap accounts matter men buhat expert hen,

madam men bhi as accountant cid mirpurkhas sindh reh chuka aur meri koshish hy k phir kahen posting ho dua ki jeay ga

men ap sy waqt ba waqt guidline k ley rabta karon ga please help kejeay ga

Thanks Dear Khalid Hussain for appreciating mine efforts for the employees and you are always welcome.

Salam Sister,

Mere abu Sindh Govt ke emloyee the un ki death 1997 me during service hoi thi jis ke bad meri ami ko family pension milti thi 2008 me meri ami ki bhi death hogai to fer wo pension meri chhoti sister ke nam tranfer hoi jo un married he ab ye bat ap se pochni he ke agar meri chhoti sister ki shadi hojaye to wo pension kya mere chote bhai jo 19 years ke he aur unemployee he study ker raha he us ko mil sakti he ya nahi

Dear saeed, pension 21 years age tak transfer ho sakti hay. he is still 19. It means you can transfer the pension in his name now.

Thanks Sister ke ap ne rply kya ap ne kaha 21 years tak lekin kisi ne bataya tha ke 24 years tak plz agar kisi se confirm ho saky to mehrbani hogi aur dosra ye ke 21 ya 24 years ke age ke bad chhoty bhai ki wo family pension band ho jaye gi?

Dear Saeed I ll confirm it again. The pension will stopped at the prescribed age. Thanks

Assalam o alaikum:-) plz calcute the amount of pention and othr fring benift my basic pay is 61000 age 60 yrs retird on 2 nd agst 2014 in grd 19 total srvc 35yers and 10 months and 22 days plz help me i wl thnkful

Basic Pay 63000

Total Service 30

Age Rate 12.3719

Ardali Allowance (if any) 0

RESULTS

Gross Pension 44100.00

65% Pesnion 28665.00

35% Pension 15435.00

Commute 2291523.32

Net Pension 61637.49

Dear Sir/Madam,

AOA. I would like to enclosed herewith my particulars as under;-

I am in scale 19 and I upgraded by the institute in grade 20 through notification dated 13-08-2014. I am at the last stage of my pay scale .e. Rs. 63000/-. Kindly advised me either I join my duties during this current month of August 2014 or to join my duties on 02-12-2014, in order to avail one annual increment through personal pay scale. Is it possible, kindly communicate the details please.

Thanks

Dear Bashir Ahmad, You will join join in August but u will opt to fix the pay on 2nd December after availing annual increment in the previous scale.

Dear

my father was Punjab (PAK) govt servant. he died during his service at age of “54”.

his basic pay is “50000”

Date of Appointment: 27-01-1985

Date of Death 08-01-2014

service period 28 year 11 months 11 days

can you please calculate pension and graduaty

Regards, Nasir mehmood

Dear Nasir, plz email me all these details as I have to set the new formula for death cases and I ll reply you soon Thanks

AoA

– if i don’t want to avail my LPR after completion of 59 yrs of service

– my question is, can i take one year full current pay or current basic otherwise what is rules

Dear Khalid, in LPR all pay and allowances except Conveyance Allowance are granted. You can also get the leave encashment if ur service is more than 30 years or 30 years. You will get all the pay and allowances if you continue ur service and after retirement you will get the Leave Encashment that is Basic Pay. Thanks

AoA

– presently, i am working as stenotypist since 5-1-1991 ( now i m in selection grade -14) and my present basic pay is Rs 23860/=. i was passed my FA exam in 1986, i would like to ask about my two qualification increments (as was announced by the Nawaz Sharif Govt in 1998)

– my question is, can u guess that my two qualification increments as FA base are included or not in my present basic pay as Rs 23860

Dear Aziz, I cannot guess the same. U can see the detail at your service book whether these are added or not?

dear

i am appointed as a lecturer BPS-18 in university in 2014….my pay scale is 20,000-1500-50,000.

plz tell me, will i get pension bcz someone told me that after the year 2012 the new govt employees will not get pension….

if it is true than what other benefit we have?

thanks

plz mail me on [email protected]

Dear Muhammad Ali, It is a false news, still no such news/notification has not been issued by the Govt.

ok thanks so what will be my take home salary in govt uni as lecturer BPS18? 48,000 or more…?

plz also give one more information at time of advertisement pay structure was 20000-1500-50000 but after budget 2014-15 it is 20000-2000-50000…so will it be applicable to me as well

Dear Muhammad Ali, The correct amount is 20000-1500-50000. There may be some deductions but me not confirm. However the gross salary will be estimate Rs. 49000/- PM

Jazak Allah

Allah Apky naseeb achay karay..Aameen

Thanks dear Muhammad Ali for praying for me.

Dear madam,

Hope you are fine and doing well. I am having a problem in finding the download link for Pension and commutation Calculator. I can’t find the link mentioned above… Please help me in this regards.

Best

Ayyaz

Dear Ayyaz u can download the same formula from this link;

http://www.glxspace.com/2013/12/24/pension-commute-calculation-along-increases-pension-various-years/

my service is 17-11-01, basic pay is Rs.19,000/- BPS-15 plz anyone tell me

my basic pay is 19,000, my date of birth is 26.06.1972, designation is stenographer BP-15, date of appointment is 22-08-1996, plz any one can calculate my pension and graduity

Dear Rizwan u calculate ur pension and commute after 25 years service.

let me my home take pension commutation

Aa madam.my father is retired honary captain from army. BASIC PAY.16980 Date o f birth .1-6-1960 DATE OF JOING.5JUNE 1977. Date of retirement.28-9-2009 TOTAL SERVICE.32 YEARS 3 M 23 DAYS AGE at retirement.49 year 3m 28 days. Madam confusion hae.pension and commute bata deen thanks

Dear Mazhar I m not confirm whether this formula is used for Army Personals or not.

Galaxcy world

Dear Madam according to notification FD-SR-III-4-72/99 dated.27-7-1999 (25 % pension increase net or gross pension) please clear to me.

Dear Shahid plz email to Mr. Amir Agha. Go to CONTACT US at this site and find the email ID of Mr. Amir Agha.

Dear Brother,

I also have some confusion, please calculate this BPS 16

Total Service is : 41 Years & 6 months, No of Leaves used :55 days in whole service

Joining Date: 1-6-1973

Retirement Date 3-12-2014

Gross Salary : 47000

Basic Salary: 27000 on retirement

Present Day Basic Salary : 25200

Please calculate my Encashment of Leave Preparatory to Retirement , Commutation , Graduaity , Pension and other payables to me or any other benefit.

Dear Ahmad Saleem your Basic Pay will be Rs. 26000/- then the detail is as under:

Commute 945708.04

Net Pension 23017.63

dear shumaila need a little favor , can u plz tell me the minimum service limit for pension . in defence forces navy , i shall be very gratefull to u .. my cell no 3142314129.. actually i was dissmissed from service after 17 years due to power leave , i just want to know i eligible for pension or not …

Dear Sultan, mujhay minimum service for pension for armed forces is not confirm.

BPS:12

Last basic pay:16000

D-O-B: 01-07-1967

Date of appointment:17 may 1989

Date of retirement:17 may 2014

Total service:25 years.

I am servant of Punjab government in education department ( PTC Teacher)

what will be my monthly pension and my total commute ?

Please guide me what is the better way to retire, leave encashment or LPR…?

Dear Shumaila kamal please guide me. i shall be very thankful to you.

Best Regards,

M Sajjad nawaz

Brothers, i got retired on 15th February 2009 on completion of my 60 years age and 32 years service as a Superintendent jail,in PB 18,at present i am getting Rs 37773 per month pension,but i m not satisfied of Bank calculation,it is correct amount, i m getting,please help me in this regard bcs i cant approach A.G office due to some reasons.

Dear Madam,

I have just cleared my test and interview for the of Lecturer Commerce BPS 17 from Sindh Public Service Commission.

Interview result announced on 7th of May, but I have not received offer Letter so far.

can you investigate and let me know:

1) When offer letter will be received?

2) Total home take of BPS 17?

3) besides MCOM I did MBA in HR, double masters degree holder get any additional allowance?

3) My Mphil expected to complete within a year, then what will be the added beneifts/grade updation or allowance?

Please help me out.

Please check my father’s stats:

Arshad Khan S/o Sharif Khan, Hon Capt. (Retired Pakistan Rangers)

Date of Birth: 20-04-1949

Date of Joining: 04-07-1972

Date of Retirement: 31-03-2003

Length of Qualifying Service: 28 Years (excluded 3 yearrs gap)

Age at the time of retirement: 53 y 11 m 11 d

Gross Pension at the time of retirement: 5458.60

Commuted portion of pension: 2183.44

Net Pension: 3275.16

Current Pension: 16704 p.m

What will be commuted gratuity?

How can we receive this gratuity?

Will there be end of commutation and the monthly pension will increase by 40% i.e Rs. 27840 p.m?

Please do reply I will be very grateful!

Dear Kashif just email all these details to Mr. Amir Agha whose detail is available at this site “CONTACT US”

Dear Sir,

I was retired on 10-12-2001 from wapda in BPS movrover-17.I was not opted the new pay scales issued on 1-12-2001.At that time my was calculated Rs-4165- now I am drawn pention Rs-22850. Because i was not opted new pay scale of 1-12-2001,my pention was in my previous scale-17.Increase in pension from 1st July 2010 was given to me 15% instead of 20%.

Please guide me;-

1- can i claim for 20% increase 1nsted of 15% from 1st July 2010 as i was not opted Pay Scale of 1-12-2001,but retired on 10-12-2001.

2-Please confirm the date& year from which i can draw my full pension. %age of my commute pension.

3-Please confirm full pension amount from witch date i can draw. year-2013,2014 or 2015.

Dear Muhammad Aslam just email all these details to Mr. Amir Agha whose details are available at “CONTACT US”.

assalamualaikum….meri date of birth 13 feb 1959 hai.date of appointment 26 march 1983 hai.provincial employe hun.scale 15 hai.basic pay 22500 hai.agar main december 2014 main retirement loon tou meri net pension kitni ho ge ar coomute?bata dain

Dear Syed Ayaz it will be animatedly:

Commute 1033201.14

Net Pension 22687.12

Dear ma’m,

My father’s service is 28 years with basic pay of 36000.

he joined paksteel at 20-71985 and he got died onduty on 27-4-2014.

what will we get in pension and grtuity.

thanks.

Dear Tariq so sad to hear Allah un ko jannat main aal maqam ata farmai aour aap ko sabr-e-jamil.just email me all these details alongwith the DOB and age of ur father at the time of death.

His Dob is 05/10/1965 and at the time of death he was 48

Ameen ma’m

His dob is 05/10/1965 and at the time of death he was 48

Dear Tariq the detail is as under:

Commute 1942617.00

Net Pension 32034.00

Thnks mam i’m lil confuse about net pension what will we get in cash i mean to say that how many cash will we get in pension with adding deductions

You are welcome Dear Tariq I have given you the detail of net pension.

Thnks once again mam

PLEASE CALCULATE PENSION AND GRADUITY

BASIC PAY 22000

SERVICE 30 YEARS

AGE 50

MY DATE OF APPOINTMENT 1-08-1984

DATE OF BIRTH 15-06-1964

Dear nasir ur pension detail at present time is as under if u r below 16 BPS:

Commute 1184478.37

Net Pension 19976.96

if BPS-16 and above then:

Commute 1184478.37

Net Pension 19476.46

Madam Shumaila.How we calculate monthly pension? give a example please.

Dear Sanaullah, just download the pension excel sheet and then after open it just scroll down u ll see all the detail. Thanks

Let me my pension and gratuity

Assistant Private Secretary

BPS-16

Date of birth 30.08.1954

Date of appointment 30.6.1974

Date of retirement 29.08.2014

Last basic pay 33600 including special pay (400) due increment also added

Special pay 400

Rate of increment 800

Dear Muhammad Qadir ur pension and commute detail if ur pay is 34400 at the time of retirement adding 1x Usual Increment, is as under:

Commute 1251244.48

Net Pension 30454.10

let me detail, how did you calculate the pension. Did you mention the medical allowance in it? Furthermore, how many adhoc relief did you mention.

Dear Muhammad Abdul Qadir, Medical Allowance is added in it. Increases in pension during 2010,2011,2012 and 2013 are also included in it.

let me my pension and gratuity

date of birth 30.9.1954

my basic pay 33600

date of retirement 29.8.2014

length of service 40 years

Dear Muhammad Abdul Qadir u did not mentioned ur scale no. Plz again with all these details.

slamo-Alaikum.

BPS 18

Date of Birth: 25-02-1955

Date of Appointment: 1-01-1885

Date of Retirement: 25-2-2015

Last Basic Pay: Rs.56000

Usual Increment: Rs. 1500

Total: Rs.57500

Please tell me about net pension and commutation.

Thank You Very Much

Dear Saqlain Awan your detail is as under:

Commute 2146029.77

Net Pension 52232.32

BAJI…ASSALM U ALIKUM

MAIN FEDERAL GOVT MAIN 7 SCALE MAIN HOON..KINDLY MARI PENSION KA PATA DAIN .BOHAT MAHRBANI HO GI…

1) (COMMUTE+ MONTHLY PENSION)

2) FULL GROSS PENSION WITHOUT COMMUTE

DATE OF BIRTH 28-09-1964

DATE OF APPOINT 04-09-1984

BASIC RS 15400/-

INCREMENT (2) RS 360X2= RS 720/-

I WILL THANKFUL TO YOU.

Dear Muhammad Tariq if you retire at present stage with 50 years age then the detail is as under:

Gross Pension 11718.00

65% Pesnion 7616.70

35% Pension 4101.30

Commute 901231.15

Net Pension 14819.81

BOHAT BOHAT SHUKRIA

madam would you please let me know the details of allowances to be included in the monthly pension e.g. if govt servant is going to retire in April, 2014 whether pension increased in earlier i.e. before his retirement will be applicable. Please detail of allowances

Dear Nawaz, pension increases in 2010, 2011, 2012 & 2013 will be included in the pension.

Merey Father ki service 34 years in Pakistan Steel basic pay 33000 date of appointment 16 01 80 date of birth 25-04 56 what will my pension and commute.Kindly yeh pochna hay pansion monthly base per aur kitnay arsay tak milti hay

Company: Pak Steel mills

Basic: 33000

Joining: 16/01/1980

date of birth: 25-04 56

Dear Ali, estimated pension and commute at present retirement will be:

If BPS-16 and above

Commute 1303366.68

Net Pension 29214.69

if BPS-01 to 15

Commute 1303366.68

Net Pension 29965.44

Merey Father ki service 34 years basic pay 33000 date of appointment 16 01 80 date of birth 25-04 56 what will my pension and commute.Kindly yeh pochna hay pansion monthly base per aur kitnay arsay tak milti hay

Dear ALi plz again email me all this detail and the Basic Pay SCale of ur father. Thanks

Is madical and gpf is include in this commute.plz tell me.thanks for ur precious time

Dear Shamim, Medical is include in this but GP Fund is a separate amount that has no relation to pension or commute.

Nasreen mumtaz and mussarat also send their figure for pension and commute kindly answer it through this mailing address

Bps 17 basic pay 43600 date of appointment 16 o1 80 date of birth 22-04 55 what will my pension and commute.

Dear Rahat Bano your pension and commute at this time retirement will be as under:

Commute 1585879.63

Net Pension 38598.80

Date of appointment 29-4-75 date of birth27-10-55 basic pay 34000 bps 17 what will my pension and commute

Dear Mussarat Yasmin your pension and commute at this time retirement will be as under:

Commute 1236695.12

Net Pension 30099.98

Date of birth 12-11-1956 date of appointment 31-01 93 basic pay 14000 bps 12 plz tell my pension and commute

Dear Nasreen if the age is 58 and total service is 21 years then at this time the pension and commute will be as under:

Commute 387060.41

Net Pension 8898.83

My date of birth is 20 4 55 and my date of oppointment is 16 01 80 .my basic pay is 40000 and I am getting personal allowence 1200 from last two years .what will my pension and commute.plz tell me .thanks

Dear Shamim your Pension detail is as under”

Commute 1585879.63

Net Pension 38598.80

date of birth is 21/2/54 my date of appointment of 5/5/82.my basic pay is 45000 and i what will my pension and commute plz tell me thanks.

Dear Ghaffar your pension and commute will be as under:

Commute 1636802.37

Net Pension 39838.21

my baisic pay is 27400 in bps 15.my age is 60 years and service is34 years. what will be my net pension and comute,

Tell me how much medical allownce for bps 15

Dear Safdar the detail of Pension and commute is as under:

Commute 996630.78

Net Pension 24880.39

my baisic pay is 18500 and my age is 60 years what will be my pension and comute and my service is 31 years

Dear Gulzar your pension and commute is as under if your BPS is less than 16:

Commute 672907.64

Net Pension 16798.80

my basic pay Rs 23860 length of service 28 years date of birth is 20-03-1961 pl tell me pension and cu mutation

Dear Khalid your net pension will be Rs. 20221.52 & Commute is Rs. 1071839/-

thanks your informative response, i have another question, if i will go on retirement on age limit (60 yrs) than what will be position of my pension and commutation

Dear Khalid just email me all the detail. Thanks

my basic pay Rs 23860 service 28 yrs and present date of birth is 20-03-1961 tell me pension and commutation on retirement at the age of 60 yrs

Dear Khalid kia aap ko pata hay aap ki pay 19-03-2021 ko kia hogi?

i think Rs 29500 on 19-03-2021

Dear Khalid, If the pay is 29500/ on 19-03-2021 in the same circumstances then ur Pension will be Rs. 26700/- and commute will be Rs. 1073014/-

Dear Shumaila AOA

Mera sawal hy ke

Pension formula ke baqi factor to sumaj ate hain liken ye last me 70/3000 jo hy ye kia hy

zaroori hy ke 70/3000 hi ho koi or hinsa nai lagta ye akhir hy kiya “70/3000” ?

Dear Zahoor, I m also not confirm but it is fixed number used in the calculation of pension and we cannot change it. Thanks

Dear Shumaila AOA

Mera sawal hy ke

“Medical Allowance” pension me kis ratio se add karte hain ku ke mujy Medical Allowance running basic ka 50% milta hy. Please inform me

Dear Zahoor Medical Allowance Pension (without increases in various years) ka 20% (gazetted) ya 2% (Nan Gazetted) lia jata hay.

Dear Shumaila AOA

Mare do (2) Sawal hy

Q1. Ye Commute kiya hota hy please is ki detal dain.

Q2. Mujy Graduati ka formula chain wo be mujy deain.

Dear Zahoor commute wo amount hoti hay jo retirement per Total Pension ka 35% milti hay. Commute aour Pension ko calculate karnay kay formulay main nain apni site per pehlay hi publish kar diay hain.

If a Person retires on year 2015 or 2016 whatever,

kia iss par previous increment apply hoga ?

e.g : 2011 mein 15% of (Net Pension – Medical Allowance)

2012 mein 20% do

2013 mein 15% do

2014 mein 10% suppose

2015 mein 15% suppose

mera question ye hy k ek person 2016 mein retire hoga to kia ye 2011 sa 2015 tak increment la ga?

Dear According to the present situation there will also these increases in the Net Pension.

if duration of service is 28 years , 6 month and 5 days

gross pension = basic pay x 28 x70/300

my question is , whether we will take qualifying service as 28 year or we consider 6 month too.

Dear Khurram we will take 29 years as qualifying service.

Dear Madam ,

I have a question regarding Next year Birthday & Age Rate

Date of Birth : 14/04/1958

Date of Appointment: 15/12/1989

Date of Retirement: 13-04-2018

Duration of Service : Years: 28 , Months: 04 , Days: 28

Q1: What will be my Next year Birthday ?

Q2: What will be the age rate from Age rate Table?

Dear Khurram Jan, ur next year birthday will be 60 years and the age rate will be 12.3719 according to this table if it is not revised upto 2018.

Dear Madam Shumaila,

My sister retired as teacher from Punjab Govt. on medical grounds as cat “A” she just got her normal retiring pension in this month. now I would like to know what other kind of pensions are admissible to her as I have heard that there will be a Medical Pension and Benevolent Pension in addition to Normal Pension and what will be the procedure for claim. your help will be great relief.

Dear Furrukh plz email me with full detail.

It means , if my Ordinary Pension is : 19167

Adhoc Relief 2011 is 15% = 2875.05

Adhoc Relief 2011 is 20% = 3833.4

Adhoc Relief 2011 is 15% = 2875.05

Medical Allowance is 20% = 3833.4

Above increments are according to KPK increses.

then my Ordinary/Net Pension will = 32583.9

am i right? if not then please kindly specify.

thanks in advance

I think it is ok.

Medical Allowance aur AR 2011 ,2012 aur 2013 ko Gross Pension sa calculate kary ga ya Ordinary Pension sa?

Dear Khurram these allowances except Medical Allowance will not be included in any pension. However increase in pension in these years will be added in the Ordinary Pension. Medical Allowance will also be included in the Ordinary Pension.

Kia Age rates updated hain? KPK ki website par Pension Rules ma Age rate different hain.

Dear Khurram, yeh age rates 1st December 2001 ko apply huay they aour us kay baad koi changes nahin ayin.

Respected madam Assalamo alekam,

during surfing net i came across your web site and found that such a nice people are present in this world who r doing such a high class service for the people of pakistan. I want to know only one thing that i have been retired from Pakistan Air Force on 28-04-2000 as Assistan Warrant Officer. Again I joined a Government Organisation on 01-11-2001.I was authorised 25% increase in pension at the time of retirement. I want to ask only that wheather i am eligible to draw that increase during my re employement period from 01-11-2001 to 01-12-2011 . Now my pension restored but this query is still pending

Regards

Mukhtar Haider

Attock

Thanks dear Mukhtar for appreciating mine efforts for the needy employees.

Plz just click on the “contact us” at this site and there u ll see the email ID of Mr. Amir Agha, I hope he will give you the answer of your question in detail. Thanks

my name is muhammad iqbal

i am computer operator in ghq

my date of birth is 10-4-1965

date of joining service is… 26-1-1984

basic pay is approx 29000

please calculate my pension with medical allowance, commutation and pls tell what is the best time of retirement for me

Dear Iqbal when u want retirement? plz write me again ur service length, basic pay, age at the time of retirement.

AOA!

my last pay will be 95150/-

date of birth is 24/02/1954

date of appointment is 19/09/1978.

date of retirement is 23/02/2014

pl inform me about net pension and commutation.

thank you very much.

Dear Irfan Ali Khan the detail of your pension and commute is as under:

Gross Pension = Basic Pay x Service (Maximum 30 years) x 70/3000

=95150 x 30 x 70/3000

=66605/-

Ordinary Pension = Gross Pension x 65 %

=43293/-

Note: This is ordinary Pension and Increases in Pension in various yreas are not included in it. Estimated amount after adding increases will be Rs. 60000/- (estimated)

Commute = 35 % of Gross Pension x 12 x Age Rate

=19982 x 12 x 12.3719

=2966584/-

Irfan saib kia yah last take home hai ya last Basic Pay? your pension will be calculated on basic pay

i am going to complete more than 35 years service. The gross pension is computed at most 30 years service. Is additional pension rule i.e 2% additional per year still exists. If No it is still present in Part II for gross pension calculation.

With regards

Dear Irfan Khan, there is no rulings now exists for 2% extra. Your pension will be calculated on the basis of 30 Years service.

A.O.A MADAM I AM ALWAYS SALAMS REGARDING TO YOUR HARD WORK AND HOW YOU TO MANAGE WORK IN THIS REGARD AFTER THE HOUSE WORK AND BEING A RESPONSIBLE HOUSE WIFE . MADAM, I AND WE HAPPY BEACUSE ON I PRESENT HERE IN THE SOCIAL MEDIA TO SOLVE AND HELP THE NEEDY IN THIS REGARD . THE ALLAH PAK GIVE MORE SUCESSES IN FUTUREPL …………I MADAM I AND WE REALLY ASK WHEN DAY COME THE OTHER PEOPLES TO DO THIS PL; 2……..MADAM MY QUESTION IS THAT .THE ……PENSION FORMULA 2001 THE TABLE SAME WIIL BE CHAGNE AND THE SCALE MANY TIMES HAS BEEN REVISED AFTER THE PASSED ABOUT 12 TWELEVE YEARS PLEASE SOME WRITE TO CHAGE MADAM . ANY PLAN TO BE CHANGEIN THIS REGARD BY GOVT;3.PL MADAMA………..4…….I REQUESTED HERE SOME DEPARTMETN OR CORPORATION HAS BEEN NOT COMPLAINCE ORDER/ NOTIFICATION OF STATE PLEASE GAUDE US WHERE WE GO AND SAME TIME NOT TO COMPLIANCE BY THE APEX COURT OF STATE AND LOWER ETC SO MADAM PLESE GIVE GAUDE LINE IN THE NAME OF ALMIGHTY ALLAH PAK . THANKS AN D WAIT FOR REPLY MADAM.

Sir my basic pay is Rs.16080 now after annual increment granted on 01-12-2013 my basic pay will be Rs.16460/= I am retiring in Jan-2014 on superannuation. How much commutation is made and how much pension is made. Sir scale is revised in 2011 so in 2012 and 2013 pension is revised. So the above said pension is added in my pension alongwith 25 % medical.kindly reply. Thanks a lot.

Dear Iqbal just email me with full detail.

In case of death of a government servant while on service, which are the rights of the family of deceased employee payable by the Government of Punjab?

Please list out the claims for submission by the family of deceased.

Also mention the rates of family pension, commutation or any other.

If you may tell the procedure of service verification of deceased employee (served on different stations) for release of family pension, I shall be highly grateful in addition of the above.

Dear Yasin Khan just email me. I ll try to give the detail of the same.

Dear sir,

i would like to get clarification about the treatment of adhoc allownces i.e. 10% (2010) 10%(,2011),20% (2012), & 10% (2013) while calculating net pension. Kindly guide me which one of the following treatment is correct and why:

Option-1

Gross pension x 65%

5758.66 x 65% = 3743.13

Net Pension= 3743 + Adhoc relief 15% (2010) + Adhoc relief 15% (2011) + Adhoc relief 20% (2012) + Adhoc relief 10%(2013)

3743+60% (10%+10%+20%+10%)= 3743+2248= 5991

Net Pension= 5991

or

3743+10%=374

(3743+374)= 4117+10%=412

(4117+412)=4529+20%=906

(4529+906)=5435+10%=543

3747+374+412+906+543= 5978

Net Pension= 5978

ur question is very important and my qustion is also same

I want to ask two questions..

1) what are the allowances that should be included in net pensi0n?

2) what is meant by commutation Rs 12,75,975 ?

Dear Muhammad Ahmad there will be the following allowances included in the pension. These allowances means the increase in pension during the past years.

These are: 2010, 2011, 2012 & 2013. Plz clearly mention the question no. 2. I could not understand.

Plz calculate my pension & commutation.

Date of Birth 06-01-1976

Date of appointment 24-06-1997

Basic Salary Rs.15600/-

Pension ?

Medical allowance/pension ?

commutation ?

I am retiring on medical grounds on 30-07-2013, in “A” category with full benefits.

Regards

Dear Shumaila mam

AOA. Is there any notification released about calculating of adoc in basic pay for the purposes of pension/commutation. Please reply.

Dear Naeem, The court has made its decision in this regard, however Finance Div has not issued the same notification.

Whether 25% medical allowance on 2011 basic pay will be included in pension calculation or not? Basic pay in 2011 is 11000

Dear Zahid I could not understand ur question plz email me ur question with full detail. Thanks

Dear

What is the latest on inclusion of adhoc relief allowances of Jul 99 to Jul 2011 in emolument recokonedable toward pension. Have you connected finance Division to know what stand by

on this subject. Please get information and send me on my email address

Amir Zarif Hussain

Sear Amir abhi to koi khabar nahin hay.

AOA, I want know that special Adl Allowance account for emmoluments of pension or not and plz also tell me the list of emmoluments thanks

Dear Abid yeh case abhi tak pending hay.

Madam kindly tell me age calculation formula

Dear Zaman, The Age Calculation formula is present at mine site in he heading of miscellaneous.

dear shumaila mam aoa mery father 18 sal 3 mah or 29 din ki service k bad 06-07-1987 ko army sy retired hoey en ki basic pay 970 thi.17-05-2002 ko en ki death ho gi pir meri mother ko family pension milni start hoey aj 26 sal bd ham ko pta chala ha k pension restore hoti ha hamara kia baqaya bnta ha govt ki trf

Dear Asif plz contact Mr, Amer Agha whose detail can be obtained in the post of restoration of Pension Post at mine site.

Please tell about minimum pensionable service of comissioned officers of armed forces with authentic source and how to calculate pension. A favorable reply will be higly appreciated.

Dear Afaq, I m not confirm about the Armed Forces. Howver if these are same as the civilians then u can see the same in the TAG of PENSION at the botom of the site.Thanks

I am grateful for your worthy response. However, I need to draw your attention towards the pesion calculator which is not user friendly and I am unable to calculate pension through that.

Dear Afaq Thanks u. The pension calculator calculates the commute accurately as i mentioned in the post but there showes errors in pension. I advise you to use the manual formula for the pension purpose. Thanks

aoa dear shumaila i must appreciate u for the marvellous work u r doing .i wanna ask u something really important.my father was federal govt employee n he expired on 25th april,2013.He was in service at time of death n ws drawing basic salary of 15400/-pm.nw plz tell me that how much pension ,at home, could we expect to get per month n wt is commutation?n what kind of allowances could we expect beside at home pension?my father had service of29 years.i hope u will give me quick response.may allah bless u.

Dear Afa Khan plz inform me about these info: Date of Birth, Date of Death, Service, Last Pay. Thanks

aoa dear here r the particulars. date of birth 10-10-1954 date of death 25-04-2013 .his service length ws 29 years n last gross pay ws 28217/- whereas basic pay ws 15400/-.anxiously waiting for ur rply along wth all deatails thanks.

Dear Afa Plz email me this all detail alongwith the date of retirement.

date of retirement is 10-10-2014

Good Day,

I need to ask as to whether qualification allowance such as Ph.D allowance is included in the basic pay for calculation of pension. Thanks.

Tahir

Dear Tahir, it is allowance not pay. Only pay is counted in pension.

Will you please calculate my home taken pension + comutation. Basic pay= 19370 service=29 years age=59 years on next birthday

Dear Husnain Qazi sb i have given the full detail of the said calculation. Plz try to calculate yourself if u fail plz email me. Thanks

Thanks, I will try.

Dear

There is some confusion .Govt increase adhoc 15% from 1 Jul 2006 and in another letter 15 incease in pension and also mentioned that those would raw pension will get this 15%.

Now govt is considering inclusion of adhoc relief of Jul 99, 2003, 2004 and 15% DA in 2006

On re fixation of pension.either Adho relief 15% and 15% adho those would drawn pension will getthese both Adhoc of 2006 whereas in pension 15% Adhoc as a IP alsready given in pension

Either this IP will standand A.D 15 given with pay will be also given on re fixation of pension or not and only 15% already being given as I.P will stand.i.e. in2006 only one AD will be stand asIP and AD 2066 will not be counted.Please clarify.

Very clear is as under

in 2006 Govt issued two letters one dated 24 Jul and one 30 Jul 2006

One DA to employees working and one DA to pensioners existed and also those to being retired. Govt given 15% of 2006 in pension as a IP. itesmena that now on newfixation of pension DA of 2006 which was allowed to working employee will be givenor not.

Request reply on my email addres: [email protected]

Amir Zarif Hussain

18 May 2013

if any one length of service 26 years and 7 month, then his qualifying service will be 27 or 26.some one told me only saught remain person lenght of service will not be rounded. and other penison any on qualifying service more 6 monts then qualying service will take next year for example 27 year and 9 months then his qualifying service wil be 28 years it is true.pls tell me how calculate qualifying service and when it will rounded

Dear Abid ALi, the service length for pension is always rounded. his service will be 27 Years and in the second case service will be counted 28 years.

Pls tell me when it will rounded the length of service. if any one take retirement then it will not rounded.pls guide me

A/Salam

My colleague expired on 09.02.2013. His date of birth is 01.07.1964. Date of appointment 10.07.1983. His basic pay is Rs.15400 and Personal pay is Rs.1210. Please calculate his gratuity and monthly salary.

Dear Naveed just replace 75% instead of 65% for Pension and 25% instead of 35% in the formula mentioned in the post. Thnaks

Dear Shumaila. A/Salam

I have some doubt about Personal pay. How it deal with the personal pay in the formula. Please explain. Thanks.

Dear PP (Personal Pay) is added in the Basic pay to calculate pension and gratuity. Thnaks

how to calculate age rate , what is age rate formula,

and how to calculate service length, for example if there is service length is 36 years, 1 month, 4 days.

then what should write service length in formula what is exact figure?

e.g

according to AGPR

service length of 36 year 1 month, and 4 days round in to 31.37195122 why?

Dear Muhammad Ahmad Butt. Age Rate is given at the bottom of the Post. Service length is taken maximum 30 even if u have the service of 36 years.

how to calculate age rate? is there is formula to calculate age rate or it is fixed or given pay agpr?

we were employees of govt nationalised bank which was privatised to agha khan fund but our pension calculation is reduced to 33percent of basic last drawn instead 65 percent under which law the can cut this benefit once given to us so what is the responsibility of finance ministry, state bank , privatisation give us favour so we be able to fight

Dear Asif Majid, i advise you to apply to ur department and demand for the refernce of the same. I hope they will give you positive response.

ASALAM O ALEKUM, Shumaila kindly calculate all benefits as my husband was expired during service on 22.12.2012 he was a primary school teacher in grade 14 his basic pay at the time of expiry was 20810 and his length of service was 25 years as his date of birth 23.09.1968 date of apointment was 8.6.1987 kindly tell me what benefits i avail

maree basic pay 20200 hay service 25 sal or age 44 me agar retrd hota hoo to mjhay net commutation or penssion monthly kitne milagee.or leave encashment kitnee milaigee

20200x25x70/3000

=11783/-

Net Pension 65% = 7659.17 without allowances

Net Pension = 12000/- with allowances (Estimated)

35% = 4124/-

Amount of Commute= 1112059/-

Thanks very much for calculate my pension would you please tell me about my LPR my total leave due is 300 days.

Dear Khalil just do the following

20200 x 300 x 12/365

=199232/-

thanks a lot but little confusion some body from my office told me if Iam retiring on 25 years of service I will not get the benefits of LPR, although my leave is 300 day due, is it right….?

Dear after 25 years retirement u can get LPR not leave encashment. Leave encashment can be availed after 30 years service retirement.

plz defined difference between laeve encashement and LPR there is some confussion

Dear Khalil, Leave Encashment is the amount that is granted on the leaves in credit at the time of retirement while LPR is premature retirement. In LPR the employee gets the leaves that are in credit at the time of retirement. LPR can be availed after 25 to 60 Years age while leave encashment is availed from 30 to 60 years service.

Dear Shumaila please explain what is 70/3000 ??

and i want to ask my father retire on 31-12-2012, his last basic pay was 35200/- his total service was more than 30 years.

please calculate how much he will receive monthly pension and commutation.,thanks

Dear madam, assalam o alaikumplease find the detailshere;- my date of birth is 08.02.1942 I joind federal govt. service on12.04.1960 after 32 years service I got ,on my own request pension . my date of retirement is 01.01.1994. half of the pension i got commuted under the existing rules(at that time). I just want to know i. when my half commuted portion be included in my drawing pension. ii. either the amount surrunder at that time be retuturn or my drawing pension bedoubled. thanks.

Dear your surrendered amount will be counted in ur pension if the Govt approves the same as decided by the Courts.

I retired from the ministry of Culture andsports Islamabad. I was assistant in BPS 15. what more moderation is required? plase indicate.

Dear just send me ur full query with detail at mine email ID.

Helpfull attitude is liked by Allmighty Allah. You willbe blessed by Alimighty Allah for this hounrable job extended to needy human being.

Thanks Dear for admiring mine efforts for the needy employees.

Dearsir/madam, I got retire ment on 01.01.1994. mydate of birth is 08.02.1942. on my on request.. at that time my half pension was commuted, under the existin rules. when my commuted pension be restored. (ii) I also heared that when pension be restored it will be the double of drawing pesion? is it correct? I shall be highly greatful for your answer. thanks

Dear u can read the full topic about the court decision at mine site in pension heading. In this decision it is clearly written that all the pension will be restored.

What is meant by commutation?

Commutation means Gratuity. It is the payment of the leaves that the employee has in his/her credit at the time of retirement. Federal Govt employee can get the benefit of maximum 365 days leaves in the shape of payment. If an employee has 30 days leaves in credit then he will get one basic salary. It is a simple example.

what is the minimum service lenght for pension and commute

Dear minimum length of service for pension and gratuity is 25 years on general basis.

my brother died on 16-1-2013 plprovide me the formula for calculation of family pension.

Dear Email me.

My wife is serving as teacher in Punjab Education Department. She intends to retire. Would you please let me know her monthly pension and commutation. Her particulars are as under :-

Date of birth : 16.10.1963

Basic pay Rs. 29200/-

Pay scale BPS 16

Length of service 28 years

Commute will be Rs. 1467313.45 and calculate pension as Gross Pension = 29200 x 28 x 70/3000

Then calculate the 65 % of the result. The result of this will be ordinary Pension. Allowances are not included in this result.The allowances will be calculated by the Account Office it self.

Dear Ahmed Nawaz

Your wife will get the following pension & commutation upon retirement.

Commutation Rs.1,026,699/-

Net Pension (Take home) Rs.25,631/-

Note: Errors & ommissions are accepted.

Madam please let me know the detail of allowances which are included in the gross pension

Dear these are alowances of 2010, 2011 & 2012 as well as Medical Allowance.

aoa please calculate my pension. my particulars are as under

pay:- Rs 29,200/-

Service:-23 years

Dear plz mention ur age too.

Thanks madam for such wonderful work i was searching it for many months.

i want to say please tell what is age rate and why these are decreasing with more age and also write pension

ordinary pension= gross pension x 65/100 as many people dont understand it and as 35/100

Dear age rate is used for calculating commute. Main pension is divided into two parts. One part is 65% that is for pension purpose calculation and 35% of it is used for commute purpose.

PLEASE GUIDE:- PENSION CALCULATION FORMULA W.E.F.1-7-2012, HOW IS IT

W.E.F.1-7-2012, BY A NOTIFICATION OR OTHERWISE?

PERHAPS PEOPLE IN EDUCATION DEPARTMENT OF PUNJAB GOVT

ARE NOT APPLYING THIS FORMULA

YESTERDAY: DEAR MADAM: YOU CALCULATED (FOR MY BROTHER

I.E.PENSION Per Month 21951.38 AND COMMUTATION WAS AS 718738.11

AND THIS WAS ALSO ACCORDING TO PENSION CALCULATOR. BUT MY BROTHER

IS FACING PROBLEM AS THEY (i.e.STAFF WORKING ON PENSION CALCULATION)

HAVE MADE RS.17122/00 INCLUDING ALL ALLOWANCES.

THIS IS MY HUMBLE REQUEST : PLEASE GUIDE ME HOW TO CONVINCE THEM TO SAVE A HEAVY LOSS TO MY BROTHER. THANKS.

Dear just try to calculate ur brothers pension and commute from any other person rather than the person calculated ur brother’s pension. So that u may satisfy about it. May be there is some difference in Fed and Provincial. Just try to calculate from any other person who is well equintance with pension calculations.

Dear Madam: Almighty Allah bless you with many more successes in life.

Basic pay of my brother = 22800/-

Length of Service = 26 Yrs

Age = 60 yrs

Retiring on 20 Dec 12

Pension Per Month 21951.38 including all allowances as well as Medical Allowance

718738.11 Commute

Madam: Is the Pension calculator (formula 1-7-12) is also applicable for Punjab Govt employees? My brother is Arabic Teacher in Govt High School in Punjab. His pension on pension Calculator from 22800/- basic pay; home take pension is shown Rs.21951/38 and commutation Rs.718,738/11 whereas his pension is calculated as Rs.17122/- an commutation is the same as your pension calculator.

Dear check again i think there may be wrong entry by you. Just email me all data of ur brother i ll calculate it mineself.

aoa,will you please,explain what allownces are added in ordinary pension to determine NET pensoin?waiting for reply

Dear i ll check it thoroughly and will tell u soon.

PLEASE CALCULATE PENSION AND GRAUDTY

BASIC PAY 9660

SERVICE 29.5 YEARS

AGE 50

Dear plz download the pension calculator to calculate it. http://www.glxspace.com/employees-network/

My dear sister: please clarify more as all employees are totally unaware of the pension formulas! if this is net pension (i.e showing by the table “EXCELL), why is it more than my basic pay.

Dear send me ur all detail to calculate pension then i ll send you detailed pension and commute.

Wah dear aap ne khob koshish ki hy pension calculator ki par durust nahein laghta apna E-mail address send karein to main aap ko 1 pension calculate karny ka formula send karta hon

This formula is 100 % ok. However allowances are not included in this formula. If you want to calculate your pension alongwith allowances then use the pension calculator at this site available. If any one says it is wrong he/she himslef/herself has wrong concept about this formula.

mine email is present at mine site too.

why you divided pension in ordinary and gross.just tell the peoples that if your basic is 20thousand you will take home lumsum 15thousand.and in order to calculate the comute now the ordinary and gross can play a role.i could not understand what i will take home if i am drawing 18000 and service is 30years age is 51 now what i will take home.

Gross Pension is the Total Pension. and only 35 % is counted for commute and 65 for pension purpse that is called ordinary pension

Your Not Home pension will be 19966.20 and commute will be Rs, 934175.

Gross Pension is total pension and 65 % of it is used for Ordinary pension and 35 % is used for commute purpose.

برائے مہربانی یہ بتائیں کہ آپ نے ایکسل سافٹ وئیر پر ٹیبل فارمولا بیان کیا ہے۔ اس میں جو ماہوار پینشن آتی ہے کیا وہ

گراس پینشن ہوتی ہے۔ یا آرڈینری؟

yeh net pension hay i e take home pension that include allowances too.

can we apply the same pension formula on those who force retierment by the department

if the employee service 15 years age 35 basic pay 12000 BPS 9 what formula apply on this for pension and commute

Try to apply the same formula. I hope it will be ok.

my service record is as under service in GEPCO (WAPDA)

BPS 9

AGE 60 Year

service 31 years

basic pay 15860

what is my pension, commute

plz calaculate

Dear I have pasted the formula. Plz try urself although i have done it for u

Your Gross Pension will be = Basic Pay x Service x 70/3000

= 11102/-

Ordinary Pension = Gross Pension x 65

= 7216.3

Commute = 35 % of Gross Pension x 12.3719 x 12

= 3885.7 x 12.3719 x 12

= 576881.90

If Allowances too added then ur pension will be 17618.87 PM

A,OA MADAM PLEASE INTIMATE US COULD BE CHAGE THE TABLE OF PENSINON NOW 2001 . WHY NOT CHANGE SINCE THE 12 YEARS AND MANY TIMES HAS BEEN CHANGE THE PAY SCLE BY THE I R O PAKISTAN . IT IS LOSS OF EMPLOYEES AND BASIC RIGHTS AS WELL AS LAKE OF MORAL AUTHORTY OS SUCH .PLEASE THIS TIME IS HEAVY TAX PAID BY THE NATION DIRECT OR IN DIRECT AS WELL AS THE SALARY PEASON.2…………………..MADAM I AND WE ARE HAPPY FROM YOUR GAUDE LINE AND HARD WORK IN THIS REGARD . PLEASE GAUDE US SOME DEPARTMENT HAS BEEN NOT COMPLAINCE BY THE ORDER OF I R P OF PAKISTAN AND APEX COURT PLEASE. WHAT IS THE FINAL DICESSION TAKEN US FOR JUSTICE.PLEASE THANKS AND WAIT FOR REPLY PLEASE .

Thanks Dear Ghulam Mustafa, All illegal orders of the superiors are not to be obeyed by the juniors as mentioned in the SC Orders and the detail of this orders is available at mine site.

Aslamo-Alaikum.

BPS 14

Date of Birth: 07-10-1954

Date of Appointment: 17-06-1971

Date of Retirement: 07-10-2014

Last Basic Pay: Rs.22640

Usual Increment: Rs. 610

Total: Rs. 23250

Please tell me about net pension and commutation.

Thank You Very Much!

Dear Manzoor Ahmad your pension and gratuity will be as under:

Commute 845681.22

Net Pension 21112.01

Madam..assalamelaqum ..pension formule ma 7 aur 300 kis ko show kar raha ha….please reply..thanking in anticipation