Last Updated on October 31, 2021 by ShumailaKamalBHP

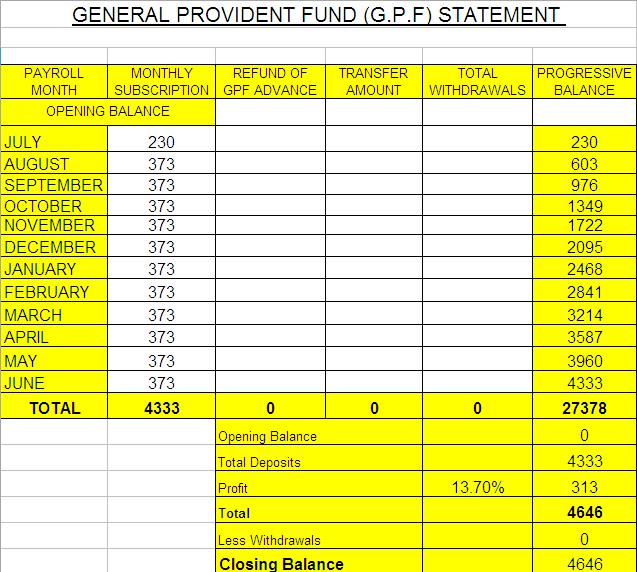

I have already published a formula for the Calculation of GP Fund Interest Amount manually after a year but now I am publishing here how to Calculate GP Fund Annual Balance Amount with Simple MS Excel Sheet. It is so simple to use and you can easily prepare your own GP Fund Statement. You have to just put the monthly deduction amount of GF Fund and the Interest rate for that year.

The main feature of this formula is that you can put the deduction of amount of GP Fund that you have drawn as advance during the year. In the same way you can also put the total amount of GP Fund Advance during the year.

You can get the help from the GP Fund Interest Rates to help you to put in this formula. Every year the GP Fund Rates are issued and the GP Fund Rates are issued after July every year. If you feel any difficulty or error in this formula just contact me so that I may solve the problem/issue regarding this. This post has been delivered by Mr. Liaquat Kamboh.

Download GP Fund Calculation Formula Sheet for GP Fund Statement

I am a employee of Autonomous Body, let me know where we deposit their general provident funds and which markup base?

AOA Madam, I was regular employee as Draftsman BS.11 and GP Fund deducted from 1994 to 2009. Then I got re appointment as Sub Engineer BS.11 on contract basis through proper channel application. During April 2014, I was regularized as Sub Engineer but interest on already deducted GP Fund is not being given to me from 2010 to 2014 due to my service on contract period by District Account Office. Kindly tell me about my right Thanx

admin please send you mail address

Dear Hassan: [email protected]

Assalam o alykum warahmatullah e wabarakatuh,

Sister,

Can u plz send me the notification regarding P.F loan advance upto 80 %.

I really appreciate ur work for just the benefit of mankind.

May ALLAH bless u in Dunya as well as in Akhirah.

Regards.

AOA

I used this excel formula to calculate my GP fund for the entire period of my service. To my utmost surprise, I got more GP fund balance than calculated by the account office. I rechecked my calculations and found one problem.

I rejoined the Higher education Department after about three years leave for PhD. My notification order for rejoining was 12 July 2011. However,my salary was released in April 2012. The account office deducted Rs. 22400 for 10 months (July 2011 – April 2012) @ 2240 per month. when I put the 22400 in April 2012, 2240 in May and 2240 in June and left the months from July 2011 to March 2012 vacant. I got lesser profit than when I put 2240 in all months from July 2011 to June 2012.

Now kindly tell me which method is correct? I am waiting for your response as I have to correct my GP balance in my Payslip.

Thanks

How the formula is adjusted for variable amounts of subscription for a year?

Dear Rehmatullah Khan the same is facilitated in this formula. If u need further assistance plz email me

Please provide me rule of GPF advance amount recovery after the Principal of the advance has been fully repaid or Broken Portion of month during the eriod between the drawal and complete repayment of the Principal.

Dear Muhammad Ali, plz email me all these details.

Dear Muhammad Ali, plz email me all these details again

This is the best formula if u want to calculate flexible monthly contribution.

all results are 100% ok

Thanks Admin

U r welcome dear Mehmood.

A.O.A DEAR MADAM THANKS FOR SENDING NEW INFORMATION AND ALSO FRIST TIME IN THE HISTORY NOW PROVIDE FREE AND SUPPORT TO ALL EMPLOYEES MAY BE OTHER PRESENT MAN TO MAN NOT THE ALL SAME GIVEN PL MADAM PLEASE GIVE THE OTHER IFORMATION WIL;L BE SENT FROM YOU AND SO WE SEEN THE SAME LETTER AND SALMS TO YOUR EFFORTS. BEST WISHES PL

Thanks Dear Ghulam Mustafa for appreciating mine efforts.

Salam

What if the GP Fund of Employees of an organization started to cut down after lapse of Few years from their Date of Appointment (after a decade or so of the commencement of the Organization).. Is there any way out to have all the Loss beared by the individuals.

E.g. If the employees have WILL to cut more GP fund Installments (for the remaining time period before superannuation date) to have a smart amount in their GP fund. Considering it that individuals cannot be blame for that .. This was the fault of Organization..

Thnx ..

Dear Batool, I am not 100% confirm about the same situation.