Last Updated on October 31, 2021 by Galaxy World

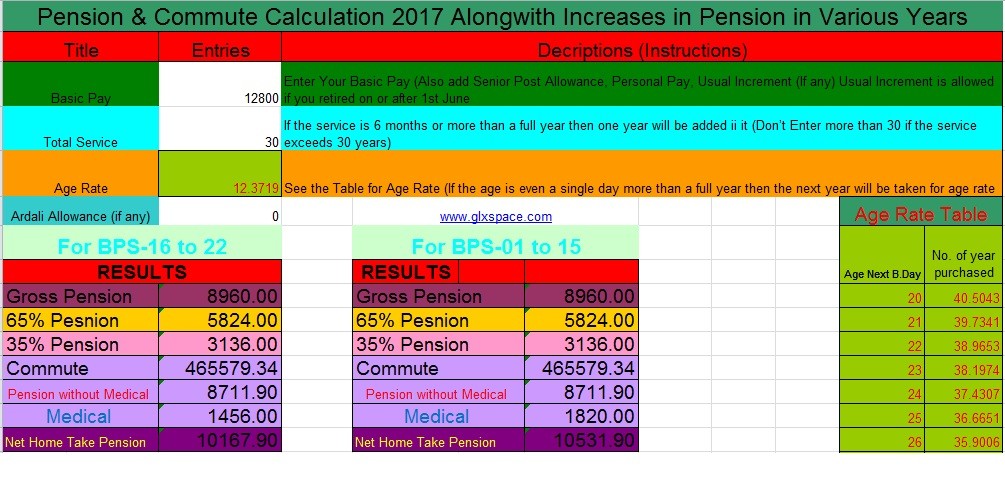

I have already uploaded pension calculation sheets nearly every year as the pension increased during the various previous years. I am now sharing the latest Revised Pension Calculation Sheet 2017 with Effect from 01-07-2017.

This sheet has the following characteristics:

- This pension calculation sheet is effective with effect from 1st July 2017 i.e it is for those employees who will retire on or after 1st July 2017.

- The employees retired prior to 01-07-2017 will use the previous sheets according to their retirement year.

- You have to just know about the following three points/things:

- Your Last Basic Pay Drawn

- Total Length of Service

- Age Rate that is already shared at the formula sheet at the right side

- This sheet calculates pension and commute separately for the employees of BPS-01 to BPS-15 as well as for the employees of BPS-16 and above.

- This sheets shows Pension calculated on the basis of increases during various years.

- This sheet also shows Medical Allowance Separately.

Pension Increases during the following years has been included in this sheet:

- Pension Increase @ 15% (2011)

- Pension Increase @ 7.5% (2015)

- Pension Increase @ 10% (2016)

- Pension Increase @ 10% (2017)

Download Pension Calculation Sheet 2017 For the Pensioners Retired wef 01-07-2017

It is to mention here that I have already published the Revised Pay Scale Chart 2017 for the Government Employees having Basic Pay Scales.

Aoa sir how to calculate monthly pension.mean k net pension or medical k ilwa kia kia shamil kia jata hai monthly pension main

2 ..lpr main just basicpay li jati hai?

You can check all the increases and medical allowance in this post: https://www.glxspace.com/2019/07/30/revised-pension-calculator-2019-20-for-federal-and-provincial-govt-pensioners/

Sir,

I would like to know the pension calcation.

my last basic salary was Rs.17205/- after completion of 58 years.

please suggest me.

thanks and regards

r r pillai/9825606725

Agar koi bhai apna pensi0n aur c0mmutati0n mal0m karna chahtha h0n apne retirement pay, He sh0uld mail his slip to my email…. my email is [email protected]

AOA, PLZ GUIDE ME HOW TO CALCULATE AGE RATE??

Dear hammad You can find the same through the given formula/details:

http://www.glxspace.com/2015/01/19/how-to-find-the-restoration-date-of-commuted-portion-of-pension/

sir i am at 17 bps and retiring on 13-06-2019 my basic will be on retiring 51070 and total service will be 15 year and 4 month pl tell me total monthly pension and commutation i am govt empolyees

I am a 17 grade officer retiring on 9-07-2018 at superannuation .My annual increase in pension will be started from which year?

Dear if govt increases then in 2019. however all increases of the previous years will be included in ur pension at the time u r 1st time granted pension.

Government employees ke retirement age 60 years hai ya 62 years hai?

60 Years

I need to know about 19 scale retirement. I will retire on 2019…

My basic pay .31050,

Date of birth. 21 July 1970,

Capital government se 19.12.17 ko retired hoa

Cumut and monthly total pinsion bataen length of service. 4.10.89 , tolal 27 year Pl

Thanks

dear sir,

my name is khushnud ahmed and i am chowkidar BPS-03

i am retired on 01-01-2018 on attaining the 25 years of service

my date of birth is 15-03-1969

my date of joining service is 23-12-1992

my basic pay is 18586/-

please calculate my pension, gross pension , and commutation/graduty etc

thanks

Kindly make correction in the early post:

65% gross pension amount is Rs. 16918

Add: 15% increased pension 2010 2538 previously wrongly typed 2358

Total 19,456

Our Finance Department Sindh is calculated Medical Allowance on( BS-19) Rs. 4,864 on

30-11-2017 as under:-

65% of gross pension amount Rs. 16,918

Add: 15% Increased in pension 2010 Rs. 2,358

Total Rs.19,456

20% Medical Allowance (OM of Finance Div-2011) Rs. 3891

25% Medical Allowance of 2010 Rs. 973

Total Medical Allowance calculated by Finance Deptt Rs. 4,864

Where as previously 31-12-2013 the medical allowance was calculated Rs.4229.50 of the

net pension of 2010 as per Finance Division Notification 2011.

for example : if 65% of grass pension is Rs. 16918 (BPS-19)

20% Medical allowance (OM Finance Dive-2011) Rs. 3,383.60

25% Medical allowance of 2010 Rs. 845.90

Total Medical Allowance Rs. 4229.50

My question is what is correct calculation while going to comparison above.

aoa. i am akbar bhatti. meri basic 111000. ha service 29 year. date of birth 2/12/1960 ha qage on retirement 58 year. pension kitni bane gi

My monthly pension slip has been discontinued w.e.f November,2017. Would you like to let me know the reasons for this discontinuation as I feel great hardships in the absence of my pension slip

Dear Abia you can contact the concerned email address for the same issue.

Dt /birth:20-01-1962, Dt of Appt /:01-06-1988 Bps:16 HST in Sindh Edu

Plz tell me when I shd tk retirement with good be nifty &how many pention l can tk if l wl tk retrmnt

Asalamualaikum i am Rana Muhammed Manzoor associate professor bps 19 mari basic pay 108000 ha mari service 26 sal ha age 55 ha may retirement layna chahata hon mari pension kitni banay gi aur totale kitna amount milay ga? thanks

Dear Rana Muhammad Manzoor your pension detail is as under:

Gross Pension 65520.00

65% Pesnion 42588.00

35% Pension 22932.00

Commute 4168432.20

Pension without Medical 63705.79

Medical 10647.00

Net Home Take Pension 74352.79

Asalam o Alaikum

My father was retired in 2005 now he is eligible for restoration of his commuted pension what are the chances of increment

AOA, HOW TO CALCULATE DISABILITY ELEMENT FOR MEDICAL BOARD PERSONAL

confirm the method of pension calculation of a government employee join after 2009

Assalam walekum my retirement date is 17-06-2019 in 60 year, but my length of service will be at retirement 22years 9 month. At this time my basic pay is 42720 I am in B-15. kindly calculate my pension at retirement. Thankfull Tariq aziz.

salam , mere total length service 22 sal 9 month banti hai retirement k waqt mujhy pension benefits milen ge?

Dear Tariq if u retire at the age of 60 then u ll get the benefits.

Is this medical allowance also admissible to retired Armed Forces Commissioned Officers?

why there is difference occured in net pension of scale 1-15 & 16 and above.

Dear M.R It is due to Medical Allowance.

What will be the effect of time scale on pension please explain if someone is in grade 17 and drawing the salary of grade 20 due to time scale as in the case of School teachers then what’s the effect.

Aoa. While working as Additional Principal Medical Officer (BS-19) in General Cadre w.e.f. 10-12-2005 on regular basis, I joined teaching cadre and was appointed Assistant Professor (BS-18) w.e.f. 01-08-2008 on contract basis. My services were regularized as A.P. (BS-18) w.e.f. 27-09-2011. How my pay will be fixed?

i am shabbir retured from pak-navy from 2010 after completion of 19 year service.

how i can calculated my pension.

any person can help me

For example if net pention is 12600 then medical allowance will be as fol:

3150 (25% of net pention)

+ 787.5(25% of Medicl Allowance)

total Medical Allowance is 3937.5

……………………………………………………………

Medical allowance is calculated on net pention but added it in pention amount after adding every years budget increament step by step.

net pention + step by step years increament + medical allowance

Thanks dear sister and Galaxy world for making life and working of government employees so easy, may Allah bless you for all this

1. Please confirm the method of calculation of medical allowance.

2. The net pension shown at the end of the sheet is probably incorrect. As it should be

net pension + increases + medical allowance.

Medical Allowance of a pentioner is calculated in two steps:

Step1 25% of net pention of scale 1 to 15 and 20% of net pention for scale 16 to 22.(OM of finance division in 2011)

Step2 25% of Medical Allowance(OM of finance division in 2015