Last Updated on October 31, 2021 by Galaxy World

Most of you are well acquainted of credit card and debit card but not know the actual difference between credit card and debit card. Wise financial decisions are based on the understanding between a credit card and a debit card.

Difference between Credit Card and Debit Card

- The fundamental difference between debit card and a credit card account is where the cards pull the money for its use.

- A debit card takes the money from your banking account and credit card charges it to your line of credit.

- Both are accepted at the same place

- Both are for the convenience for the persons

What Is a Debit Card?

Debit cards offer the convenience of a credit but it works in a different way. Debit cards draw money directly from your bank account you make the purchase. They can do this by placing hold on amount of the purchase. Then the merchant sends in the transaction to their bank and it is transferred to the merchants account. It can take a few days for this to happen, and the hold may drop off before the transaction goes through. For this reason, it is important to keep a running balance of your checking account to make sure you do not accidentally overdraw your account. It is possible to do that with a debit card. You will have a PIN to use with your debit card at stores or ATMs. However, you can also use your debit card without a PIN at most merchants; you will just sign the receipt like you would with a credit card.

- A debit card is tied directly to your checking account.

- It can be used where a credit card can be used.

- Generally, you will have to use your PIN to complete the transactions.

What Is a Credit Card?

A credit card is a card that allows you to borrow money in small amounts at local merchants. You use the card to make your basic transactions.

The credit card company then charges you interest on your purchases, though there is generally a grace period approximately 45 days before interest is charged if you do not carry your balance over from month to month. Credit cards have high interest rates and are considered a revolving line of credit that you can use again after you pay it down. Your credit card balance and payment history can affect your credit score.

- A credit card is a line of credit you can access with your card.

- Generally, you must sign on these purchases (exceptions may be at the gas pump or for small amounts at a drive-thru window).

- You will pay interest on the purchases made if not paid off in thirty days.

Debit Cards vs Credit Cards

In the past many people felt that you needed a credit card to complete certain transactions such as rent a car or to purchase items online. They also felt that it was safer and easier to travel with a credit card rather than carrying cash or trying to use your checkbook. However debit cards offer the same convenience without making you borrow the money to complete the transactions. It can be difficult to determine when to use a credit card or a debit card. Some argue that a credit card offers additional insurance on purchases and makes it easier to request a refund or a return.

You should carefully read the disclosure information for your credit card to understand the benefit.

Choosing the Best Card for the Situation

It is better to use your debit card whenever possible, because it will prevent you from accidentally falling into the credit card trap. When you can pay cash for most items, you are doing better financially. Some rental car agencies and hotels may still request a credit card over a debit card because they want to have a card where they can bill you for damages to their property. Be sure to check with the hotel or agency before you travel to make sure you can use your debit card instead of your credit card.

Some people will argue for using a credit card for the majority of purchases to take advantage of credit card reward programs. This works if you pay off the balance in full each month.

However, if you do not, you will not earn enough to make up for the rewards. The credit companies offer the rewards as an incentive for you to use the credit card and would not do so if they lost money on the transactions.

- Consider using credit cards for hotel reservations and car rentals.

- For daily purchases, your debit card can help you stick to your budget.

- If you are going to take advantage of rewards, be sure to pay off the balance in full each month.

بینک کارڈز کا روز مرہ زندگی میں استعمال عام ہے، بلوں کی ادائیگی ہویا اے ٹی ایم مشین سے پیسے نکالنے ہوں، عموماً بینک کارڈز کا استعمال ہی کیا جاتا ہے لیکن بہت کم لوگ اے ٹی ایم کارڈز کے راز جانتے ہیں۔اکثر بینک کارڈز 16ہندسوں پر مشتمل ہوتے ہیں لیکن بعض کارڈز پر 19 عدد بھی ہوتے ہیں۔ اس میں سب سے پہلا نمبر کارڈ کی شناخت کے لیے استعمال ہوتا ہے۔ اگر کارڈ پر لکھا پہلا نمبر 4 ہے تو اس کا مطلب یہ ویزا کارڈ ہے اور اگر 5 نمبر لکھا تو یہ ماسٹر کارڈ کی پہچان ہے۔ اگلے 5 نمبرز متعلقہ بینک کو ظاہر کرتا ہے جب کہ آگے 9 نمبرز بینک اکاونٹ کے بارے میں ہیں

جو کہ بینک کارڈ کا اجرا کرتا ہے۔ یہ 9نمبرز دراصل بینک حاصل کردہ کارڈ کے مالک کی شناخت کے لیے استعمال کرتے ہیں۔یہ بہت کم لوگ جانتے ہیں کہ بینک کارڈز کواسی طرح محفوظ بنایا گیا ہے جس طرح کرنسی نوٹوں کے اصلی ہونے کی کچھ مخصوص علامات رکھی جاتی ہیں۔ ویزا کارڈ پر الٹرا وائلٹ روشنی پرمبنی “V” دکھائی دیتا ہے جب کہ ماسٹرکارڈ پر”M”اور امریکی کارڈ پر چیل بنی نظر آتی ہے۔بینک کارڈ کے پچھلے حصے میں 3 ہندسوں کا ایک سیکورٹی کوڈ درج ہوتا ہے۔ CVV کوڈ VISA کارڈ کے لیے ہے جب کہ CVC کوڈ MASTER کارڈ کے لیے ہوتا ہے۔ ان دونوں کارڈز میں CV کا مطلب CARD VERIFICATION ہے۔ یہ کوڈ کارڈ کی تصدیق کے لیے استعمال ہوتا ہے۔اگر آپ انٹرنیٹ سے آن لائن کوئی چیز خرید رہے ہیں تو یہ بات لازماً مدنظر رکھیں کہ متعلقہ ویب سائٹ محفوظ ہے۔ ویب سائٹ کے ایڈریس سے پہلے https لکھا نظر آئے تو یہ محفوظ ویب سائٹ کی پہچان ہے۔ہمیشہ اپنے کارڈ کی حساس معلومات کو یاد رکھیں، مثلاً PIN اورCVV نمبرز ذہن نشین کرلیں۔ کسی غیر بھروسہ مند شخص کو اپنا کارڈ نہ دیں خصوصاً عوامی مقامات پر کارڈ کے نمبرز پر گفتگو سے گریز کریں۔اگر آپ پیسے نکالنے کے لیے اے اٹی ایم مشین کا رخ کریں تو اس بات اطیمنان کرلیں کہ مشین کے کی بورڈ پر اضافی کیمرے یا اس جیسا کچھ اور تو موجود نہیں جو آپ کا پن کوڈ چوری کرنے کا سبب بن جائے۔

The bank card is commonly used in everyday life. Bank cards are used to pay the utility bills, to draw the money from ATM machine and many other purposes.

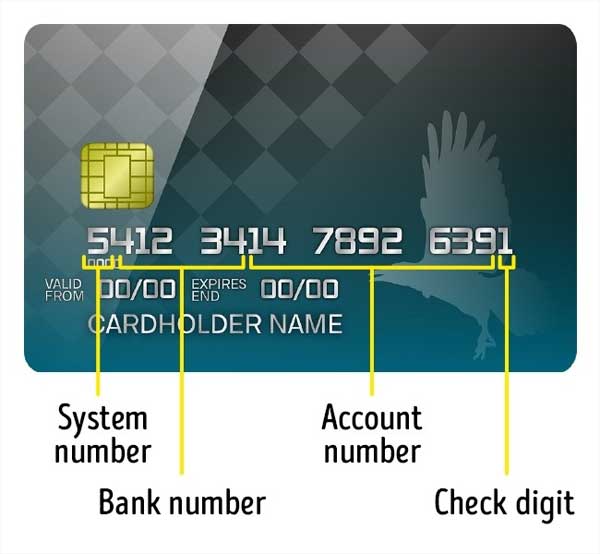

but very few people know the secrets of ATM cards. Bank cards mostly consists 16 digits But there are 19 numbers on certain cards. The detail of these numbers is as under:

The 1st number is used for the card identification.

If the 1st number of card is 4, then it means the visa card and if it is written 5 numbers, then it is the Master Card’s identity.

The next 5 numbers show the relevant bank and the next nine numbers show the bank account which executes the bank card. These 9 numbers actually use the bank to identify the owner of the card. There are very few people know that bank cards have been saved in the same manner, as some of the specific signs of currency notes are placed.

On the visa card, the ultra-light light performances show “V” while “M” on the mastercard. There appears to be a cheel on the American card.

The back of the bank card contains a 3 digit security code. The CVV code is for a VISA card while the CVC code is for MASTER cards. CV in these two cards means CARD VERIFICATION. This code is used to verify the card. If you are buying something online from the internet, then keep in mind that the relevant website is safe. It is a safe web site to know HTTP address before addressing the web site. Always remember your card’s sensitive information, such as PIN and CVV numbers consider mind. Do not give your card to an unbelievable person, especially in public places, avoid conversation. If you turn aside ATT machine to withdraw money, please make sure that the camera or the additional camera on the keyboard’s keyboard something like this does not exist which causes you to steal your PIN code.

Sir, I want Pakistan’s active mobile numbers list or Link, please sent me to my email. Thanks