Last Updated on October 31, 2021 by Galaxy World

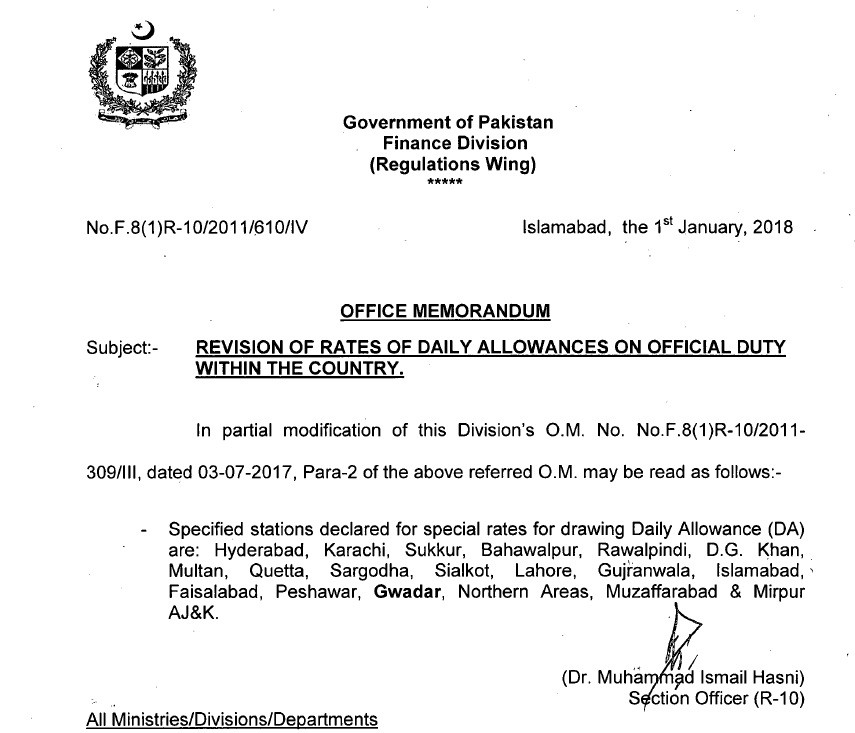

Government of the Pakistan, Finance Division (Regulation Wing) has issued office memorandum on 1st January 2018 in connection with clarification regarding Revision of Rates of Daily Allowance on Official Duty Within Country.

Revision of Rates of Daily Allowance

In partial modification of this Division O.M of the dated 03-07-2017 para-2 of the above referred O.M regarding Revised Rates Daily Allowance 2017 may be read as follow:

Specified stations declared for special rates for drawing Daily Allowance (DA) are: Hyderabad, Karachi, Sukkur, Bahawalpur, Rawalpindi, Dera Ghazi Khan, Multan, Quetta, Sargodha, Sialkot, Lahore, Gujranwala, Islamabad, Faisalabad, Peshawar, Gwadar, Northern Areas, Muzaffarabad & Mirpur AJ&K.

The new addition in this list of cities for Daily Allowance is Gwadar.

AoA.. Want 2 know abt DA paid by fbise..wether may i claim double daily against hotle charges???

completd fbise duty as supdnt..need guidance plz

17% of gst÷ 5

i think its for all government employees

please explain ye kis k lie hai?

madam different method used for calculation of GST for various bills. presently 17 percent GST deducted from unreg firm and 1/5 of 17% from reg firm,in the bill. we need clarification that 17% direct from the bill like that total amount incl GSto x 17% or total amount incl gst x 17/117 for clarification on the same.

Just Gwarder added in specified big city