I am here sharing today the proposed New Revised Income Tax Slabs for Salaried Persons. Earlier it was announced that there would be no tax upto the annual salary of 1200000/- 12 lacs but now it has been decided to start tax from 4 lacs per annum income. Detail is as under:

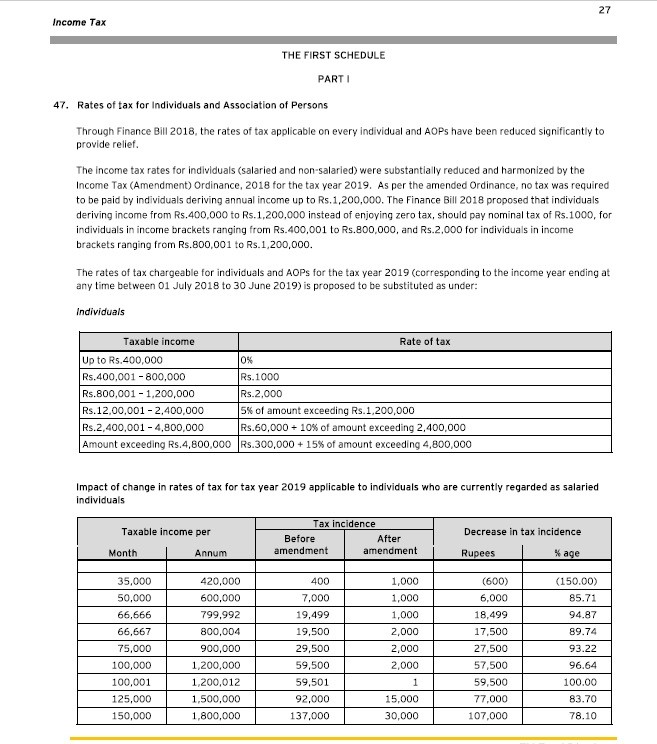

Through Finance Bill 2018, the rates of tax applicable on every individual and AOPs have been reduced significantly to income tax (Amendment) Ordinance, 2018 for the tax year 2019, As per the amended Ordinance, no tax was required to be paid by individuals deriving annual income up to Rs.1,200,000, The Finance Bill 2018 proposed that individuals deriving income from Rs.400,000 to Rs.1,200,000 instead of enjoying zero tax, should pay nominal tax of Rs.1000, for individuals in income brackets from Rs.400,000 to and Rs.800,000, and Rs.2,000 for individuals in income brackets ranging from Rs. 800,001 to Rs. 1,200,000.

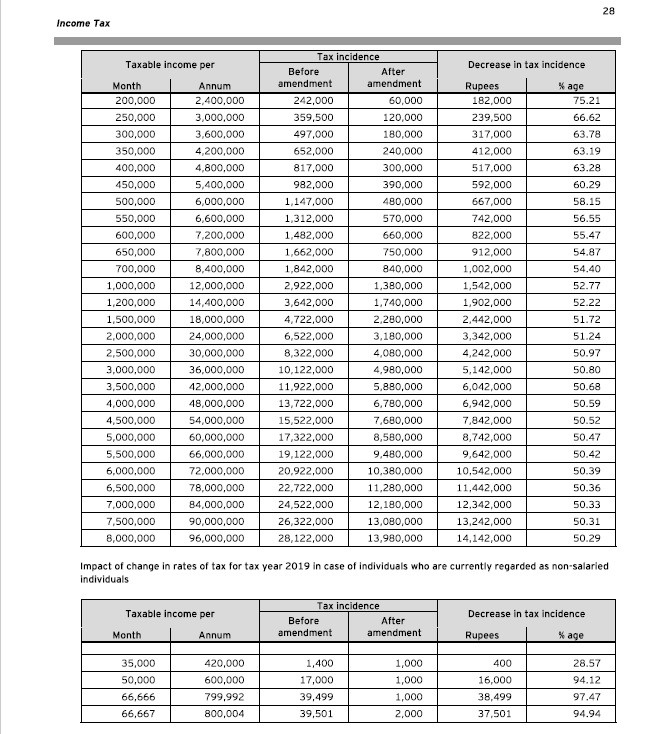

The rates of tax chargeable for individuals and AOPs for the tax year 2019 (corresponding to the income year ending at any time between 01 July 2018 to 30 June 2019) is proposed to be substituted as under as shown in the pics.

It is to mention here that the income tax amendment ordinance 2018 has already been issued.

What is full time teacher /Researchersrebate for tax year 2019-2020

Rates of tax for individuals w.e.f 01.07.2018

1. Up to 1200000. 0%

2. 1200001 to 2400000. 5% of exceeding 1200000

3. 24000001 to 4800000. 60000+10% of exceeding amount 4800000

4. Above 4800000. 180000+15% exceeding 4800000.

This nonsense poor should be killed who cannot give 83 per month but enjoys roads, motorways, parks, picnic places. Yes poor apni mashuqa ko 2 hours daily mobile phone ker sakta hay. Kuch bhi accha ho yeh jaddi pushti kahil lazy kaamchor rota hee rahay ga

aslam u alikum

mujhay to 1200000 annual amdan tak ko koi fiada nazar nahe aia.ager aap samjha sakeen .to inform karen

Bhai this tax i-e 1000 is not per month it will divided in 12 month i-e Rs.83 per month

Dear Saad Ahamd You are right it is 1000/- for the whole year.

Jis ka pehlay per year tax Rs.1000 se kum bunta tha ub oss ko bhi Rs.1000 dena parein gay, yeh tu small employees ka naqsaan hay, aur big fishes ko nawaz dia……..zyadti with poors.