I shall today share the detail of Payment of Sum Assured / Contributions under Group Life Insurance (GLI) submitted by Mr. Agha Amir. I hope you will understand the whole detail of the Group Insurance Amount for the employees.

Detail of Group Life Insurance (GLI)

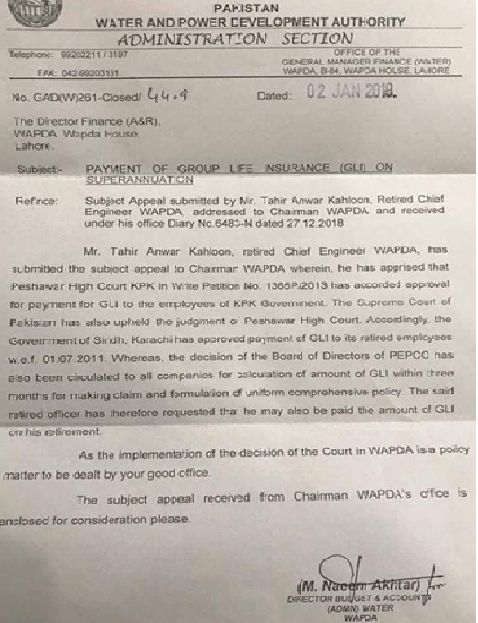

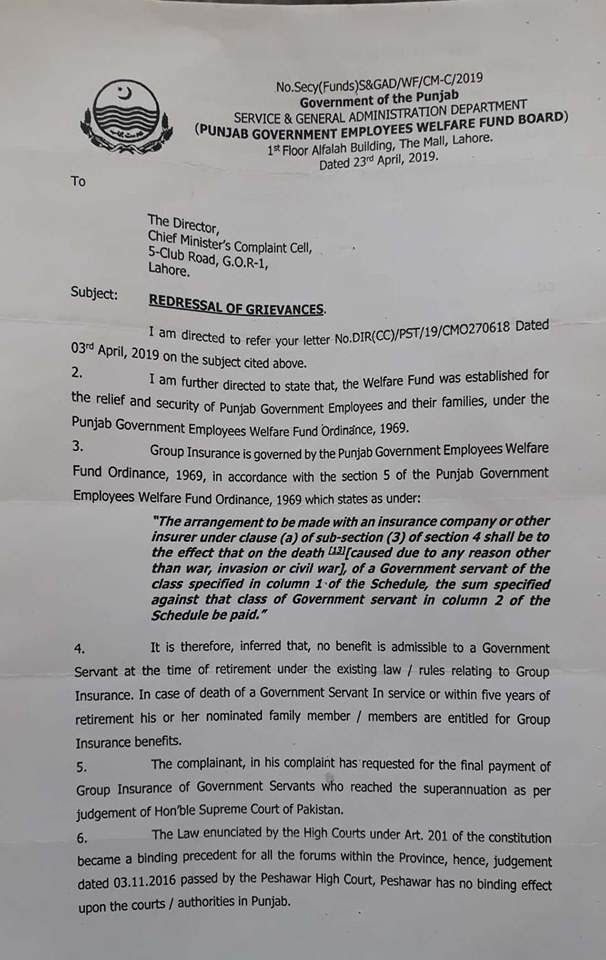

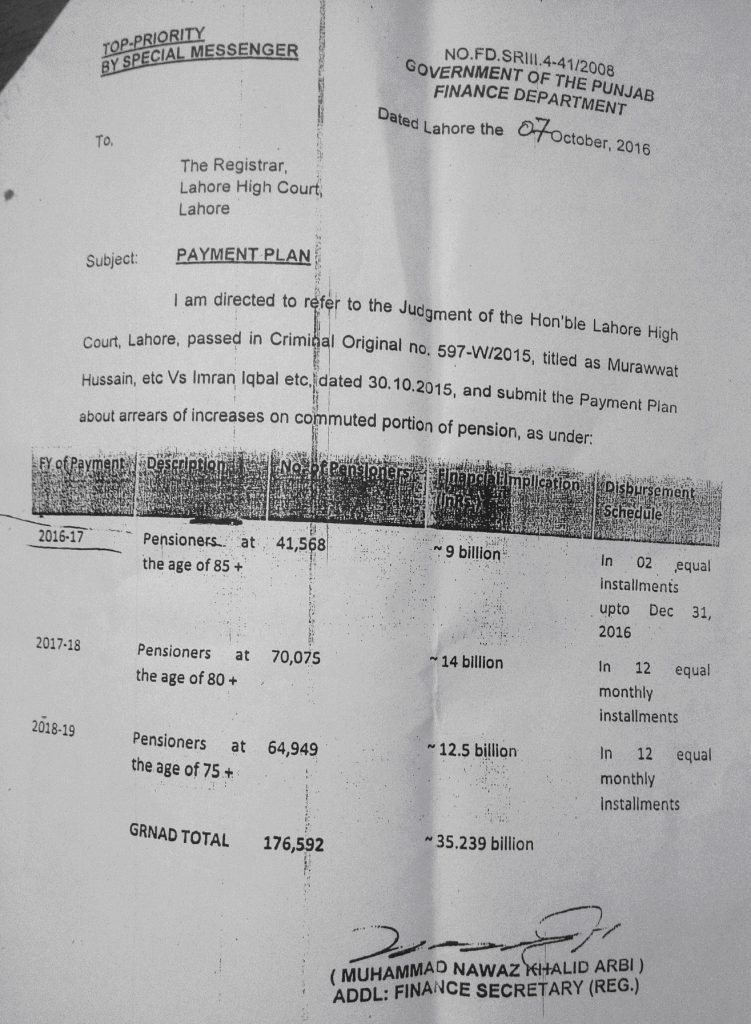

1. Many retired government servants have been led to believe that contributions towards Group Life Insurance (GLI), deducted from their salary, are to be paid back to them. Others have pinned hopes upon receiving the sum assured upon retirement. Orders of Peshawar High Court, upheld by the Supreme Court, are often quoted in support of this impression. Letter dated 02 Jan 2019 from Director Budget and Accounts WAPDA, addressed to the Director Finance (A&R) WAPDA Lahore is copied below which also speaks of payment of Group Life Insurance upon superannuation.

2. Some relevant aspects about Group Life Insurance laws applicable to federal government employees, and retirement benefits laws applicable to KPK government employees are discussed below. Retired persons are requested to please examine these legal provisions, and decide for themselves which group life insurance / retirement benefits laws are applicable in their cases. I shall be awaiting their comments.

Group Life Insurance – Federal government

3. Life insurance is broadly of two types:

(a) where the sum assured is payable to the person nominated in the policy if the insured person dies during validity period of insurance policy. However, if insured person survives the validity period, nothing is payable by the insurer. Group life insurance is generally of this type. If an employee retires alive from employment, nothing is payable by insurer. Premia amounts for this type of insurance are comparatively very small compared to the amounts of premia for policy of (b) type.

(b) where the sum assured is payable to the person nominated in the policy if the insured person dies during validity period of policy. However, if the insured person survives the insurance period, the sum assured is paid to that person. Premia amounts for this type of insurance are obviously very large compared to premia for (a) type policy.

4. When a person takes life insurance policy for air travel, validity of that life insurance is limited to the risk of death during that flight. If the insured person meets some accident during the flight, the insurance company pays the sum assured to the insured person or to the person nominated in the insurance policy. However, if the passenger completes the air journey safe and sound, nothing is payable by the insurer. Such air travel life insurance is of type (a).

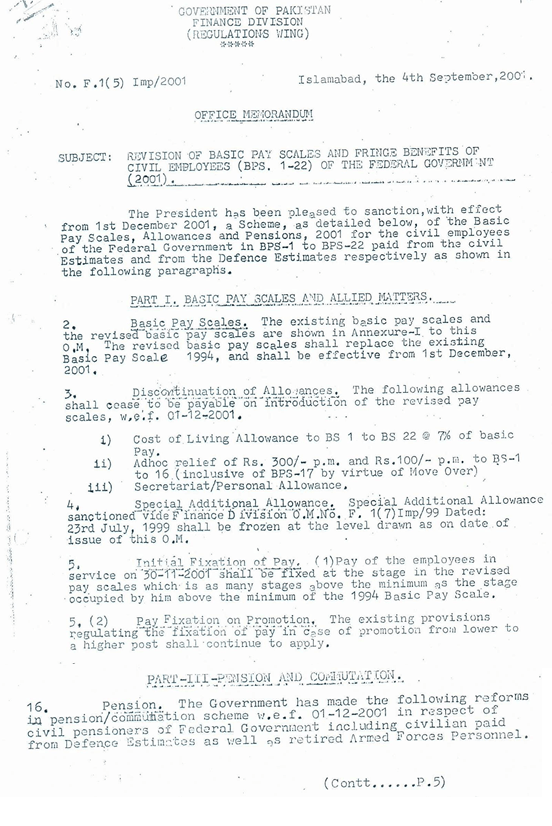

5. The Act : There was no concept of compulsory life insurance for federal government employees before enactment of Federal Government Employees’ Benevolent Fund and Group Insurance Act 1969 (the Act) . They could obtain life insurance policy of their choice, like any other member of public. Life insurance introduced by the Act is of type (a). If an employee dies during service, the sum assured is paid to nominated heir. But if the employee retires alive, nothing is payable by the insurer. Employees have of course the option of obtaining on their own additional insurance of type (b).

6. Two special funds were created under the Act for extending the intended benefits. Titles and sources of receipts of these Funds are given below.

(i) Benevolent Fund, established under Section 11 (1) of the Act. Receipts into this Fund include:

(a) sums paid by employees as subscription;

(b) grants by government and other organizations;

(c) donations;

(d) income and profits from investments of Fund moneys; and

(e) loans raised by Fund’s Board of Governors.

(ii) Insurance Fund, established under Section 2 (17) of the Act. Receipts into this Fund comprise

(a) sums received from employees as premia against their group insurance; and

(b) any interest or profit accruing thereon.

7. Section 15 of the Act provides that in the event of the death of an employee, occurring by whatever cause, during the continuance of his employment, the Board (of Governors) shall pay to the family of the deceased employee, a sum (sum assured) as may be prescribed (in the Act / Rules).

8. Section 16 of the Act allows the Board of Governors to arrange life insurance through an insurance company or other insurer. Liability to pay the sum assured in such case devolves direct upon the insurance company or insurer.

9. Every employee is liable under Section 18 (1) of the Act to pay to the Insurance Fund the prescribed sums of money as premium for group life insurance. The premium is normally deducted at source from employees’ pay and credited or remitted to the Insurance Fund. If the premia is not deducted at source, the employee is required to pay it direct to the Fund. This requirement is reiterated under Rule 6A (1) of the Federal Employees Benevolent Fund and Group Insurance Rules 1972. Rates at which monthly payments are to be made to the Insurance Fund stand specified in Third Schedule to the Rules.

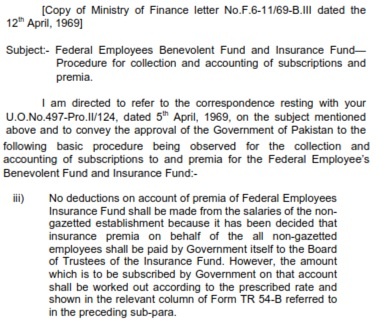

10. Premia on behalf of non-gazetted employees – Although every employee is required to pay the premia sums, yet government decided that premia in respect of non-gazetted employees would be paid by government itself to the Board. This is evident from the following extract from Ministry of Finance letter No.F.6-11/69-B.III dated 12 April 1969. No premia is therefore deducted from the salaries of non-gazetted employees.

11. Section 19 of the Act provides that payment of sum assured is to be made upon death of the employee. Rules 6A (2) and (3) read with Third and Fourth Schedule to the Rules, specify those amounts of ‘sum assured’ which are payable to the families of deceased employees who die while in service.

12. In case an employee retires alive from service for any reason, no benefit out of Insurance Fund is payable to him or his family. In simple words, the life insurance covers the only risk of death during service, and no other risk. It is just like getting insurance against the risk of theft or accident of a car. If the insured car is stolen, or meets accident, the insurance company pays to the policy holder the cost of repairs / vehicle up to the sum assured. If the car is neither stolen nor meets any accident during the risk coverage period, the insurance company is not under any obligation to pay any amount to the policy holder. Premia received by the insurance company is deemed its final revenue income, and there is no question of refunding it in part or whole to the policy holder upon expiry of insurance policy.

Retirement benefits – KPK Government

13. A new KPK Civil Servants Retirement Benefits and Death Compensation Act (the Act) was enacted in 2014. The old KPK Government Employees Welfare Fund Ordinance 1969 was repealed u/s 15 of the 2014 Act.

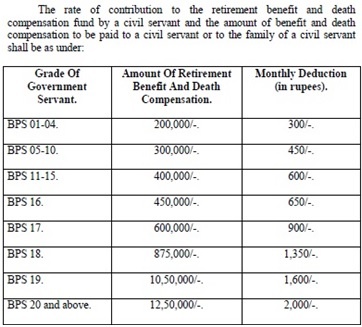

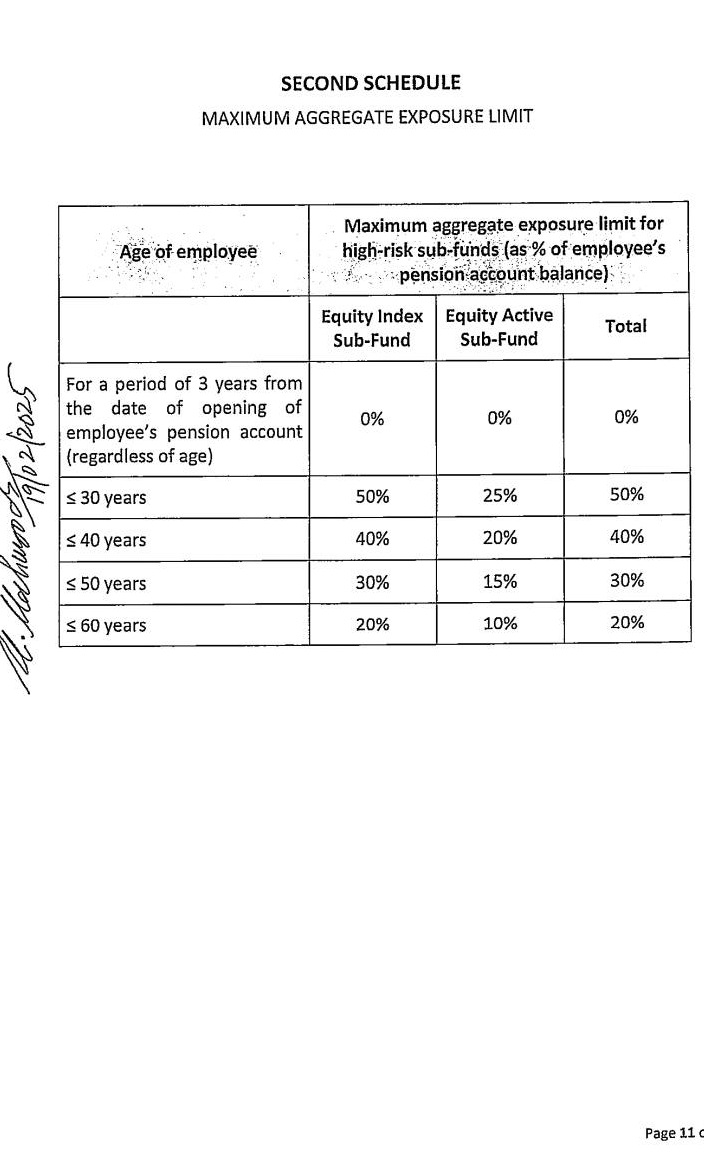

14. A new Fund, known as KPK Government Employees Retirement Benefits and Death Compensation Fund was established under Section 7 of this Act. Fund established under the 1969 ordinance is deemed to be a part of the new Fund, as per Section 7 (2) of the Act. Contribution from every KPK civil servant is deducted at source from salary and is credited / remitted to the Fund. The amounts of (a) contribution and (b) Retirement Benefit & Death Compensation are given in Schedule to the Act (copied below), which vary with Basic Pay Scale of civil servants.

15. Benefit out of the Fund is payable to the full extent [ 100% ] of the amount specified in the Schedule to only those civil servants who retire after 15 years from promulgation of the Act, i.e. from 2029 onward. For those retiring within first 5 years of promulgation of the Act, the benefit is only 25% of the specified amount. The benefit keeps on increasing according to the number of years served after promulgation of the Act, as under:

Retiring during / after %age of amount

(a) First 5 years [2014~2018] 25%

(b) After 5 years [2019~23] 50%

(c) After 10 years [2024~28] 75%

16. Benefit to civil servants who are dismissed, removed, terminated or who resign from service, is limited to the extent of actual contribution to the Fund.

17. Comparison between Federal and KPK laws and benefits

| Federal | KPK | |

| 1 | Federal Government Employees’ Benevolent Fund and Group Insurance Act 1969 still prevails | KPK Civil Servants Retirement Benefits and Death Compensation Act enacted in 2014. KPK Government Employees Welfare Fund Ordinance 1969 repealed under the 2014 Act |

| 2 | Federal Government Employees’ Benevolent Fund and Group Insurance Rules 1972 still prevail | KPK Retirement Benefit & Death Compensation Fund Rules framed in 2017 |

| 3 | Life Insurance Fund is separate from Benevolent Fund | A single Fund exists for (a) Retirement Benefits and (b) Death Compensation, both benefits |

| 4 | Insurance premium for non-gazetted employees paid by Government | Contributions payable by all civil servants |

| 5 | Sum assured payable in case of death during service only. | A single amount for both benefits paid on retirement (or death in service if earlier) |

| 6 | No consideration of service length for payment of sum assured | 25% benefit payable for each 5 years period commencing from Act promulgation in 2014 |

| 7 | Sum assured alone payable to employees who die during service. No refund of any insurance premium upon retirement | Benefit to civil servants who are dismissed, removed, terminated; or who resign from service, is limited to the extent of actual contribution to the Fund. |

Request To Readers to Comment

18. Readers are requested to view their own respective cases in the light of applicable law. Comments / suggestions are welcome.

Agha Amir

amir_agha@hotmail.com

Someone tell me about group insurance ful and final amount of grade 12 employee of wapda

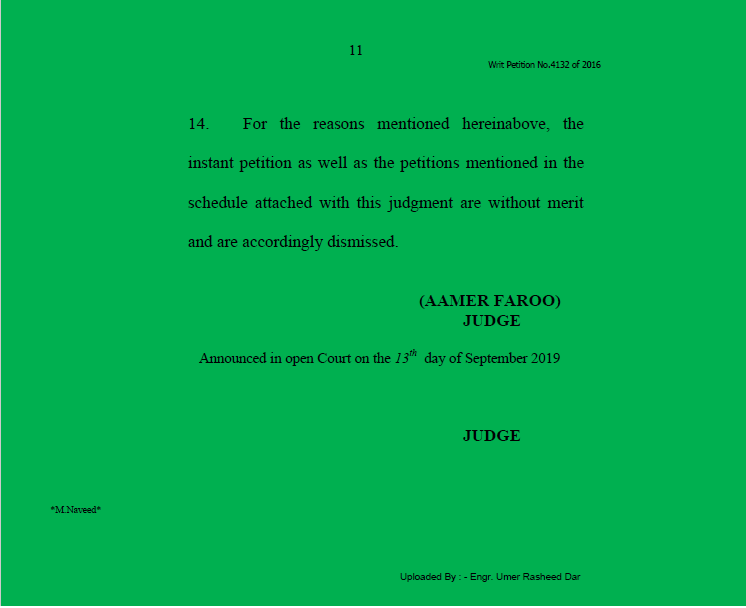

Prima Facie the author has supposed that the Group Life Insurance (GLI) is of first type of Insurance due to the fact that Premium amount is very much low. Definitely this very fact has also been evaluated in the Hon’ble Court and failed to satisfy not only the Hon’ble Judges of the High Court but of the Judges of Apex Court too. It thus legitimate on part of the pensioners to expect that the amount they have paid to the Insurance Company shall be paid back to them along with all legitimate increase.

The instance of Air Journey and like things are quite distinct matters wherein the Insurance Company covers the Circumstantial Life Risk which is almost none in the life of Government Servant. Span of service of the civil servant is not so much short and not so much risky as to be compared with the Air Journey. Even on the other hand, Life Insurance of second category is analogous to alleged first type because in the former the Insured Person is bound to pay certain amount (whether meager or heavy) for a certain period (suppose of 10 or 20 years) during which it is uncertain whether he will survive through or not. Thus, there is no fundamental difference between the both policies.

Furthermore, all the policies stipulates certain time-period for maturity of the Policy upon which the Premium becomes payable. Civil Servant is bound to pay the amount for life or untill 60-yeras of age (roughly for 30-35 years) and proved fortunate enough to have a long life and at the end the Insurance Company refused to pay him back because of fact that “he could not die to have the sum assured” irrespective of the fact that he has succeeded to pay the amount till the last day of period assured. Wht would you say if a person pay for 10-years and at the end the Insurance Company refused him to pay anything because he did not die.

بھائی کسی کے پاس وفاقی ملازمین کا گروپ انشورنس کا نوٹیفکیشن ہے.