Last Updated on July 14, 2019 by Galaxy World

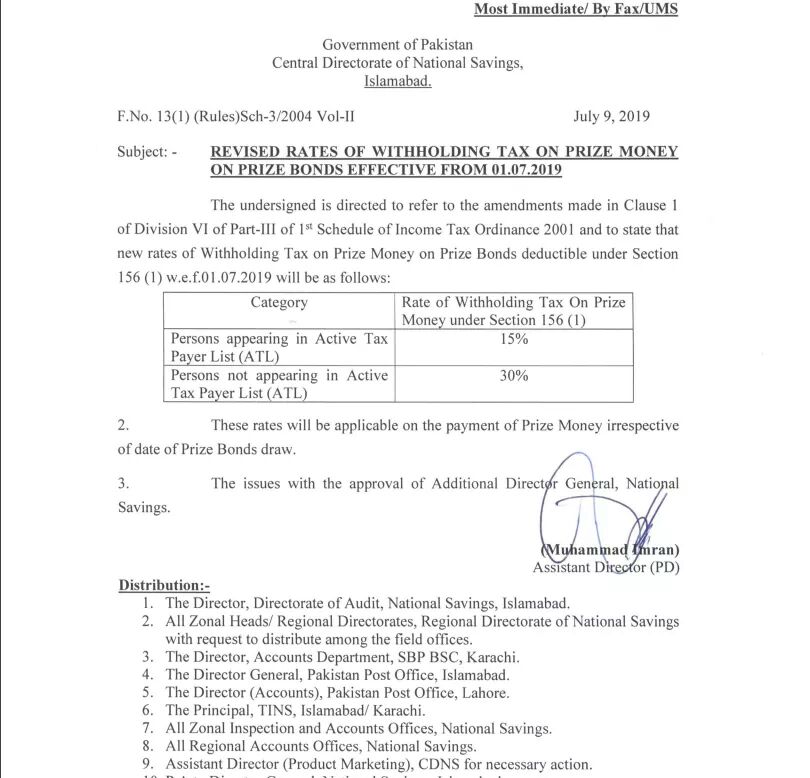

Government of Pakistan, Central Directorate of National Savings, Islamabad has issued Notification on 09-07-2019 in connection with Revised Rates of Withholding Tax on Prize Bonds Prize Money. Detail is as under:

The undersigned is directed to refer to the amendments made in Cause 1 of Division VI of Part-III of 1st Schedule of Income Tax Ordinance 2001 and to state that new rates of Withholding Tax on Prize Money on Prize Bonds deductible under Section 156 (1) w.e.f. 01-07-2019 will be as follows:

| Category | Rate of Withholding Tax On Prize Money under Section 156 (1) |

| Persons appearing in Active Tax Payer List (ATL) | 15% |

| Persons not appearing in Active Tax Payer List (ATL) | 30% |

- The rates will be applicable on the payment of Prize Money irrespective of date of prize Bonds draw.

- The issues with the approval of Additional Directed General, Nation Savings.

Special thanks to Mr. Zahid Khan for sending the copy of the Notification.

nice post