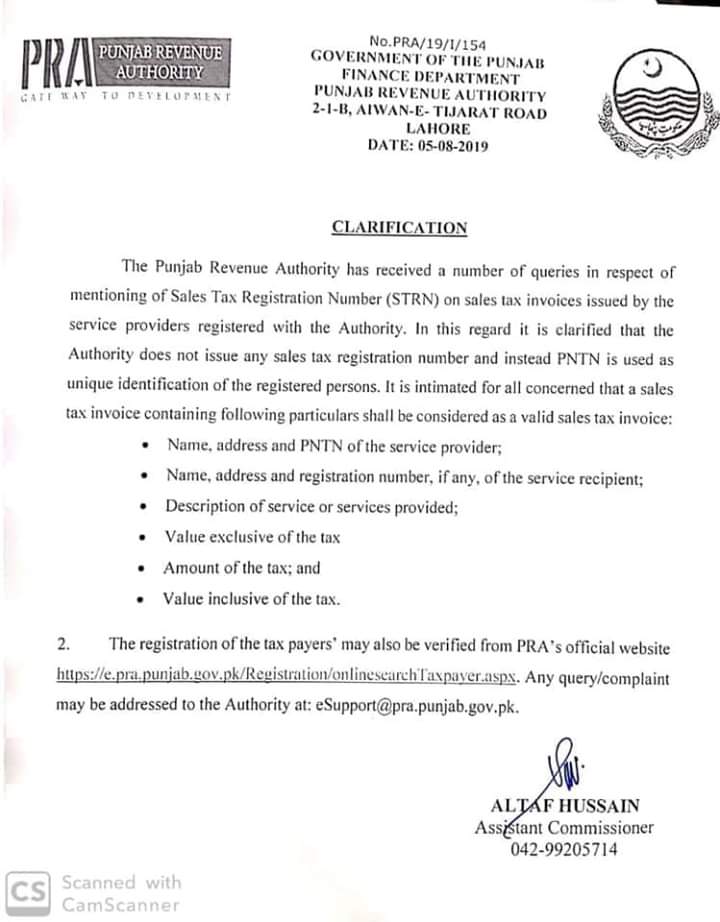

Government of the Punjab, Finance Department has issued Notification on 05-08-2019 in connection with Clarification Regarding Sales Tax Registration Number (STRN). Detail is as under:

The Punjab Revenue Authority has received a number of queries in respect of motioning of Sales tax Registration Number (STRN) on sales tax invoices issued by the service provides registered with the Authorities. In this regard it is clarified that the Authority does not issue any STRN and instead PNTN is used as identification of the registered persons. It is intimated for all concerned that a sales tax invoice containing following particulars shall be considered as a valid sales tax invoice.

. Name, address and PNTN of the service provider;

. Name, address and registration number, if any, of the service recipient;

. Description of service or services provided;

. Value excusive of the tax

. Amount of the tax; and

. Value inclusive of the tax.

- The registration of the tax payers’ may also be verified from PRA’s official website. Any query/complaint may be addressed to the Authority at: eSupport@pra/.punjab.gov.pk.

Special thanks to Mr. Zahid Khan for sending the copy of the Notification.