Last Updated on October 30, 2021 by Galaxy World

This GP Fund Final Amount Calculator for All Grades and all services has been prepared by Mr. Ahmed Ali Mangrio. There may be some errors and chances of amendments. If you think there is a requirement to change the formulas, you can do so, as the cells are not protected.

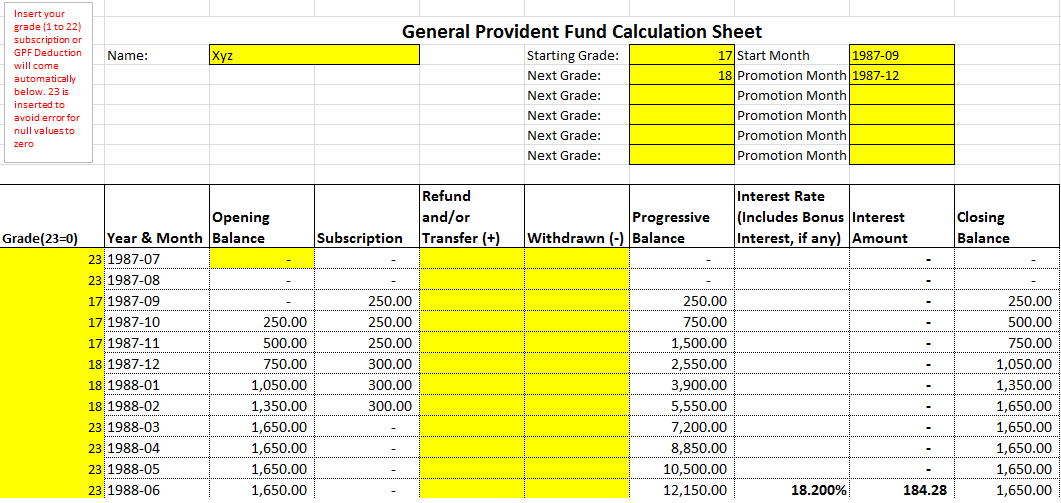

GP Fund Final Amount Calculator

Dear Readers,

I often doubted many GPF Amounts mentioned in our salary / pay slips, these amounts usually are miscalculated or had missing entries due to different postings, transfers, or promotions of employees in different grades and departments. For example, someone is appointed as Assistant in BPS-16 then clears FPSC and appointed as Lecturer BPS-17 and gets promotion or time scale up-gradation later on, then it is very difficult to correctly calculate his or her GPF Amount.

Based on data available on the internet I prepared this sheet to easily calculate the General Provident Fund amount since the date of first joining in government service. Further GPF rules say that only FULL GPF Deduction will be deducted for a calendar month service. If someone joined from 17 to 18 grade on the 20th day of a month then this month will be counted for BPS 17 only and the full amount of General Provident Fund deduction for BPS-17 will be deducted in that month. If you are appointed before the 15th day of any month then the full amount of GPF subscription will be applicable and if appointed after 16th then no deduction will be made for GPF in that first month.

Examples of Calculation Final GP Fund Payment

CASE EXAMPLE:

A person is appointed on 5th March 1992 in BPS 12 and promoted on 1st May 1995 in BPS-16 and again promoted on 1st Sep 2005 in BPS-17 and till date working in BPS-17.

SOLUTION:

In column Y (Year and Month) go to the first month of your appointment (e.g. 1992-03), then insert your BPS besides in column X (BPS) (i.e.. 12). Now copy-paste 12 till the last month you worked in Grade 12 (e.g., 1995-04). Then type ’17’ in yellow shaded column X before the month (1995-05). Now copy-paste 16 till the month 2005-08. Now type ’17’ before 2005-09 and copy-paste ’17’ till the last row of a sheet in the BPS Column (Column X of Sheet 1). Just that it. The sheet will automatically do the rest automatic tasks are:

1) puts subscriptions amount applicable for that year, month, and grade,

2) calculate interest based on the rate and amount of that year, and

3) will carry that amount to all next coming years.

Please Note:

- This sheet is for employees appointed on or after 1st July 1987.

- Actually, the excel formula not allowed the choice for null value in the corresponding function so I fixed 23 numbers for zero value. Therefore you must put 23 in column X (BPS) for 1986-07 to 1995-03.

- These sheet amounts are just for check purposes only, not holds any authority. The final authority to calculate GPF amount lies with the Accounts Office. Though prepared with much zeal and zest errors are possible.

- You can also add amounts for any advance you have withdrawn or refunds for the advances if any in column AB and AC.

- The printable area is set and you can easily print the whole sheet for further workouts.

Remember me in your prayers.

Ahmed Ali Mangrio

Lecturer in Commerce

Govt. Islamia Arts & Commerce College Sukkur

You may also like: GP Fund Marks-up Rates 2018-2019