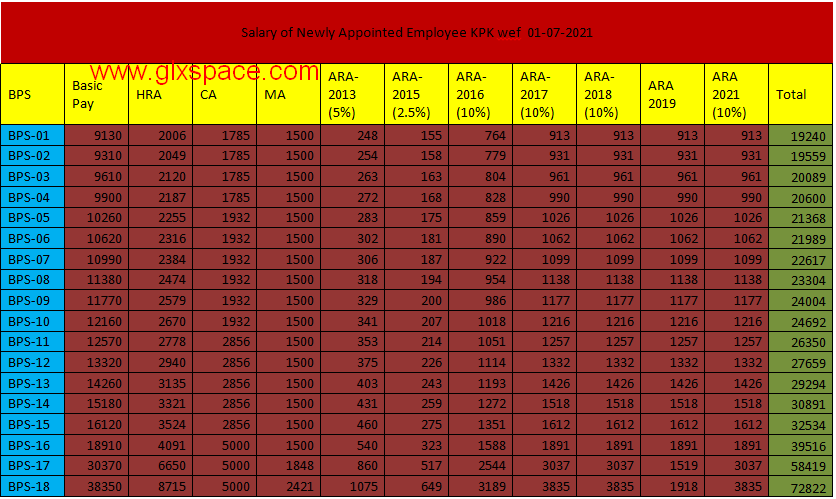

I have prepared a chart of Salary of Fresh Appointed Employee 2021-22 Pay Scale Wise. Through this chart of pay and allowance for the newly appointed employee in the year 2021-2022, you can see the details of all the employees of BPS-01 to BPS-18. Although this chart will not cover all the employees of all the departments, however, the employees who are not getting any special allowance equal to 100% or more will get benefits from it.

Chart of Estimated Salary of Fresh Appointed Employee 2021-22

I had also prepared the estimated salary chart of fresh appointed employees 2020-21 BPS Wise. Now as the salaries of the employees have been revised during the budget 2021-22. I have prepared the charts of salaries for all provinces and federal employees. This chart covers all the employees of all the provinces of Pakistan as well as Federal Government employees. The newly appointed employee in Punjab, Sindh, Balochistan, Khyber Pakhtunkhwa (KPK), Gilgit Baltistan (GB) as well as in Azad Jammu & Kashmir (AJK) can check his/her salary. I have prepared separately for each province and Federal employee. Before going to the charts let’s see which common pay and allowances the employees of all provinces and federal government employees are getting. The details of pay and allowances are as under:

Common Pay and Allowances for All Employees

As I earlier mentioned that this chart is usually for the employees who are not getting special allowances except the recently announced disparity reduction allowance 2021 and special allowances. So the details of common pay and allowances that afresh appointed employee will get are as under:

- Basic Pay

- Medical Allowance

- House Rent Allowance / Hiring

- Conveyance Allowance

- Adhoc Relief Allowance 2016 (Frozen)

- Adhoc Relief Allowance (ARA-2017) 2017

- ARA- 20218 – Adhoc Relief Allowance 2018

- Adhoc Relief Allowance 2019

- Adhoc Relief Allowance 2021

- Disparity Reduction Allowance /Special Allowance

What is House Rent Allowance and Hiring?

The employees get at some stations hiring and at some cities, they get hiring of residential accommodation. There are 6 cities where Federal employees get hiring, these cities are as under:

- Lahore

- Quetta

- Karachi

- Peshawar

- Rawalpindi

- Islamabad

If any employee in these cities does not get Hiring, he gets House Rent Allowance. House Rent Allowance Rates are also different in various cities. House Rent is categorized as Special Cities and Common Cities. Here Special Cities mean Lahore, Karachi, Quetta, Peshawar, Rawalpindi, Islamabad, Faisalabad, Multan, Gujranwala, Sargodha, Hyderabad, Bahawalpur, etc. In Special cities, the employee gets 45% HRA of the initial of the Revised Pay Scales 2008 Plus 50%. While in other cities the employee gets 30% Plus 50% of the initial of the revised pay scales 2008. The rates of hiring are different for Islamabad and the other five cities. The rates of Hiring are pay scale-wise. Finance Division has already issued the Notification of Enhanced Rental Ceiling 2018. You can check the rates of hiring there.

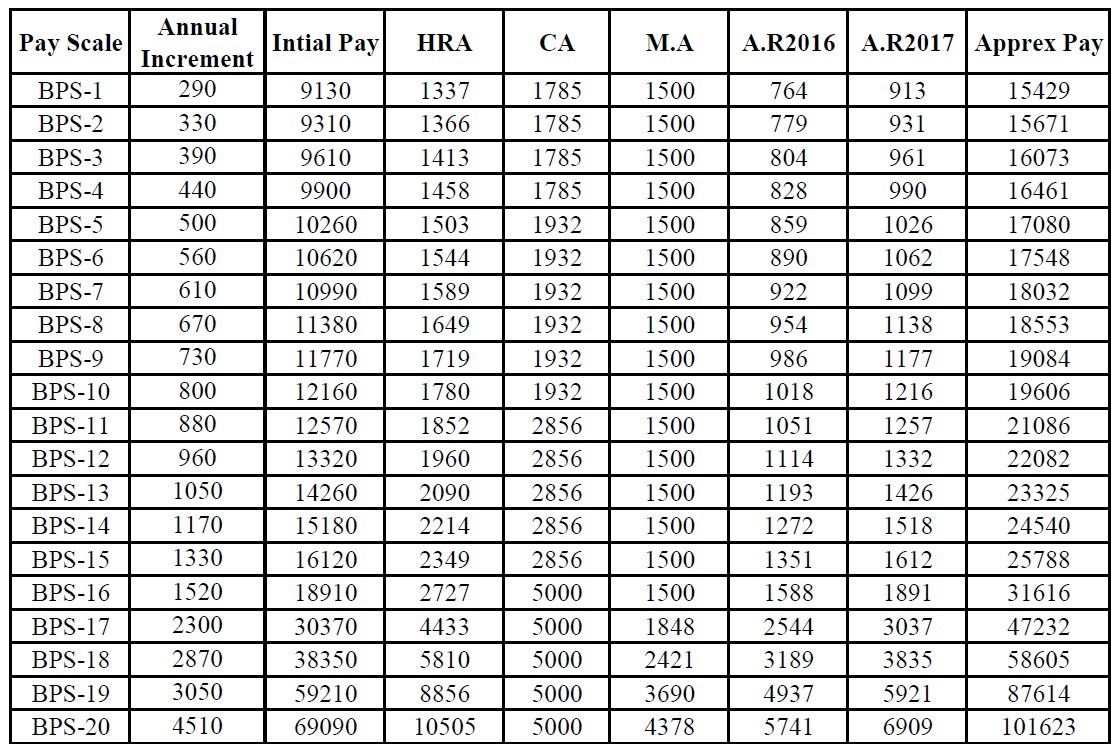

The table of House Rent Allowance and Hiring is as under:

Table of House Rent Allowance Federal and Provinces Except KPK

| BPS | 30% HRA | 45% HRA |

| BPS-01 | 1337 | 2006 |

| BPS-02 | 1367 | 2051 |

| BPS-03 | 1413 | 2120 |

| BPS-04 | 1458 | 2187 |

| BPS-05 | 1503 | 2255 |

| BPS-06 | 1544 | 2316 |

| BPS-07 | 1589 | 2384 |

| BPS-08 | 1650 | 2475 |

| BPS-09 | 1719 | 2579 |

| BPS-10 | 1781 | 2672 |

| BPS-11 | 1853 | 2780 |

| BPS-12 | 1961 | 2942 |

| BPS-13 | 2091 | 3137 |

| BPS-14 | 2214 | 3321 |

| BPS-15 | 2349 | 3524 |

| BPS-16 | 2727 | 4091 |

| BPS-17 | 4433 | 6650 |

| BPS-18 | 5810 | 8715 |

Some Other Allowance that a Newly Appointed Employee Can Get

There is some other allowance too that the newly appointed employee can get, these are as under:

- Teaching Allowance for teachers

- Qualification Allowance (M.Phil, Ph.D. Allowance)

- Computer Allowance

- Integrated Allowance

- Washing Allowance

- Dusting Allowance

- Dress Allowance/Uniform Allowance

- Charge Allowance

- Hard Area Allowance

- Health Risk Allowance for Health Department Employees

In addition to the above, different departments are also granting some other allowance too. These allowances depend on which department your appointment is made. It is not a surety that if a department is granting any special allowance, the other department will also grant it. Every department may have some of its own special allowances. But the main pay and allowance that I mentioned in common pay and allowance are nearly the same. Now let’s move to the chart of the salary of a newly appointed employee in provinces and federal during the year 2021-2022.

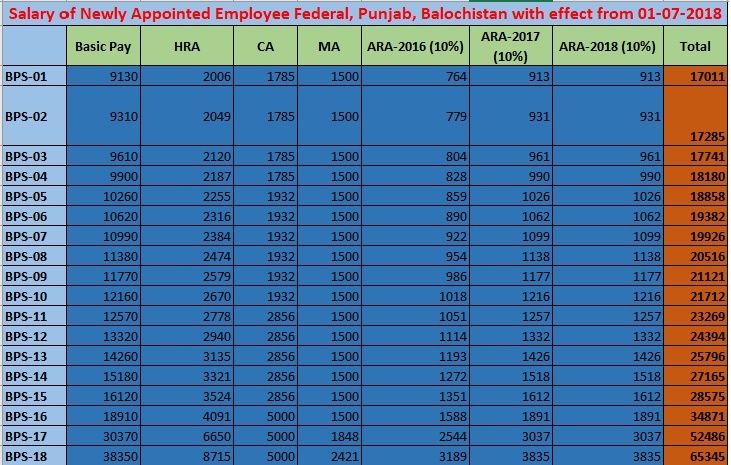

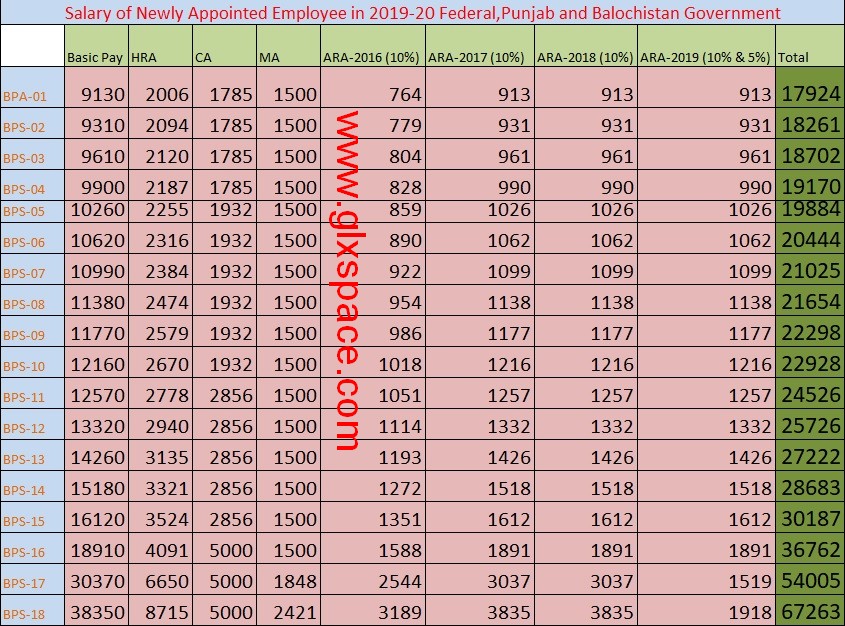

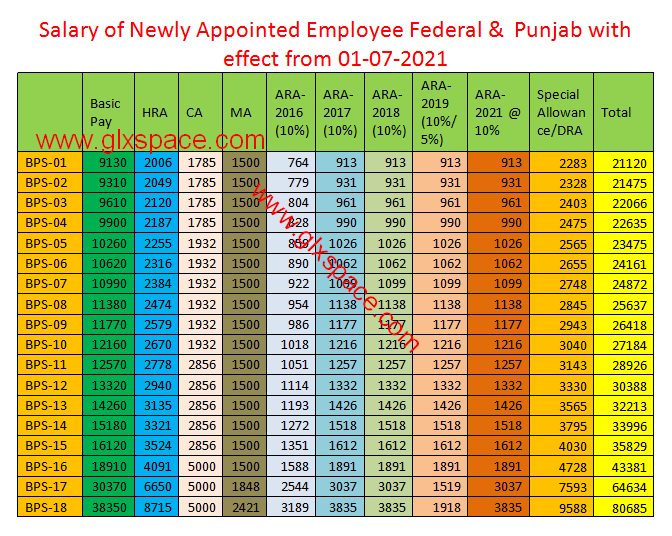

Salary Chart PayScale Wise Federal and Punjab

The Federal Government employees and Punjab Government employees on their initial appointment will get nearly the same pay and allowance for general posts. However, there may be a special allowance for special designations and departments. Punjab Employees will get Special Allowance 2021 on the initial basic pay of the revised pay scales 2017. Federal Government employees will get a Disparity Reduction Allowance that is also 25% but on the running basic pay. However, it is the same for the newly appointed employees in Federal and Punjab. The class IV employees of Punjab will get Rs. 450/- as an integrated allowance while the Federal Class IV employees will get Rs. 900/- as integrated allowance. The total estimated salary excluding any specific allowance for the fresh appointed employee PayScale Wise is as under:

| Pay Scale | Gross Salary |

| BPS-01 Salary | 21120 |

| BPS-02 Salary | 21475 |

| BPS-03 Salary | 22066 |

| BPS-04 Salary | 22635 |

| BPS-05 Salary | 23475 |

| BPS-06 Salary | 24161 |

| BPS-07 Salary | 24872 |

| BPS-08 Salary | 25637 |

| BPS-09 Salary | 26418 |

| BPS-10 Salary | 27184 |

| BPS-11 Salary | 28926 |

| BPS-12 Salary | 30388 |

| BPS-13 Salary | 32213 |

| BPS-14 Salary | 33996 |

| BPS-15 Salary | 35829 |

| BPS-16 Salary | 43381 |

| BPS-17 Salary | 64634 |

| BPS-18 Salary | 80685 |

Table of Pay and Allowances Punjab Province/Federal

Note: Federal Government has granted Disparity reduction Allowance 2022 @ 15% on running basic pay. This allowance is only for the employees of FG who are not getting any special allowance equal to or more than 100%. We’ll add 15% more of the basic pay in the below chart.

| BPS | Basic Pay | HRA | CA | MA | ARA-2016 (10%) | ARA-2017 (10%) | ARA-2018 (10%) | ARA-2019 (10%/5%) | ARA-2021 @ 10% | Special Allowance/DRA | Total |

| BPS-01 | 9130 | 2006 | 1785 | 1500 | 764 | 913 | 0913 | 913 | 913 | 2283 | 21120 |

| BPS-02 | 9310 | 2049 | 1785 | 1500 | 779 | 931 | 0931 | 931 | 931 | 2328 | 21475 |

| BPS-03 | 9610 | 2120 | 1785 | 1500 | 804 | 961 | 0961 | 961 | 961 | 2403 | 22066 |

| BPS-04 | 9900 | 2187 | 1785 | 1500 | 828 | 990 | 0990 | 990 | 990 | 2475 | 22635 |

| BPS-05 | 10260 | 2255 | 1932 | 1500 | 859 | 1026 | 01026 | 1026 | 1026 | 2565 | 23475 |

| BPS-06 | 10620 | 2316 | 1932 | 1500 | 890 | 1062 | 01062 | 1062 | 1062 | 2655 | 24161 |

| BPS-07 | 10990 | 2384 | 1932 | 1500 | 922 | 1099 | 01099 | 1099 | 1099 | 2748 | 24872 |

| BPS-08 | 11380 | 2474 | 1932 | 1500 | 954 | 1138 | 01138 | 1138 | 1138 | 2845 | 25637 |

| BPS-09 | 11770 | 2579 | 1932 | 1500 | 986 | 1177 | 01177 | 1177 | 1177 | 2943 | 26418 |

| BPS-10 | 12160 | 2670 | 1932 | 1500 | 1018 | 1216 | 01216 | 1216 | 1216 | 3040 | 27184 |

| BPS-11 | 12570 | 2778 | 2856 | 1500 | 1051 | 1257 | 01257 | 1257 | 1257 | 3143 | 28926 |

| BPS-12 | 13320 | 2940 | 2856 | 1500 | 1114 | 1332 | 01332 | 1332 | 1332 | 3330 | 30388 |

| BPS-13 | 14260 | 3135 | 2856 | 1500 | 1193 | 1426 | 01426 | 1426 | 1426 | 3565 | 32213 |

| BPS-14 | 15180 | 3321 | 2856 | 1500 | 1272 | 1518 | 01518 | 1518 | 1518 | 3795 | 33996 |

| BPS-15 | 16120 | 3524 | 2856 | 1500 | 1351 | 1612 | 01612 | 1612 | 1612 | 4030 | 35829 |

| BPS-16 | 18910 | 4091 | 5000 | 1500 | 1588 | 1891 | 01891 | 1891 | 1891 | 4728 | 43381 |

| BPS-17 | 30370 | 6650 | 5000 | 1848 | 2544 | 3037 | 3037 | 1519 | 3037 | 7593 | 64634 |

| BPS-18 | 38350 | 8715 | 5000 | 2421 | 3189 | 3835 | 3835 | 1918 | 3835 | 9588 | 80685 |

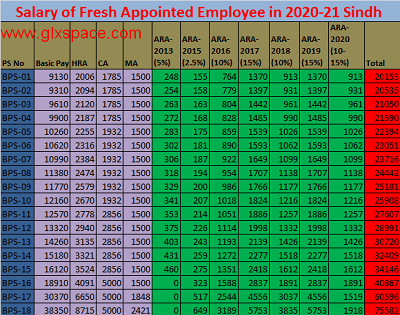

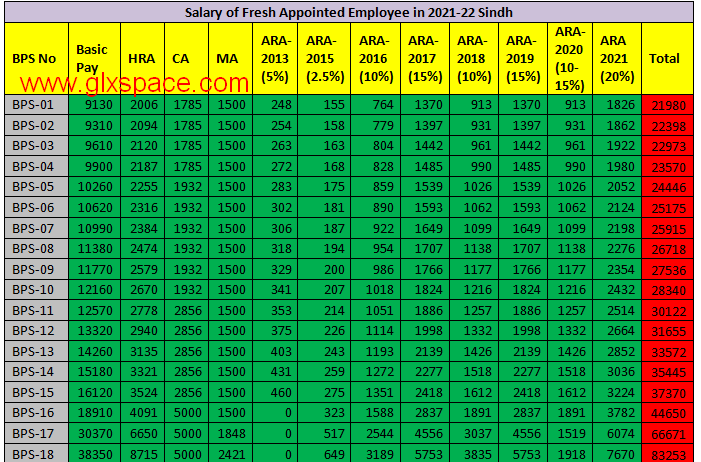

Salary Chart For Each Employee Sindh

The Sindh Government employees will also get other allowances depending on their post and department. Recently the Sindh Government Finance Department issued the Notification of Adhoc Relief Allowance 2021 and Personal Allowance. Salary of Fresh Appointed Employee 2021-22

Sindh also depends on many factors.

This personal allowance is for the employees of BPS-01 to BPS-05. The rates of personal allowance 2021 Sindh Government are as under:

| Sr. No | Pay Scale | Amount (Rs.) |

| 1 | BPS-01 | Rs. 1900/- per month |

| 2 | BPS-02 | Rs. 1500/- per month |

| 3 | BPS-03 | Rs. 900/- per month |

| 4 | BPS-04 & BPS-05 | Rs. 250/- per month |

The employees of the province of Khyber Pakhtunkhwa will also get the following allowances depending on their department/job description:

- Monthly Stipend for Nursing Internees @ 31000/- per month

- Monthly Stipend for House Officers Rs. 64358/- for category-A Hospitals and Rs. 75600/- for Category-B hospitals

- Lady Health Workers Allowance @ 2200/- per month

- Lady Health Supervisors Allowance @ 3000/- per month

- Teaching Allowance @ 20% of the Initial Basic Pay of the Revised Pay Scales 2017 to all teachers

- Special Allowance to civil employees of BPS-06 to BPS-16 @ 3500/- per month (Note: Only particular employees who are not getting technical Allowance, Integrated Allowance, Teaching Allowance, Risk Allowance, Health Professional Allowance will get this special allowance

- Risk Allowance to the police uniform personnel @ 20% of the initial basic pay of 2017 pay scales

- Integrated Allowance @ 600/- per month (BPS-01 to BPS-06 All employees)

- Washing Allowance @ 1000/- per month (BPS-01 to BPS-06 All employees)

- Dress Allowance @ 1000/- per month (BPS-01 to BPS-06 All employees)

- Health Professional Allowance @ 15000/- per month

- Technical Allowance for Engineers ranging from Rs. 45550/- per month to 103635/- per month for the employee of BPS-17 to BPS-20

- IT Professional Allowance @ one Initial Basic Pay of the Pay Scales 2017

Chart of House Rent Allowance KP Province Employees

| BPS | Peshawar | Rest of KPK |

| BPS-01 | 2,697 | 2,005 |

| BPS-02 | 2,719 | 2,049 |

| BPS-03 | 3,542 | 2,120 |

| BPS-04 | 3,576 | 2,187 |

| BPS-05 | 3,310 | 2,255 |

| BPS-06 | 3,640 | 2,315 |

| BPS-07 | 4,968 | 2,383 |

| BPS-08 | 5,013 | 2,474 |

| BPS-09 | 5,066 | 2,579 |

| BPS-10 | 5,111 | 2,670 |

| BPS-11 | 6,909 | 2,778 |

| BPS-12 | 6,990 | 2,940 |

| BPS-13 | 7,088 | 3,135 |

| BPS-14 | 8,640 | 3,321 |

| BPS-15 | 8,741 | 3,524 |

| BPS-16 | 9,024 | 4,091 |

| BPS-17 | 12,557 | 6,649 |

| BPS-18 | 13,590 | 8,714 |

| BPS-19 | 18,684 | 13,284 |

| BPS-20 | 23,074 | 15,758 |

| BPS-21 | 27,024 | 17,469 |

| BPS-22 | 32,292 | 18,684 |

Balochistan Employees Salary on Initial Appointment

I have not yet received the Notification of ARA 2021 and other benefits for the Balochistan Government employees. As soon as I get the same, I shall update the Salary of Fresh Appointed Employee 2021-22 for Balochistan employees. However, for the general calculation of pay for the newly appointed employees in Balochistan, anyone can use the chart of the Federal Government except the DRA-2021.

Deductions from Salary

The above-mentioned salary is gross salary. However, the employee gets a net salary every month after some deductions. The deductions are as under:

- Benevolent Fund (BF)

- General Provident Fund (GP Fund)

- Income Tax

- Group Insurance for BPS-16 and above employees

The rates of deduction of Group Insurance and Benevolent Fund may be different for the employees of the provinces and Federal. However, the rates of income tax depending on the slabs issued by FBR. The employee getting Rs. 600,000/- or less annual salary will not have to deduct any income tax.

Rates of Deduction of Group Insurance Federal

The rates of deduction of Group Insurance for federal government employees are as under:

| Sr No | Basic Pay | Deduction of Group Insurance |

| 1 | Up to 5,000 | 381 |

| 2 | 5,001 to 10,000 | 436 |

| 3 | 10,001 to 15,000 | 490 |

| 4 | 15,001 to 20,000 | 545 |

| 5 | 20,001 to25,000 | 600 |

| 6 | 25,001 to 30,000 | 654 |

| 7 | 30,001 to 35,000 | 709 |

| 8 | 35,001 to 40,000 | 763 |

| 9 | 40,001 to 45,000 | 818 |

| 10 | 45,001 to 50,000 | 872 |

| 11 | 50,001 to 55,000 | 926 |

| 12 | 55,001 to 60,000 | 981 |

| 13 | 60,001 to 65,000 | 1,036 |

| 14 | 65,001 & above | 1,090 |

Rate of Deduction of Benevolent Fund Federal Employees

The rats of the monthly deduction of BF for the Federal Government employees are as under:

| Sr. No. | Basic Pay | Monthly Deduction of BF |

| 1 | Upto 5,000 | 120 |

| 2 | 5,001 to 5,500 | 126 |

| 3 | 5,501 to 6,000 | 138 |

| 4 | 6,001 to 6,500 | 150 |

| 5 | 6,501 to 7,000 | 162 |

| 6 | 7,001 to 7,500 | 174 |

| 7 | 7,501 to 8,000 | 186 |

| 8 | 8,001 to 8,500 | 198 |

| 9 | 8,501 to 9,000 | 210 |

| 10 | 9,001 to 9,500 | 222 |

| 11 | 9,501 to 11,000 | 246 |

| 12 | 11,001 to 13,000 | 288 |

| 13 | 13,001 to 15,000 | 336 |

| 14 | 15,001 to 17,000 | 384 |

| 15 | 17,001 to 19,000 | 432 |

| 16 | 19,001 to 21,000 | 480 |

| 17 | 21,001 to 23,000 | 528 |

| 18 | 23,001 to 25,000 | 576 |

| 19 | 25,001 to 27,000 | 624 |

| 20 | 27,001 to 29,000 | 672 |

| 21 | 29,001 to 31,000 | 720 |

| 22 | 31,001 to 33,000 | 768 |

| 23 | 33,001 to 35,000 | 816 |

| 24 | 35,00 1 to 37,000 | 864 |

| 25 | 37,001 to 39,000 | 912 |

| 26 | 39,001 and above | 960 |

GP Fund Monthly Deduction Rates

Rates of the monthly subscription of the General Provident Fund (GP Fund) for the employees, and the Government have already been announced. These rates of deduction of the GP Fund are as per the basic pay scale of the employees. The rates are different for each pay scale employee from BPS-01 to BPS-22.

Turn of the employees:

If the employees think that there is a need to have some amendment or addition to the above charts, can send me feedback or email me the details on the Salary of Fresh Appointed Employee 2021-22

So that I may update the post for the guidance of the newly appointed employees all over Pakistan.