Last Updated on June 30, 2022 by Galaxy World

I am sharing here the latest Income Tax Rates 2022-23 for Salaried Persons (Employees) with Slabs. There was various news regarding an increase in tax rates for employees. Now the Government has issued the latest chart of the salaried person’s tax rates 2022-23. The chart of the tax rates for 2022 for employees is as under:

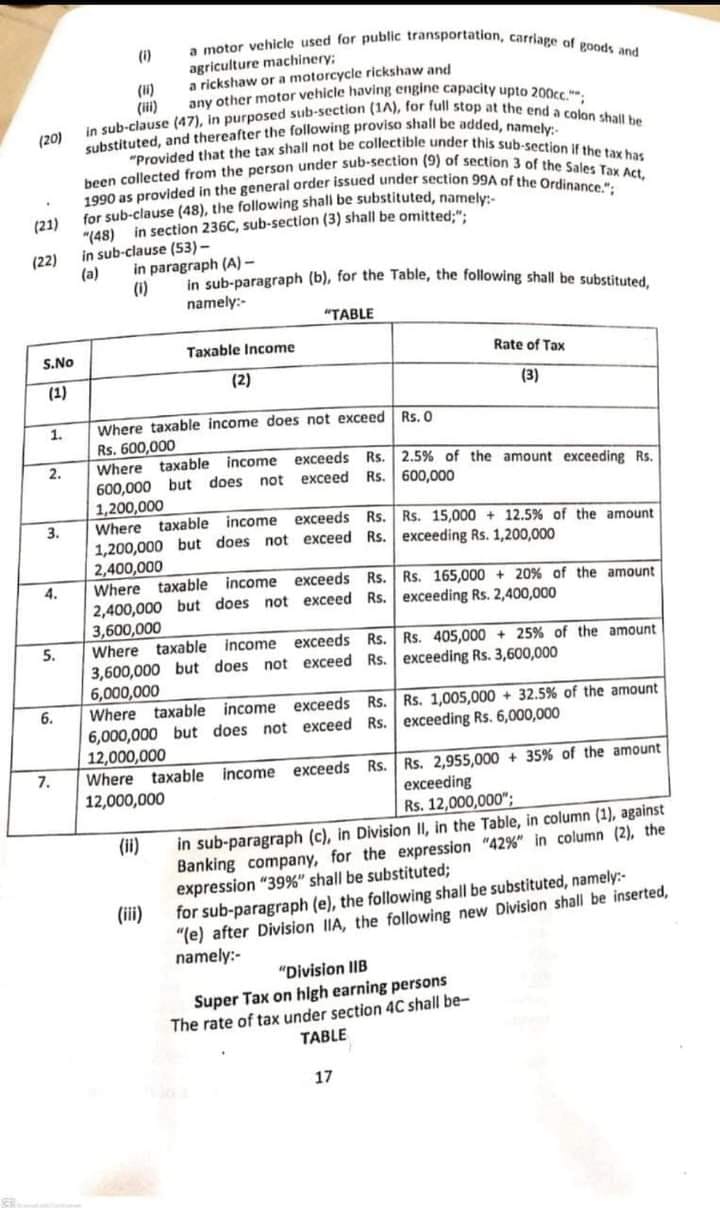

Income Tax Rates 2022-23 for Salaried Persons (Employees)

| S. No. | Taxable income | Rate of Tax |

| (1) | (2) | (3) |

| 1. | Where the taxable income does not exceed Rs.600,000 | Rs. 0 |

| 2. | Where the taxable income exceeds Rs.600,000 but does not exceed Rs.1,200,000 | 2.5% of the amount exceeding Rs.600,000 |

| 3. | Where taxable income exceeds Rs.1,200,000 but does not exceed Rs.2,400,000 | Rs.15,000 + 12.5% of the amount exceeding Rs.2,400,000 |

| 4. | Where taxable income exceed Rs.2,400,000 but does not exceed Rs.3,600,000 | Rs.165,000 + 20% of the amount exceeding Rs.2,400,000 |

| 5. | Where taxable income exceeds Rs.3,600,000 but does exceeds Rs.6,000,000 | Rs.1005,000 + 32.5% of the amount exceeding Rs.6,000,000 |

| 6. | Where the taxable income exceeds Rs.6,000,000 but does not exceed Rs.12,000,000 | Rs.2,955,000 + 35% of the amount exceeding

Rs.12,000,000”; |

- In sub-paragraph (c), in Division II, in the Table, in column (1), against Banking company, for the expression “42%” in column (2), the expression “39%” shall be substituted;

- For sub-paragraph (e), the following shall be substituted, namely:-

“(e) after Division IIA, the following new Division shall be inserted, namely:-

“Division IIB

Super Tax on high-earning persons

The rate of tax under section 4C shall be—

Table

Tax Rates Increased or Decreased?

If we look at the chart the tax rates for various slabs of employees decreased. For example, if we look at the 2nd slab of tax, the tax rates decreased from 5% to 2.5%. In previous years the tax rates for these employees were 5%. However, the slab extended. Previously the annual income for this slab started from 800,000/- per annual, now this slab starts from 600,000/- per annual. Employees whose monthly income is 50,001 will have to pay the income tax. You can check other slabs too for the calculation of your annual tax. The employees whose salary is Rs. 1 to 50,000/- will have to pay no tax.

Calculation of Tax

We will calculate the tax on the amount that exceeds the slab’s amount. Suppose the monthly income of an employee is 70,000/- then we shall minus 50,000/- from it and total tax will be on the amount of 20,000/- SO the tax calculation on 20000/- is 20000 x 2.5/100 = 500/- Rupees.

You may also like: Revised Pay Scales 2022 & Salary Increase GB Employees

AOA PLEASE GUIDE ANY CHANGE IN BUDGET 2022-23 FOR WITHHOLDONG TAX ON COMMISSION I.E 12% AND 24% FOR FILER AND NON FILER

I have not yet updates of this.

The 2.5% tax on the exceeding amount, is that for each month or just for whole year

This tax is monthly. Annually bhi karain to total annual amount per bhi 2.5 hi hoga.

In serial No. 3, you have written 2400000 instead of 1200000 under the heading of rate of tax, plz make the correction.

Ok I ll do it.

Kindly check slab number 3, rate is on exceeding Rs.12,00,000/- instead of Rs.24,00,000/-.

Ok Thanks for pointing out mistake.

Incorrect Information given for Slab 3 – It should be amount exceeding 12 lacs not 24 lacs.

Thanks I ll correct it.

Yes, table in the news and table refered from FBR does not match. Report needs to be corrected.

Salary tax wrong