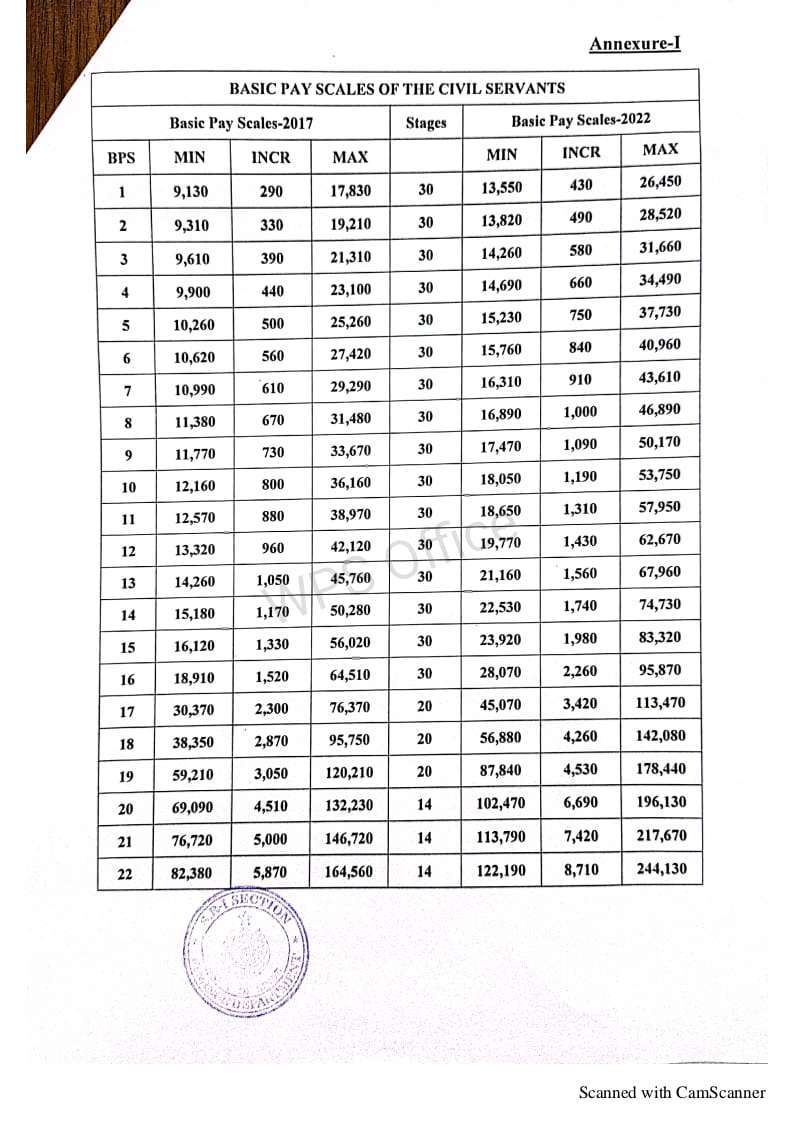

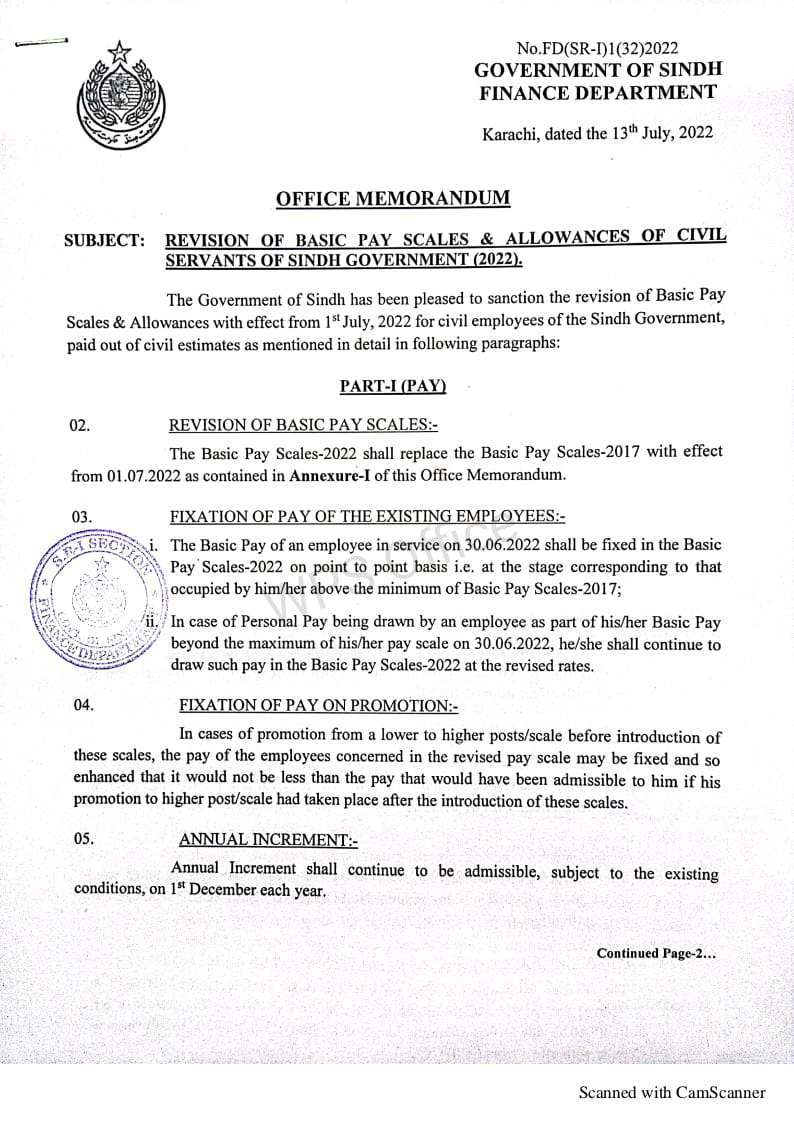

Government of the Sindh issued a Notification on 13-07-2022 in connection with Notification Revised Pay Scales 2022 Sindh. The Pay scales of the Sindh Government employees have also been revised after 5 years. Sindh Government employees will also get a Adhoc relief allowance 2022 @ 15% of the current basic pay of the Revised Pay Scales 2017.

Notification Revised Pay Scales 2022 Sindh Province

Sindh Government has also merged five Adhoc Relief Allowances granted in 2016, 2017, 2018, 2019, and 2021. But their allowances will be merged as per the following ratio:

| S. No | Allowance | Rate of Allowance | A portion of Allowance merged into basic pay | Remaining Allowance |

| 1 | Adhoc Relief Allowance 2016 | 10% of basic Pay of 2016 Pay Scales | 10% | 0% |

| 2 | 2017 Adhoc Relief Allowance | 10% of basic Pay of 2017 Pay Scales | 10% | 0% |

| 3 | 2018 Adhoc Relief Allowance | @ 10% of Basic Pay of 2017 Pay Scales | 10% | 0% |

| 4 | 2019 ARA | 15% of 2017 pay scales current pay | 10% | 5% |

| 5 | 2020 ARA | BPS-01 to BPS-16 = 10%

BPS-17 and above = 5% |

0 | 10% and 5% |

| 6 | 2021 Adhoc Relief Allowance | 20% of 2017 pay scales basic pay | 10% | 10% |

| 7 | Adhoc Relief Allowance 2013 | 0% | ||

| 8 | Ad-hoc Allowance 2015 | 0% |

The remaining part of the allowances has been converted into Disparity Reduction Allowance 2022.

Before this in Budget Speech 2022-23 Sindh, the Government announced a good package for the employees. The most important was the revision of basic pay scales that were occurring after five years in other provinces and Federal.

Adhoc Relief Allowance 2022 Sindh

Sindh Government has granted Adhoc Relief Allowance 2022 @ 15% of Running Basic Pay of 2017 pay scales with effect from 1st July 2022 to all employees of BPS-01 to BPS-22.

The new entrants in Government jobs will also get this allowance but on the initial of the concerned BPS of 2017 pay scales.

Differential Allowance

The difference allowance @ 34.35% of Basic Pay Scales 2017 to employees in BPS-01 to BPS-15 and 31.7& of basic pay Scales 2017 to employees in BPS-16 to BPS-22 shall be allowed in lieu of the differential rate of Adhoc Relief Allowances 2013, 2015, 2017, 2019, 2020 and 2021. This allowance shall stand frozen at its level.

You may also like: Comparison of Pay and Allowance Increase 2022 Federal and Other Provinces

Assalam O Alaikum Sir Kindly Explain Difference Between DRA & Diffrential Allowance

Or Sir Yeh Jo Adhocs Hain 5% , 10% , 10% Jo K Banta Hai All Over Basic Ka 25% Jo K Merge Nahi Hua Hai Basic Mae To Kiya Yeh Amount Pay Slip Mae DRA K Allowance K Column Mae Aye Ga I Mean Pay Slip Mae DRA Ka Column Add Ho Jaye Ga ?

Or Sir Yeh Jo 34.35% Percent Diya Gaya Hai Diffrential Allowance Yeh To Basic Ka 34.35% Percent Diya Gaya Hai Yeh To Clear Ho Gaya Hai Kiyo K Gmail Per Change Alert Ki Mail Agaye Hai Bus Yeh Uper Walay Questions Clear Ker Dain Kindly Jazak ALLAH

pl share comparison chart of tax calculator for the last financial year (2021-2022) and this year (2022-2023)

jis ki basic fixed hai aur PP lg rha ho aus ki basic k sy revised ho ge ?

Yes, he/she will also get PP in new pay scales as well as the last stage will be fixed in new pay scales too.

Diffreincial allowance 2017 k scale ki basic pay per ya 2017 ki running basic pay per calculate hoga ?kindly guide

Differential Allowance jitnay bhi extra allowance hain un ka sum hay aour ab yeh fix hay.

5% remaining in Adhoc Allowance 2017.? (Mistake)

2 2017 Adhoc Relief Allowance 10% of basic Pay of 2017 Pay Scales 10% 0%

The difference allowance @ 34.35% of Basic Pay Scales 2017 ???

can you define this ???

basic pay of July – 2017 ???

It is fixed.

The difference allowance @ 34.35% of Basic Pay Scales 2017 “Basic pay” running or minimum Basic Pay 2017????

Yeh differential allowance mukhtlif allowances ko akatha ker kay calculate kia gia hay. Ab yeh freez ho jai ga.

Means we will get only 15% benefit?

pl send calculator for the differential allowance calculation

I have uploaded the same at my website.