The Federal Tax Ombudsman Islamabad issued a decision on 23-08-2022 in connection with Tax Concession for Teachers 3% tax instead of 10% on Examination Duties and Others. Some main points are as under:

Tax Concession for Teachers 3% Tax Instead of 10% on Examination Duties and Other Duties

Recommendations

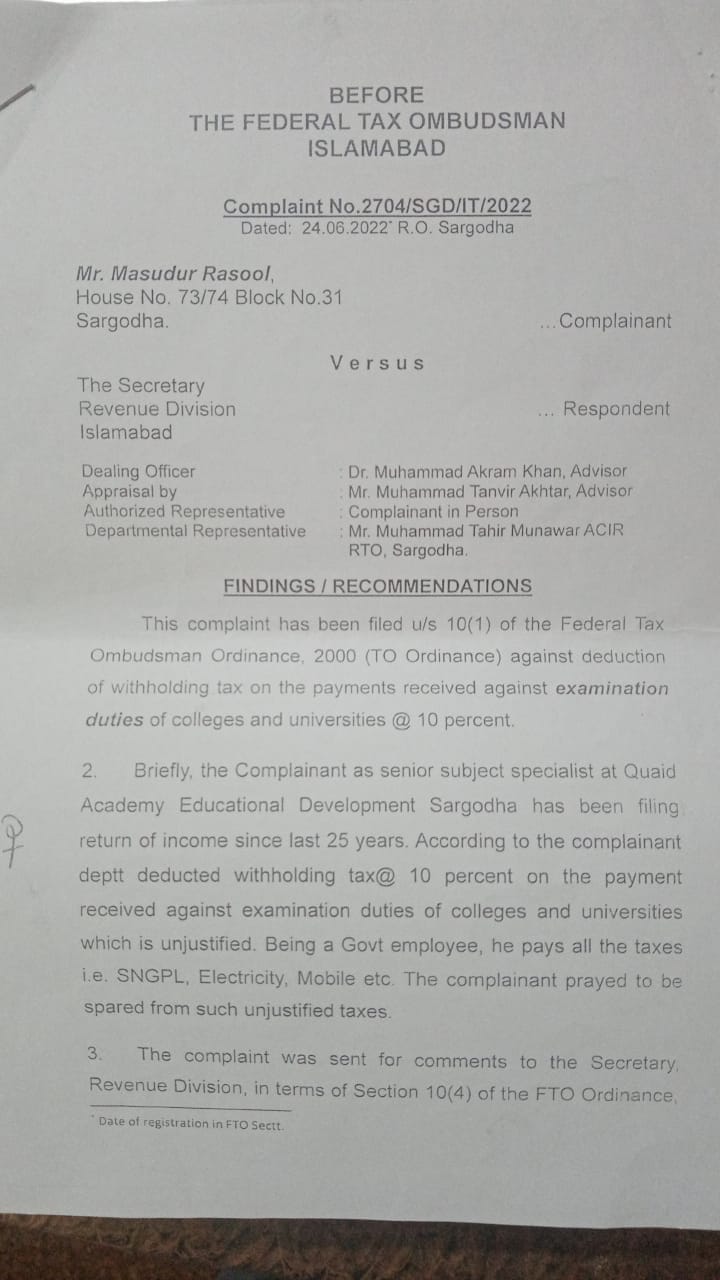

This complaint has been filed u/s 10 (1) of the Federal Tax Ombudsman Ordinance 2000 (TO Ordinance) against the deduction of withholding tax on the payments received against examination duties of colleges and universities @ 10%.

Briefly, the complainant as a senior subject specialist at Quaid Academy Educational Development Sargodha has been filing a return of income for the last 25 years. According to the complainant, the department deducted withholding tax @ 10% on the payment received against examination duties of colleges and universities which is unjustified. Being a Government employee, he pays all the taxes i.e SNGPL, Electricity, Mobile, etc. The complainant prayed to be spared from such unjustified taxes.

The complainant was sent for comments to the Secretary Revenue Division, in terms of Section 10(4) of the FTO Ordinance.

For You: BISE AJK Mirpur SSC-II Annual Result 2022

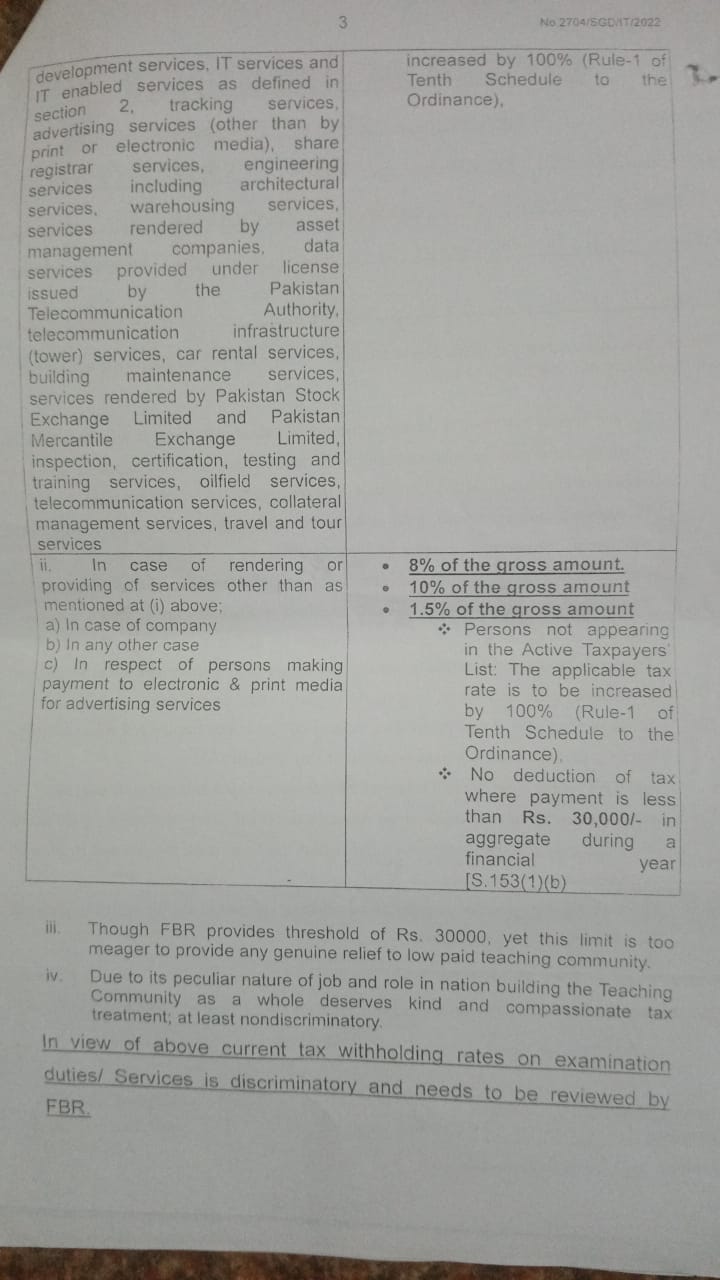

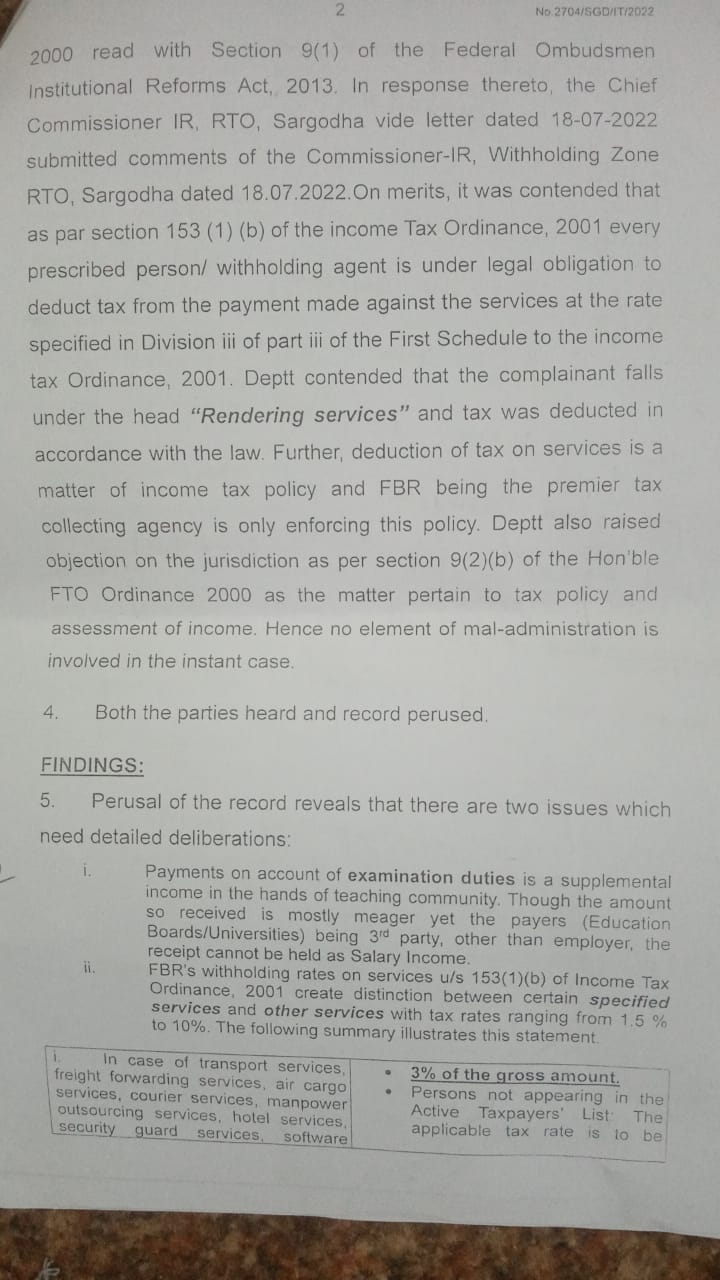

| In case of rendering or providing of services other than as mentioned at (i) above a) in case of a company

b) in any other case c) in respect of persons making payments to electronic and print media for advertising services. |

8% of the gross amount

10% of the gross amount 1.5% of the gross amount Persons not appearing on the active taxpayer’s list. The applicable tax rate is to be increased by 100% No deduction of tax where payment is less than 30000/- in aggregate during a financial year. |

You may also like: Income Tax Rates 2022-23 for Salaried Persons

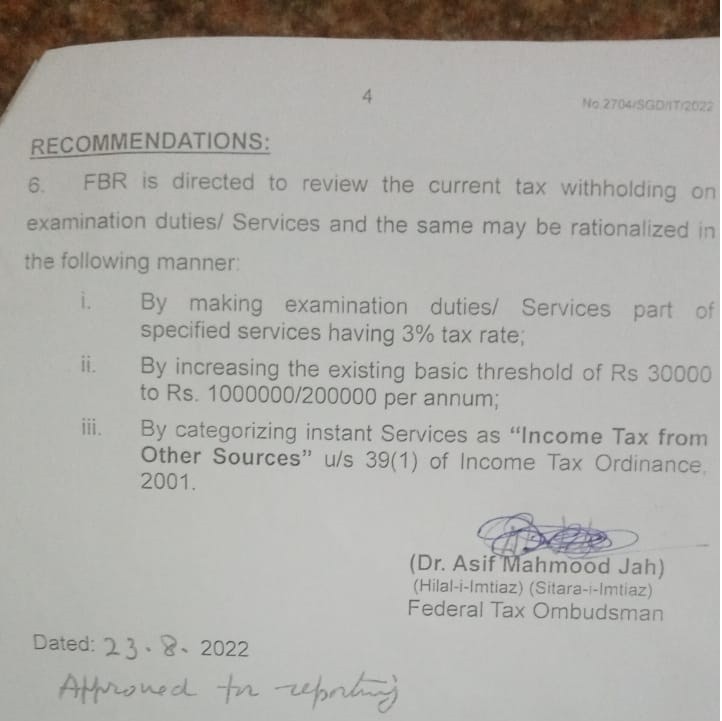

FBR is directed to review the current tax withholding on examination duties/services and the same may be rationalized in the following manner:

- By making examination duties/services part of specified services having a 3% tax rate.

- By increasing the existing basic threshold of Rs. 30000 to Rs. 1000000/2000000 per annum.

- By categorizing instant services as “Income Tax form Other Sources” u/s 39(1) of income tax ordinance, 2001.