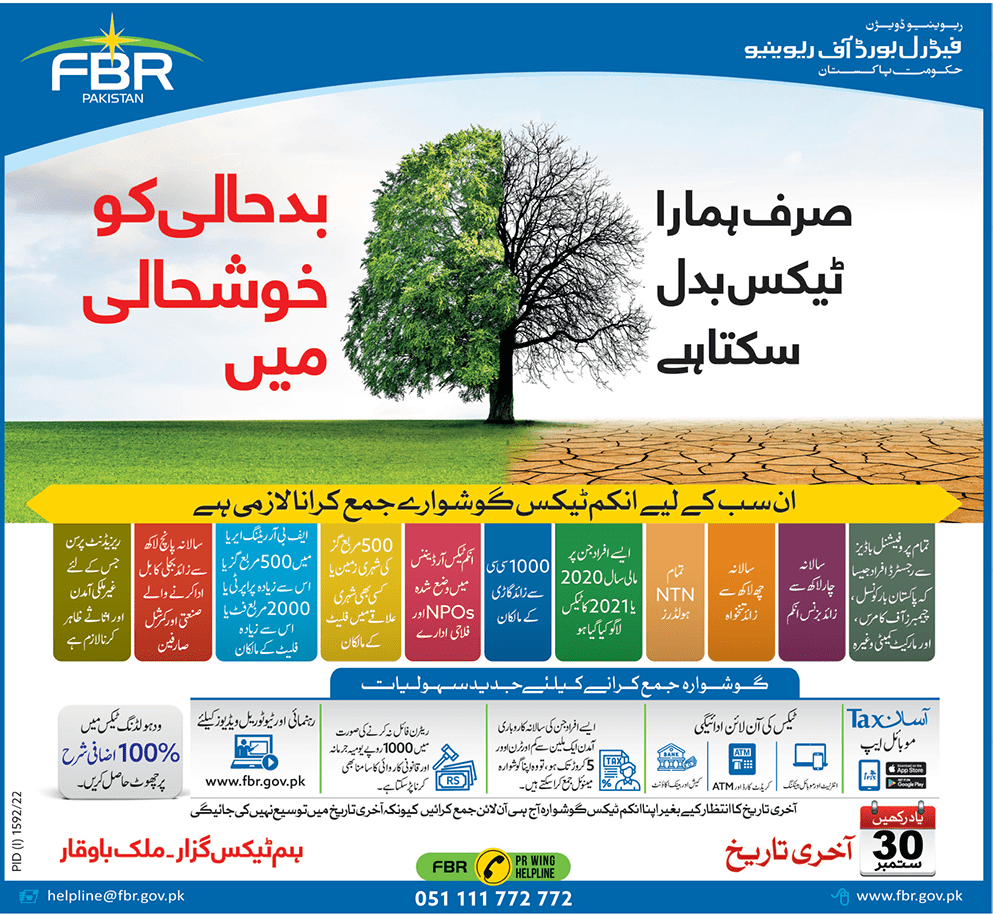

The Federal Board of Revenue (FBR) has announced the Last Date to Submit Income Tax Returns for the year 2022.

You will read the details regarding the criteria to submit the income tax returns, the deadline as well as the fine if tax returns are submitted after the due date.

Last Date to Submit Income Tax Returns 2022

Federal Board of Revenue (FBR) advertised to aware the tax holders of the basic criteria of tax and further, it informs them about methods to submit their tax statement & mentions the last date of submitting the statement. FBR aims at making Pakistan a prosperous country with help of Tax.

Criteria to submit the Income Tax: Returns 2021-22

| 1. | All individuals registered from professional bodies |

| 2. | More than 400,000 business income per year |

| 3. | More than 600,000 salaries per year |

| 4. | All NTN holders |

| 5. | Such individuals, to whom the tax was applied in Economic Year 2020 or 2021 |

| 6. | Owners of more than 1000 CC vehicles |

| 7. | Urban Landholders of 500 Square yards or Flat owners |

| 8. | 500 Square yards or more property in FBR returning area or 2000 Square feet or more flat holders |

| 9

|

All industrial or Commercial users who pay bills of 500K or more |

| 10 | The resident person is held responsible to show foreign Income and assets. |

The above-mentioned persons are eligible for filing tax statements. So, they should pay their taxes within the due date as mentioned by the FBR.

How to Submit Tax Statement?

There are 3 main facilities provided by the Federal Board of Revenue (FBR) to submit Tax statements.

Submit Tax online

- ASAAN Tax app

- Internet Banking & Mobile Banking

- Credit Card ATM

- Cash and Bank Account

- Cash Or Bank Account

- Manual

Those who have Income less than 1 million per year But out the return of more than 50 Million (5 Crore).

*In case of not filing a return, Rs. 1000 shall be fined per day and the person will have to face accountability as per law.

Last Date:

The deadline for submitting Tax statements is 30 September 2022.

For Further Information and to watch the Tutorial video visit the websites of FBR.

Helpline:

Ph# (051) 111 772 772

You may also like: Tax Concession for Teachers 3% instead of 10%