This is the important question that most employees ask about the right time to get retirement from Government service. If the employees retire from service on superannuation or completion of sixty years of age, then this question does not matter. However, if an employee gets premature retirement, then this question is of great importance. Here we shall discuss whether the employee has to get retirement in January to June or July to August of a particular year. Is it beneficial to get retirement after 25 years of service or 30 years of service or even 60 years of age?

Right Time to get Retirement from Government Service

Before selecting the right time for retirement from service, we shall discuss the time when the employee can get the retirement. Here are five options for the employee to get retirement:

- After completion of 25 years of service (Leave Preparatory to Retirement – LPR)

- After 30 years of service (LPR and Leave Encashment)

- On attaining 60 years of age (LPR and Leave Encashment)

- Retirement on Medical Grounds

Leave Preparatory to Retirement after 25 Years

An employee can get retirement after the completion of twenty-five years of service. In this retirement, the employee will get leave Preparatory to retirement (LPR). He will not get Leave Encashment unless he retires after 25 years of service at 60 years of age. In LPR the employee get leaves that he/she has in his leave account balance up to a maximum of 365 days. That leave period starts after 25 years and after availing of leaves he/she will retire from service. After completion of 25 years of service, the employee can use this option at any time till the age of 60 years.

On Completion of 30 Years’ Service

Here on thirty years’ service, the employee has two options:

- Leave Encashment

- LPR

Leave Encashment or LPR period starts after completion of 30 years’ service. In leave encashment, the employee will get paid for the leaves on his/her credit but not more than 365 days of leave. Leave Encashment rates are equal to one month of basic pay. For each month the employee will get one basic pay. If he/she has 365 days of leaves in his/her credit and has a basic pay of 30000/- then the total amount of leave encashment comes to Rs. 360,000/-

In leave encashment, the employee will have to do duty at his office/institution. In LPR the employee avails leaves. He/she gets all pay and allowances during LPR except Conveyance Allowance. In leave encashment, the employee also gets all pay and allowances in addition to the Leave Encashment amount.

On Attaining 60 Years Age

The employee has the same choice as on retirement after 30 years of service. He/She can avail of LPR as well as Leave Encashment.

Note: The employee can get retirement at any time after 25 years of service to 60 years of age. In Punjab, there is some condition at this time that if an employee wants retirement after 25 years’ service he/she must have a minimum of 55 years of age.

Selection of Best Time for Retirement from Govt Service

I have given the merits and demerits of retirement on 25 years of service or 30 years of service or age of superannuation i.e 60 years. You will have more options for the Right Time to get Retirement. So we discuss the same more.

Concept of 25 to 30 Years’ Service Retirement

Here is a concept of some of the employees the best retirement time is 25 years of service to 30 years of service. As more than 30 years of service is not counted towards pension. The pension formula is as under:

Pension Formula = Basic Pay x Service x 70/3000 (Service is not taken more than 30 years)

Suppose an employee has 38 years’ service, we shall count only 30 years’ service for pension purposes. If less than 30 years then the actual length of service we take for pension calculation.

Commute/Gratuity Formula = 35% of pension x Age Rate x 12

Here age rate is most important; the higher the age of the employee, the lower the age rate, hence lowering the commute or gratuity. For example, for 55 years age, we shall take 15.1478

As the age rate and for 60 years age we shall take 12.3719 as the age rate. We calculate gratuity or commute with these two values:

Suppose the 35% pension of an employee is 49,000/- then the results are as under:

At 55 years of retirement have the same basic pay and same length of service

Commute/Gratuity Formula = 35% of pension x Age Rate x 12

= 49000 x 15.1478 x 12

= 8906906/-

At 60 years of age retirement has the same basic pay and same length of service

Commute/Gratuity Formula = 35% of pension x Age Rate x 12

= 49000 x 12.3719 x 12

=7274677/-

Difference = 16, 32,229/-

In the above examples, the employee seems to get more gratuity but the facts may differ. The employee is retiring at the age of 55 years if he continues his/her service his basic pay increases every year and if during this period Government revises Basic pay Scales, his/her basic Pay increases more. Hence he/she may get more commutation or gratuity.

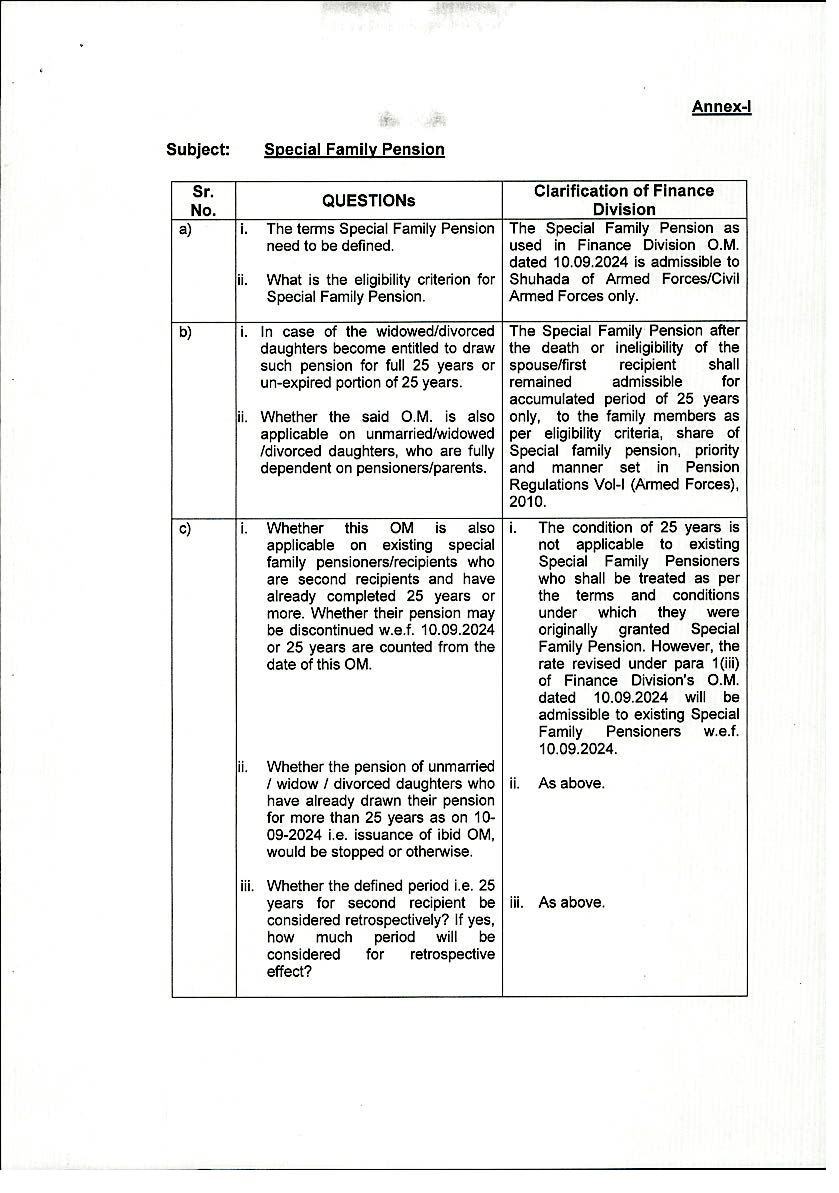

The table of age rates is as under:

Table of Age Rates for Retirement

| Age Next Birthday | No. of the year purchased |

| 20 | 40.5043 |

| 21 | 39.7341 |

| 22 | 38.9653 |

| 23 | 38.1974 |

| 24 | 37.4307 |

| 25 | 36.6651 |

| 26 | 35.9006 |

| 27 | 35.1372 |

| 28 | 34.375 |

| 29 | 33.6143 |

| 30 | 32.8071 |

| 31 | 32.0974 |

| 32 | 31.3412 |

| 33 | 30.5869 |

| 34 | 29.8343 |

| 35 | 28.3362 |

| 36 | 28.3362 |

| 37 | 27.5908 |

| 38 | 26.8482 |

| 39 | 26.1009 |

| 40 | 25.3728 |

| 41 | 24.6406 |

| 42 | 23.9126 |

| 43 | 23.184 |

| 44 | 22.4713 |

| 45 | 21.7592 |

| 46 | 21.0538 |

| 47 | 20.3555 |

| 48 | 19.6653 |

| 49 | 18.9841 |

| 50 | 18.3129 |

| 51 | 17.6526 |

| 52 | 17.005 |

| 53 | 16.371 |

| 54 | 15.7517 |

| 55 | 15.1478 |

| 56 | 14.5602 |

| 57 | 13.9888 |

| 58 | 13.434 |

| 59 | 12.8953 |

| 60 | 12.3719 |

Minimum 20 years of service for Farewell Grant on Retirement

If the employee gets retirement after a minimum of 20 years of service he/she will get basic pay as a farewell grant on retirement. The employee retiring on less than 20 years’ service is not eligible for a farewell grant. 20 years’ service retirement may occur but only in the case of 60 years of age. Some employees get jobs at 40 years of age. These types of employees cannot complete 25 years of service. But they have to get retirement at 60 years of age.

Best Date of Retirement

If you have finally decided on the retirement year from the above discussions then the last option is the best date of retirement. You can get retirement at any time of the year but we shall discuss the best date of retirement. In this choice you have further two options for retirement these are as under:

- Retirement before July

- Retirement after July

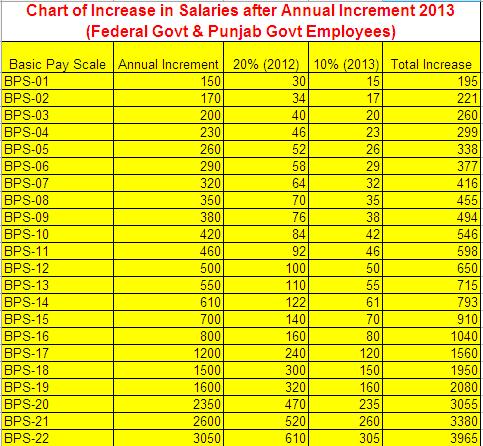

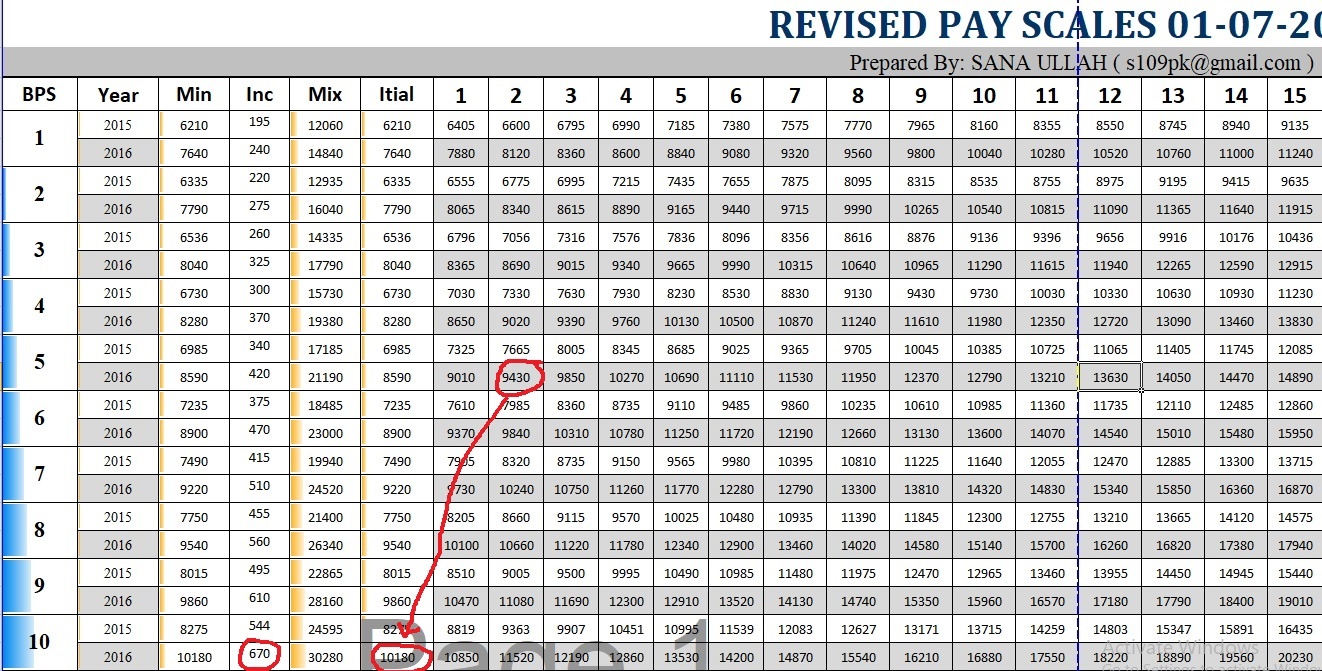

Before and After July Retirement

If you want to get retirement from service before July, in my opinion, you should not do that. The best example of that is this year’s retirement. For example, the employee who retired before July 2022 has fewer benefits as compared to the employees who retired in July or later. The employees who retired in July 2022 or later got nearly 1.5 times more gratuity/commute and leave encashment as compared to those who retired prior to July 2022. So the best time/date of retirement is after 1st July. The employees got a huge benefit from Revised Pay Scales 2022 especially the retiring ones after 1st July 2022.

Retirement After 1st December

If the employee can wait he or may delay his/her retirement till 1st December. On 1st December he/she will get the Annual Increment of that year. This annual increment is more useful for pension, gratuity/commute, TA/DA on retirement and leave encashment, etc. Although the employee will get a Usual Increment in the retiring year on his/her retirement after 1st June, however, this Usual Increment is only counted towards pension/gratuity.

You Option

I have given all options in detail. Now it is on you which option suits you.

AOA, It is requested that to please give us this opportunity to add pdf option all of your govt orders and information provided on your this website. So that viewers can download and use pdf file for future use/benefits. Please consider my point. Thanks

I shall try to use PDF Files too in the future In Sha Allah.

Aoa,

There is a question regarding pension admissibility. I recently inducted in ministry of defence on BPS18. My age when employed was 40 years and 2 months. I cannot complete 20 years of service. Can you please tell me that pension will be admissible to me or not. Your guidance will be highly appreciated.

Regards

As per my knowledge, you will get a pension and all other benefits except a Farewell Grant equal to one month’s basic pay at the time of retirement.

Thank a lot for your prompt reply sir.

Jazak Allah