Government of Khyber Pakhtunkhawa Finance Department issued a Notification on 19-08-2022 and published it in the gazette on 23-08-2022 in connection with Contributory Fund Rules 2022 KPK. The details are as under:

Contributory Fund Rules 2022 KPK

According to the Notification, in the exercise of the powers conferred by section 26 of the Khyber Pakhtunkhawa Civil Servants Act. 1973 (Khyber Pakhtunkhawa Act No. XVIII of 1973), read with section 19 thereof, the Government of Khyber Pakhtunkhawa is pleased to make the following rules, namely:

THE KIIYBER PAKIITUNKUWA CONTRIBUTORY PROVIDENT FUN!) RULES, 2022

Chapter-I Preliminary

- Short title, application, and commencement.—(I) These rules may be called the Khyber Pakhtunkhawa Contributory Provident Fund Rules. 2022.

(2) These rules shall apply to all the employees, mentioned in clause (e) of rule 2 of these rules, duly recruited after the commencement of the Khyber Pakhtunkhawa Civil Servants (Amendment) Act, 2022 (Khyber Pakhtunkhawa Act No. X of 2022): Provided that an employee who leaves service prior to attaining the retirement age may opt to no longer be subject to these rules, and withdraw up to one hundred percent (1 00%) of the accumulated balance in his pension account by informing the Pension Office/Cell in writing.

(3) These rules shall come into force at once.

- Definitions.—In these rules, unless there is anything repugnant in the subject or context.-

(a) “Accountant General” means the Accountant General, Khyber Pakhtunkhawa;

(b) “Act” means the Khyber Pakhtunkhawa Civil Servants Act, 1973(Khyber Pakhtunkhawa Act No. XVIII of 1973);

(c) “Allocation policy” means the allocation of contributions, in various sub-funds of a pension fund, as required by Voluntary Pension System Rules, 2005;

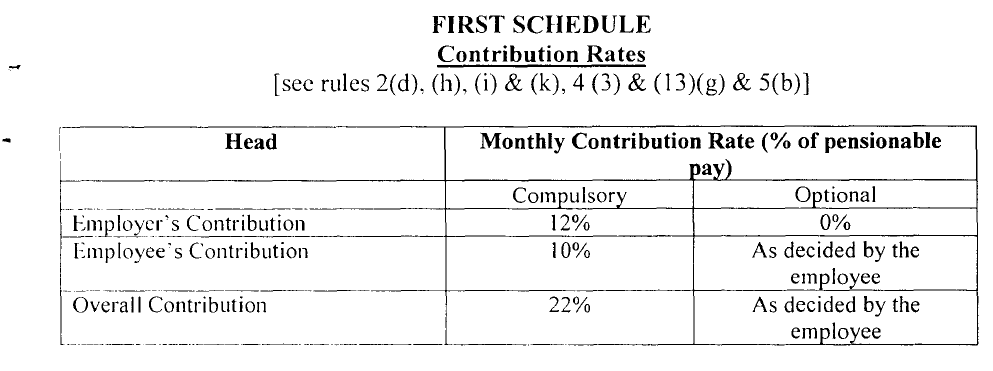

(d) “Contributory provident fund” means the defined contribution pension scheme, either a conventional pension fund or. as the case may be, the Shariah-compliant fund, specified in these rules, in which both the employer and employee contributions, as per First Schedule, to the pension account, and such contributions are invested until the retirement of the employee and the accumulated balance in the pension account, at the time of retirement, is withdrawn or invested further to generate Monthly income during the post-retirement phase, subject to exceptions under these rules;

(e) “Conventional fund” means a type of contributory provident fund, to be managed by the Pension Fund Manager, in a conventional manner, in accordance with the Voluntary Pension System Rules, 2005;

(f) “Employee” means-

(i) a civil servant, recruited under the Act, after coming into force of the Khyber Pakhtunkhawa Civil Servants (Amendment) Act, 2022 (Khyber Pakhtunkhawa Act No. X of 2022); or

(ii) an employee of the Government, regularized as a civil servant through any legal instrument, issued after coming into force of the Khyber Pakhtunkhawa Civil Servants (Amendment) Act, 2022 (Khyber Pakhtunkhawa Act No. X of 2022), irrespective of the effective date of regularization;

(g) “Employer” means the Government of Khyber Pakhtunkhawa;

(h) “Employee’s contribution” means the amount, computed by multiplying the employee’s pensionable pay with the employee’s contribution rate, as specified in the First Schedule;

(i) “Employer’s contribution” means the amount, computed by multiplying the employee’s pensionable pay with the employer’s contribution rate, as specified in the First Schedule;

(j) “Finance Department” means the Finance Department, Government of Khyber Pakhtunkhawa;

(k) “Overall contribution” means the sum of the employer’s contribution and employee’s contribution, respectively, as specified in the First Schedule;

(1) “Overall contribution rate” is the rate of the sum of the employer’s contribution and employee’s contribution as specified in the First Schedule;

(m) “Pension account” means a contributory provident fund account, opened and maintained by an employee with a Pension Fund Manager, in accordance with Voluntary Pension System Rules, 2005;

(n) “Pension Fund Manager” means Pension Fund Manager, as defined in the Voluntary Pension System Rules, 2005, and has entered into an agreement with the employer to manage the contributory provident fund for the employees under these rules, and the employer has not terminated or canceled the agreement, as per law;

(o) “Pensionable pay” means the sum of running basic pay and personal pay, if applicable, and does not include any other pay, allowances, or perquisites;

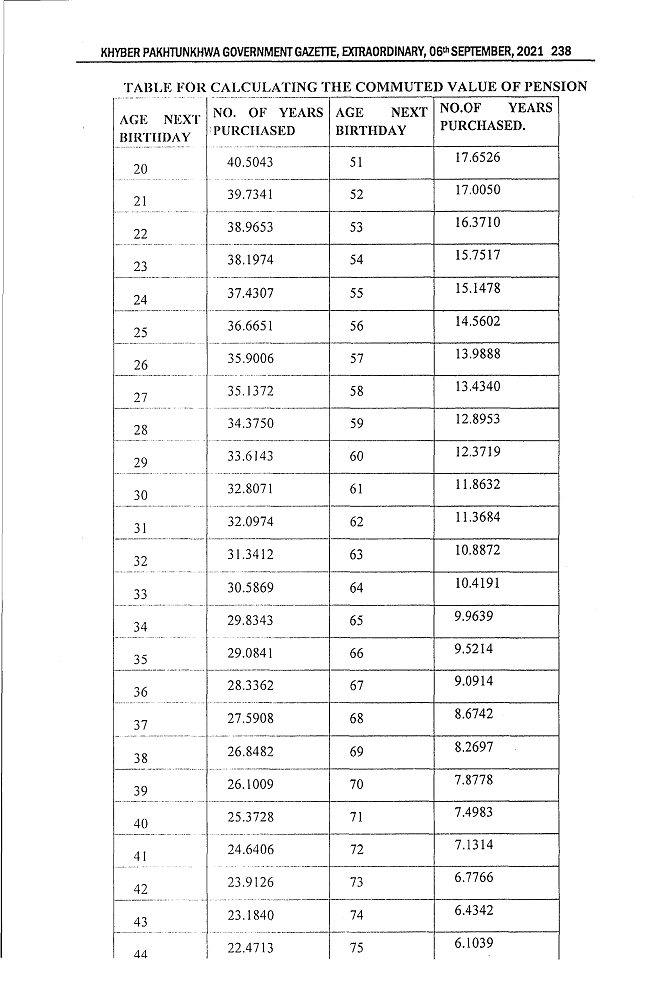

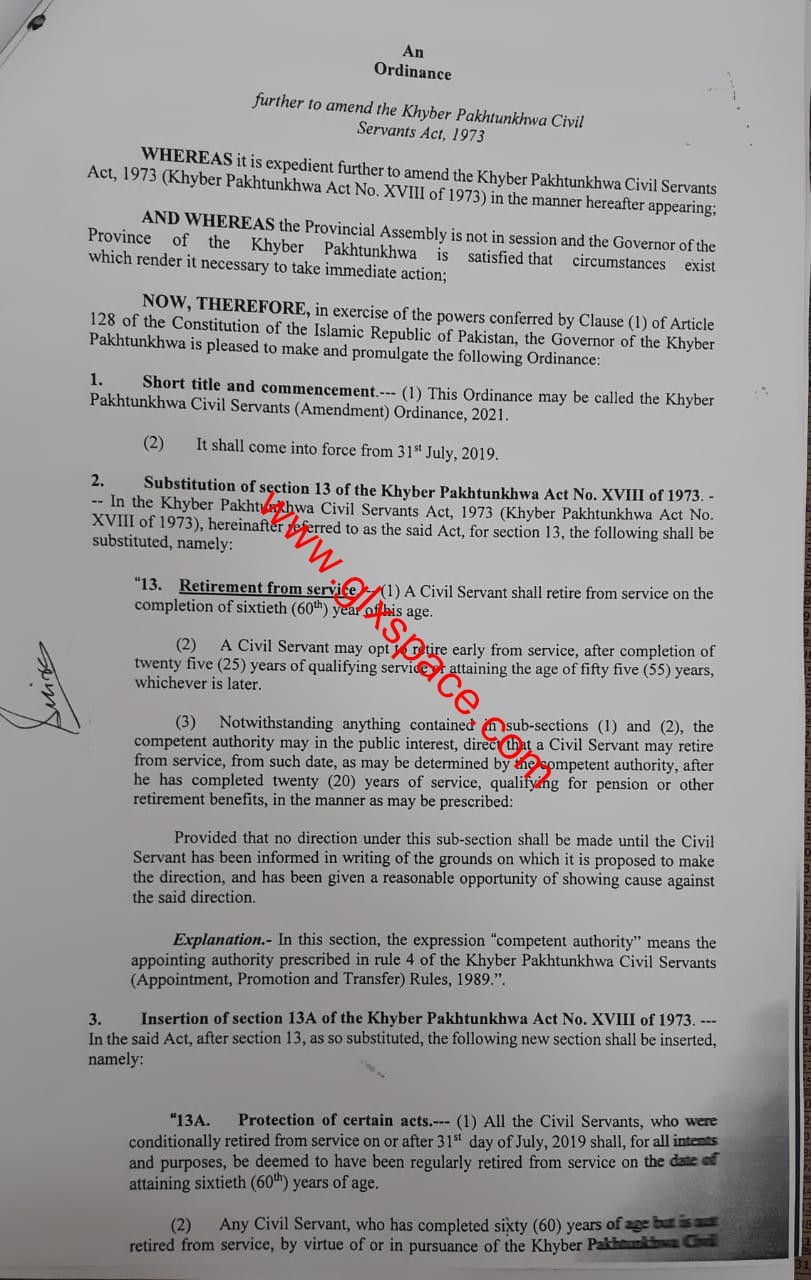

(p) “Retirement age” means the retirement age specified in sub-sections

(1) and (2) of section 13 of the Act; and

(q) “Shariah-compliant fund” means a type of contributory provident fund, governed by the requirements of Shariah law, in accordance with the Voluntary Pension System Rules, 2005.

(2) All other expressions, used but not defined in these rules, shall have the same meanings as are respectively assigned to them under the Voluntary Pension System Rules, 2005.

You may also like: Revised Pension Calculator 2022

KPK CP Fund Rules 2022 Chapter-Il Framework

- Governance of the contributory provident fund.—(1) Save as otherwise provided in these rules, the contributory provident fund shall be governed by Voluntary Pension System Rules, 2005.

(2) The contributory provident fund shall be managed only through Pension Fund Managers.

(3) The balance in the pension account, including both the employer’s contribution and the employee’s contribution, and profits thereon, shall be subject to these rules.

- Role of the employer.—(1) The employee’s contribution shall be deducted, at source, by the employer at the time of payment of salary to the employee.

(2) The employer’s contribution shall be in addition to the salary otherwise payable to the employee.

(3) The employer shall not have any legal or constructive obligation to make any additional contribution or payment in respect of the contributory provident fund, beyond those mentioned in the First Schedule.

(4) The employer shall annually budget the employer’s contributions in accordance with these rules under a separate head of account.

(5) The employer shall transfer the overall contribution in the pension account, at the time of payment of salary to an employee, without any delay. The Accountant General shall forward monthly reports to the Finance Department and the State Bank of Pakistan, respectively, regarding the transfer of contributions, in accordance with the agreed-upon reporting format and timelines:

Provided that in case of a delay of more than two months in the transfer of either the employee’s contribution or employer’s contribution, or both, the State Bank of Pakistan shah debit the account of the employer, and transfer the said contributions to the pension accounts with the assistance of the office of the Accountant General. The employer shall issue debit authority to the State Bank of Pakistan for this purpose under these rules.

(6) The employer shall transfer the overall contribution to the pension account through direct credit by electronic means:

Provided that-

(a) the system, used by the Accountant General for the purpose of transferring the contributions through direct credit by electronic means, has not been operationalized; or

(b) Certain employees’ pension accounts have not been opened; the overall contributions in respect of the relevant employees shall be placed temporarily in profit-earning commercial bank accounts, opened by the Finance Department, specifically for this purpose, as per sub-rule (7) of this rule.

(7) The Finance Department shall, for the purpose of management of contributory provident fund at its own level, open two profit-earning commercial bank accounts. One account shall be used for the placement of contributions allocated for conventional funds, and the other account shall be used for the placement of contributions allocated for Shariah-compliant funds.

(8) Once the system. used by the Accountant General, is ready, and the relevant employees’ pension accounts are opened, the amounts allocable to the employees, including the amount of overall contributions and the profits earned thereon, under sub-rule (7) of this rule, shall be computed on a pro-rata basis, and such amounts shall be transferred from the commercial handle account(s) to the respective employees’ pension account through direct credit by electronic means.

(9) The employer shall enter into an agreement, having standard terms and conditions, with each Pension Fund Manager, whose systems support the electronic transfer of contributions directly from the employer’s bank account to the pension account. The agreement shall include a mandatory insurance plan, providing death and disability risk cover to the employees, to be arranged by the Pension Fund Manager.

(10) The Finance Department shall notify a list of Pension Fund Managers and publish it on its official website, as soon as practicable, and update the list from time to time.

(11) The employer may terminate the agreement with any Pension Fund Manager if ii. is satisfied that termination of the agreement is in the interest of the employee.

(12) The employer shall ensure that each Pension Fund Manager establishes a separate pension fund for the purposes of contributory provident fund and the sub-funds of each pension fund, including the sub-funds, specified by the Finance Department.

(13) The employer shall establish a specialized Pension Office/Cell in the Finance Department to perform the following functions, namely:

(a) Monitoring of the contributory provident fund;

(b) Requisitioning and analyzing periodic reports from the Pension Fund Managers, including but not limited to information regarding the number of pension accounts, the number of pension account holders, the number of contributions received, the performance of sub-funds of the pension funds being managed, pension account holders who have reached retirement age, amount withdrawn by such pension account holders. Number of employees who have invested in monthly income plans and annuities and amount of monthly profit and annuity paid to such employees;

KHYBER PAKHTUNKHWA GOVERNMENT GAZETTE, EXTRAORDINARY, 23′ AUGUST, 2022 193

(c) Providing separate updated lists to the Pension Fund Managers, in respect of the employees,

(i) whose pension accounts are to be opened; or

(ii) who have left employment before attaining the retirement age;

(iii) who have attained retirement age;

(d) preparing and disseminating training materials for the education of the employees, regarding these rules, Voluntary Pension System Rules, 2005, a selection from among the Pension Fund Managers, the opening of pension account, setting up online access to the pension account, choosing or revising allocation policy, understanding account statements, updating any changes in personal information and switching from one Pension Fund Manager to another etc.;

(e) acting as an intermediary between the employees and Pension Fund Managers for the opening of pension accounts and performing necessary tasks in this connection, including obtaining the information required for pension account opening from the employees according to the template. Jointly developed by the Pension Fund Managers, sharing the information with Pension Fund Managers, resolving any discrepancies or deficiencies, and ensuring that the pension accounts are opened as soon as practicable;

(f:) ensuring that only one updated pension account is recorded with the Accountant General;

(g) ensuring that the optional contribution rate in respect of an employee as per the First Schedule is recorded with the Accountant General;

(h) Facilitating the employees in the resolution of any issue, such as updating personal information, using online services, understanding their account statements, and notifying the pension account holder about the termination or cancellation of the agreement with the Pension Fund Manager by the employer, etc.;

(i) Coordinating with relevant stakeholders for resolving any issue that may arise in connection with the contributory provident fund; and

Ci) formulating standard operating procedures for the performance of its functions.

- Rights and obligations of the employee.—An employee-

(a) shall make the employee’s contribution in accordance with the contributory provident fund;

(h) shall inform the Pension Office/Cell through his respective Account

Office, regarding his optional contribution rate, if he chooses to make an optional contribution in addition to a compulsory contribution as specified in the First Schedule;

(c) shall be entitled to his pension account balances, from the date of qualifying for the contributory provident fund, in accordance with these rules, subject to the exceptions under the Voluntary Pension

System Rules, 2005, and these rules;

(d) shall open a pension account with the Pension Fund Manager of his choice, as soon as practicable and provide necessary information to the Pension Office/Cell on the template specified by the Pension

Office/Cell for this purpose. including:

(i) his selection between a conventional fund or a Shariah compliant fund: and

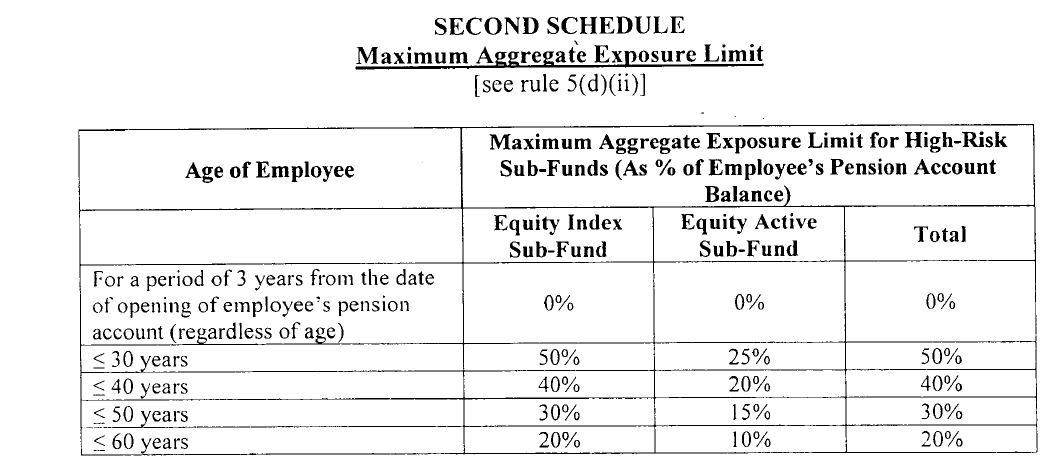

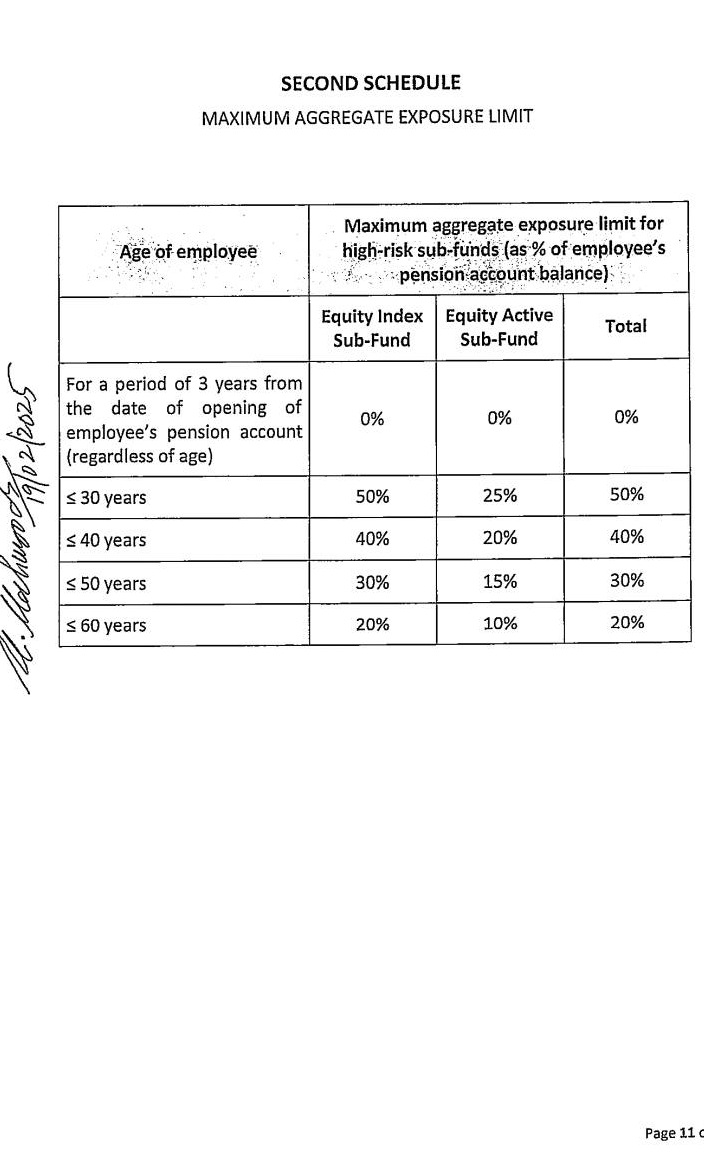

(ii) his allocation policy for allocation of the contributions in his pension account among the sub-funds of the contributory provident fund, subject to exposure limits specified in the Second Schedule:

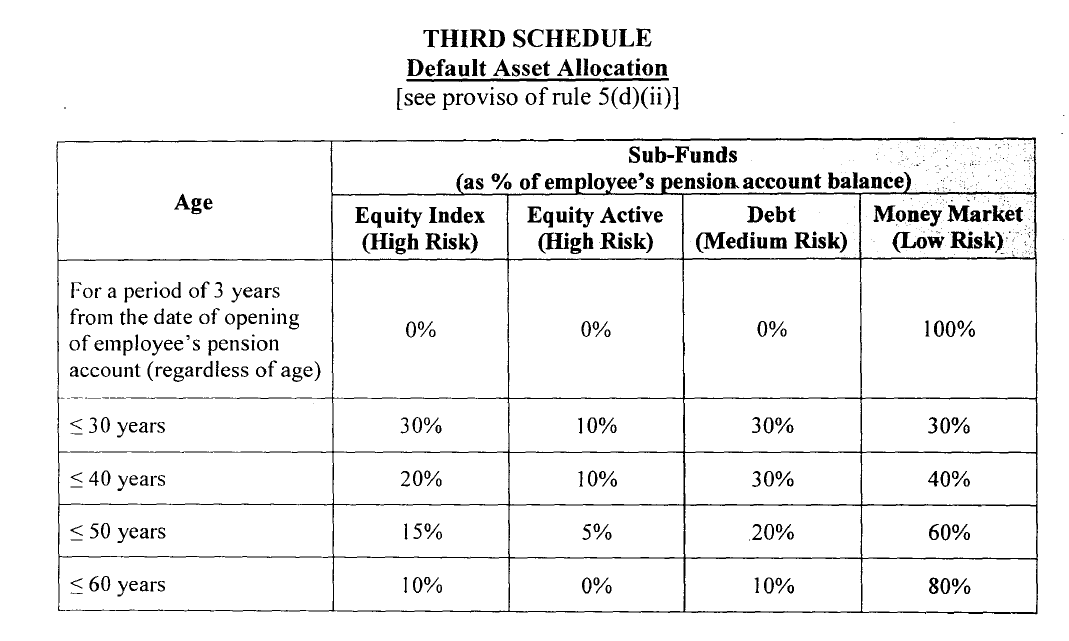

Provided that an employee who does not indicate his allocation policy shall have his pension account managed in accordance with the default allocation policy specified in the Third Schedule;

(e) shall have the option to switch from a conventional fund to Shariah compliant fund, and vice versa, as well as from one Pension Fund Manager to another Pension Fund Manager, in accordance with the Voluntary Pension System Rules. 2005; shall ensure that his updated pension account number is recorded with

the Pension Office/Cell; shall not withdraw any amount from his pension account before attaining the retirement age. In case of contravention of this restriction, the employer shall stop making employer’s contributions in his pension account and shall not resume such contributions until the employee deposits the withdrawn amount, along with an additional amount equal to one percent (1 %) of the withdrawn amount for every completed month, since the date of withdrawal, in his pension account;

(h) may withdraw, in a lump sum, not more than twenty percent (20%) of the accumulated balance in his pension account, upon attaining retirement age, and shall keep the remaining balance invested in the manner prescribed in the Voluntary Pension System Rules, 2005, for a period of at least twenty years, or till his death, whichever occurs earlier;

(i) may opt to no longer be subject to these rules, if he leaves service prior

to attain the retirement age, by informing the Pension Office/Cell in writing, and withdrawing, in a lump sum, up to one hundred percent (100%) of the accumulated balance in his pension account:

Provided that these rules shall not apply in case the annuity or monthly income offered to the employee is less than rupees three thousand (3,000) per month.

Khyber Pakhtunkhawa CP Fund Rules 2022