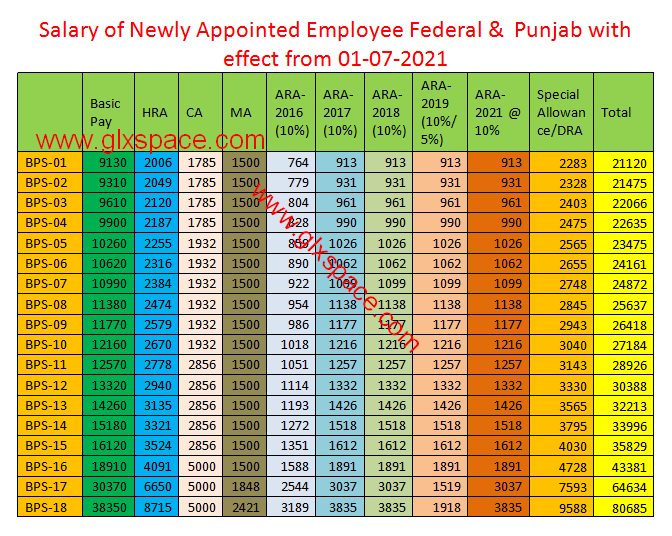

Finance Division issued Notification No. F.No.1(5)Imp/2022-25 on 02-02-2023 in connection with the Removal of Anomaly in Fixation of Pay 2022 Basic Pay Scales. Such type of anomalies may occur due to the introduction of revised pay scales in 2022 for the Government employee of Pakistan. The Finance Division merged the following Adhoc Relief Allowances into basic pay:

- Adhoc Relief Allowance 2016

- ARA-2017

- ARA-2018

- Adhoc Relief Allowance 2019

- Adhoc Relief Allowance 2021

When some employees added these Adhoc allowances into basic pay, they were wondering to see the new basic pay they got reduced. Simply means they get the new basic pay after adding all the five allowances into basic pay. They should have equal or more new Basic Pay of 2022 Pay scales than the sum of Adhoc allowances and their old basic pay.

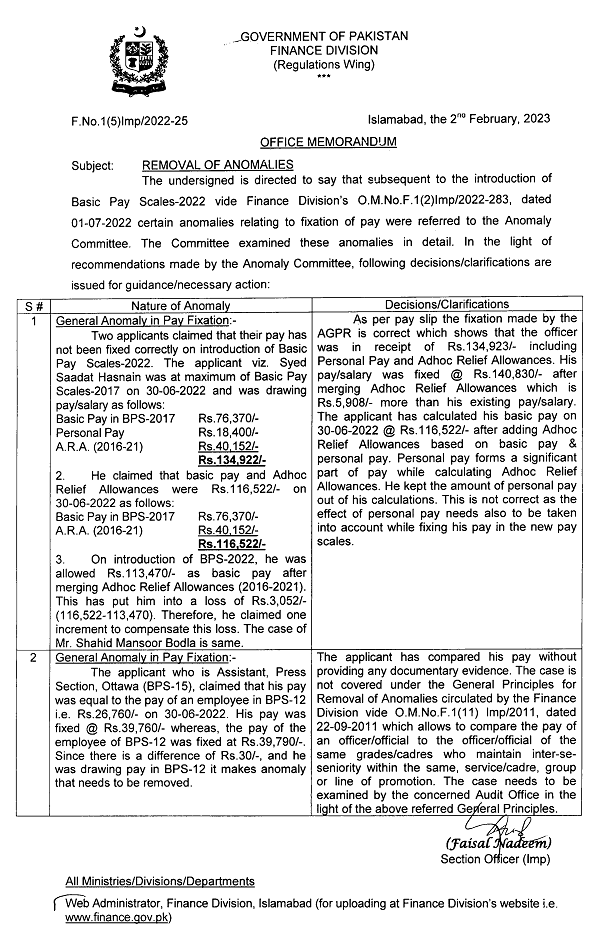

Removal of Anomaly in Fixation of Pay 2022 Basic Pay Scales

The undersigned direct to say that subsequent to the introduction of Revised Basic Pay Scales 2022 vide Finance Division O.M.No.F.1(2)Imp/2022-283, dated 01-07-2022 certain anomalies relating to fixation of pay were referred to the Anomaly Committee. The Committee examined these anomalies in detail. In the light of recommendations made by the Anomaly Committee, the following decisions/clarifications are issued for guidance/necessary action:

General Anomaly in Fixation of Basic Pay

Two applicants claimed that their pay has not been fixed correctly on the introduction of Basic Pay Scales-2022. The applicant viz. Syed Saadat Hasnain was at a maximum of Basic Pay Scales-2017 on 30-06-2022 and was drawing pay/salary as follows:

Basic Pay in BPS-2017 Rs.76,370/-

Personal Pay Rs.18,400/-

A.R.A. (2016-21) Rs.40,152/-

Tota: Rs.134,922/-

- He claimed that basic pay and Adhoc Relief Allowances were Rs.116,522/- on 30-06-2022 as follows:

Basic Pay in BPS-2017 Rs.76,370/-

A.R.A. (2016-21) Rs.40,152/-

Total: Rs.116,522/-

- On the introduction of BPS-2022, he was allowed Rs.113,470/- as basic pay after merging Adhoc Relief Allowances (2016-2021). This has put him into a loss of Rs.3,052/- (116,522-113,470). Therefore, he claimed one increment to compensate for this loss. The case of Mr. Shahid Mansoor Bodla is

Decisions/Clarifications of Anomaly

As per the pay slip the fixation made by the AGPR is correct which shows that the officer was in receipt of Rs.134,923/- including Personal Pay and Adhoc Relief Allowances. His pay/salary was fixed @ Rs.140,830/- after merging Adhoc Relief Allowances which is Rs.5,908/- more than his existing pay/salary. The applicant calculated his basic pay on 30-06-2022 @ Rs.116,522/- after adding Adhoc Relief Allowances based on basic pay & personal pay. Personal pay forms a significant part of pay while calculating Adhoc Relief Allowances. He kept the amount of personal pay out of his calculations. This is not correct as the effect of personal pay needs also to be taken into account while fixing his pay in the new pay scales.

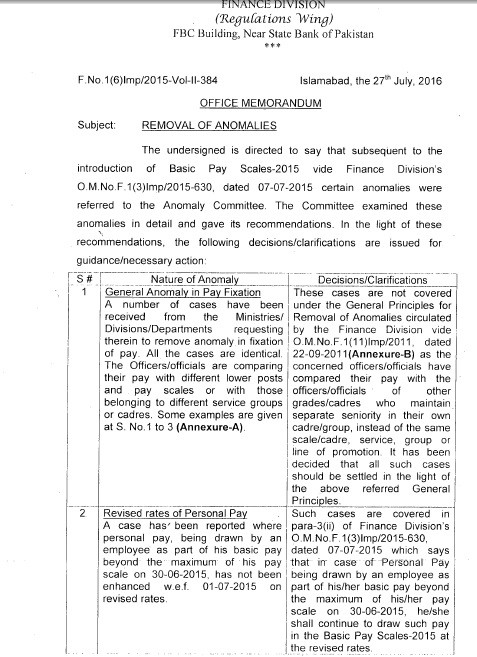

General Anomaly in Pay Fixation

The applicant who is Assistant, Press Section, Ottawa (BPS-15), claimed that his pay was equal to the pay of an employee in BPS-12 i.e. Rs.26,760/- on 30-06-2022. His pay was fixed @ Rs.39,760/- whereas, the pay of the employee of BPS-12 was fixed at Rs.39,790/-. Since there is a difference of Rs.30/-, and he was drawing pay in BPS-12 it makes an anomaly that needs to be removed.

Reply/Clarification of the Anomaly of Pay Fixation

The applicant has compared his pay without providing any documentary evidence. The case is not covered under the General Principles for Removal of Anomalies circulated by the Finance Division vide O.M.No.F.1(11) Imp/2011, dated 22-09-2011 which allows comparing the pay of an officer/official to the officer/official of the same grades/cadres who maintain inter-se- seniority within the same, service/cadre, group or line of promotion. The case needs to be examined by the concerned Audit Office in light of the above referred General Principles.

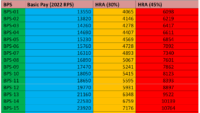

After the above discussion, the employees can check their old basic pay plus 5 ad-hoc allowances from 2016 to 2021 sum as compared to their new basic pay of 2022 Pay scales. If they get less pay they can submit the fixation again after adding one more or as so increment in their pay unless their new basic pay is equal to or more than the sum of their previous basic pay and 5 ARAs.

If two employees get the same basic pay in Basic Pay Scales 2017 and their pay changes from each other in 2022 pay scales. They also can claim the same anomaly.

Before this Finance Division issued a Notification on 05-07-2022 in connection with the creation of anomaly committee basic pay scales 2022 for Federal Government employees. Now the Federal Govt has issued the pay fixation anomaly Notification.