Last Updated on May 8, 2023 by Galaxy World

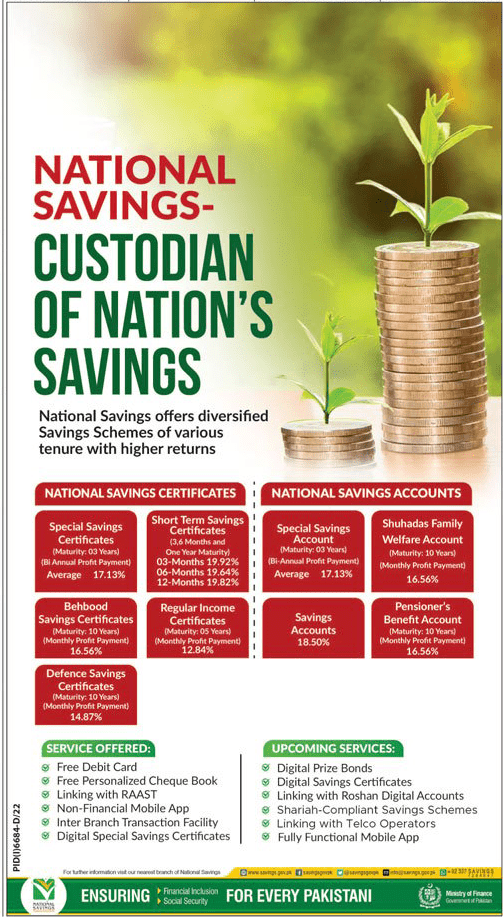

I am sharing here the National Savings Latest Saving Schemes 2023 for various terms and higher returns/profit. The National Savings have now introduced new saving accounts and saving certificates. The details are as under:

The National Savings Latest Saving Schemes 2023

The National Savings Bank of Pakistan is owned by the Central Directorate of National Savings. It works as an attached department of finance under the control of the Ministry Of Finance. It functions as Custodian of the Nation’s Savings.

Aims/Vision of National Saving

National saving is working in order to promote the Habit of Thrift for the mobilization of savings. It is helpful for the small Savers in facilitating the objective of financial inclusion. In the same way, it also operates to extend Social Security to all the deserving sections of society. It made the convenient and easy transfer of payments of bills and purchases.

Save More Earn More

National Saving helps all small Investors to Save Money As Saving Certificates and in Saving Accounts. National Savings provides all these facilities by which the user can earn more profit at a higher rate.

Services Offered

It provides the best of services for every Pakistani as Financial inclusions and Social safety by the provision of the following services:

- Free Debit Cards help to make transactions any time in a week. Totally 24/7 service helps to get money conveniently.

- Free Personalized Cheque Book helps to make easy payments. Easy to carry and secure.

- Linking with RAAST helps to connect easily. As it offers fast pay and Receipt method.

- Inter Branch Transaction Facility helps to make without charges inter-branch transactions. It helps to reduce the deduction of service charges.

- Digital Special Saving Certificates help to generate saving certificates for customers. These are available as an investment opportunities for small and medium savers in order to meet their periodic financial needs

- Non-Financial Mobile App helps The user in order to check the transaction history and the result of the draw of prize bonds results

National Savings offers diversified savings schemes of various tenures with higher returns in order to assist small savers.

National Savings Certificates

The National Savings provide diversified savings certificates to users with different maturity periods with higher returns.

Special Savings Certificates

National Savings provide say special savings certificates for a maturity period of three years so that an average annual profit payment is 17.13%

Short-term savings National Savings also provide short-term savings certificates for a maturity period of three and six months also for one year.

Special Saving Accounts

These accounts help small investors in order to save money by depositing it in the various accounts of National Savings according to their needs. They can deposit money for maturity period which suits them as 3, 6,12 Months, or up to 01-10 years.

National Saving Certificates (NSC)

| Sr.No | Certificates | Maturity Period | Rate Of Return |

| 1. | Special Saving Certificate | 03-Years | Average

17.13% |

| 2. | Short Term Saving Certificates | 03-Months

06-Months 01-Year |

19.92%

19.64% 19.82% |

| 3. | Behood Saving Certificate | 10-Years | Monthly Profit 16.56% |

| 4. | Regular Income Certificate | 05-Years | Monthly Profit 12.84% |

| 5. | Defense Saving Certificate | 10-years | Monthly Profit 14/87% |

National Saving Accounts

| Sr. No | Account Name | Maturity Period | Rate of Return |

| 1. | Special Saving Accounts | 03-years | Average 17.13% |

| 2. | Shuhdas Family Welfare Account | 01-year | Average

16.56% |

| 3. | Saving Accounts | Average

18.50% |

|

| 4. | Pensioner’s Benefit Accounts | 10-years | Average

16.56% |

Future Services/Upcoming Services

It is planning To provide the following feature services to all customers and users;

- Prize Bonds

- Digital Savings Certificates

- Linking with Saving Certificates

- Shariah Complaint Saving Schemes

- Linking with Telco Fully Functional Mobile App