Last Updated on July 2, 2023 by Galaxy World

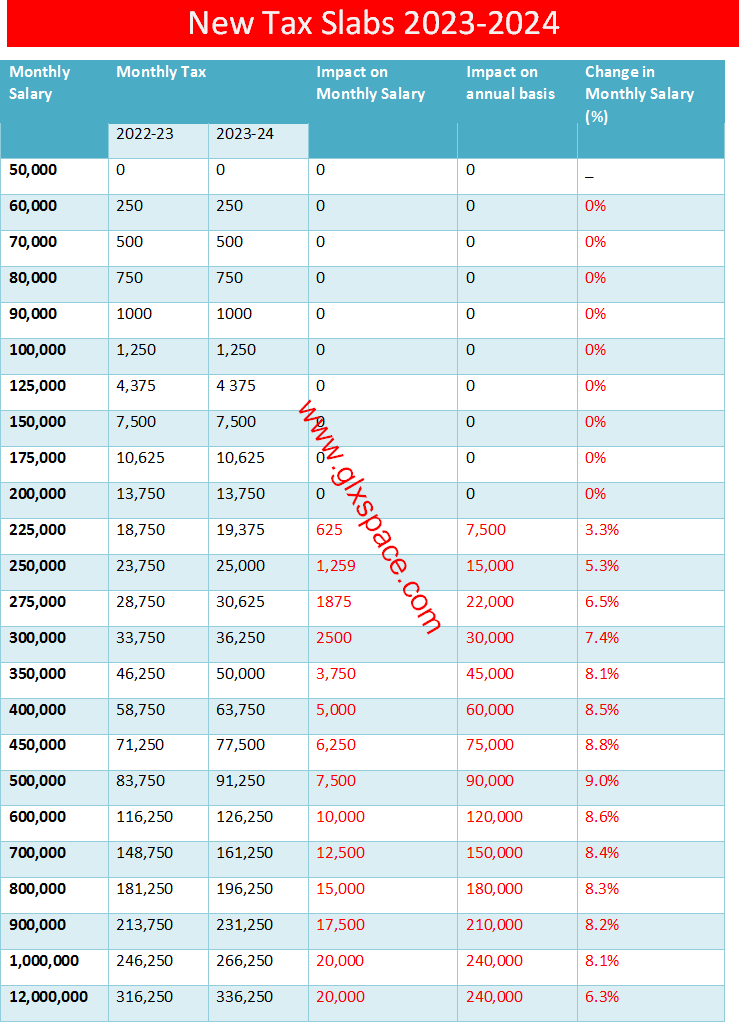

I am sharing here the New Income Tax Slabs 2023-24 for Employees / Salaried Persons. The false news of an increase in taxes for all Government Employee’s salaries is spreading. It is not true as the revised tax rates do not affect all government Employees. It will only impact a specific range of Taxable Salaries. I am sharing here the Revised Tax Slabs for Government Employees. According to revised Tax Slabs, the rate of tax increases gradually in relation to income. The Revision in Tax Slabs is for years 2023-24. The employees shall pay more tax as per new tax slabs as it is effective on Government Employees/ Salaried individuals. The New tax slab shows the change in the rate of tax as per Taxable salary. It also shows the monthly and annual impact of tax on the salaries of employees.

Revised Income Tax Slabs 2023-24 for Salaried Persons

Revised Tax Slabs for Government Employees / Salaried Persons are as given below:

| Monthly Salary | Monthly Tax | Impact on Monthly Salary | Impact on an annual basis | Change in Monthly Salary (%) | |

| 2022-23 | 2023-24 | ||||

| 50,000 | 0 | 0 | 0 | 0 | _ |

| 60,000 | 250 | 250 | 0 | 0 | 0% |

| 70,000 | 500 | 500 | 0 | 0 | 0% |

| 80,000 | 750 | 750 | 0 | 0 | 0% |

| 90,000 | 1000 | 1000 | 0 | 0 | 0% |

| 100,000 | 1,250 | 1,250 | 0 | 0 | 0% |

| 125,000 | 4,375 | 4 375 | 0 | 0 | 0% |

| 150,000 | 7,500 | 7,500 | 0 | 0 | 0% |

| 175,000 | 10,625 | 10,625 | 0 | 0 | 0% |

| 200,000 | 13,750 | 13,750 | 0 | 0 | 0% |

| 225,000 | 18,750 | 19,375 | 625 | 7,500 | 3.3% |

| 250,000 | 23,750 | 25,000 | 1,259 | 15,000 | 5.3% |

| 275,000 | 28,750 | 30,625 | 1875 | 22,000 | 6.5% |

| 300,000 | 33,750 | 36,250 | 2500 | 30,000 | 7.4% |

| 350,000 | 46,250 | 50,000 | 3,750 | 45,000 | 8.1% |

| 400,000 | 58,750 | 63,750 | 5,000 | 60,000 | 8.5% |

| 450,000 | 71,250 | 77,500 | 6,250 | 75,000 | 8.8% |

| 500,000 | 83,750 | 91,250 | 7,500 | 90,000 | 9.0% |

| 600,000 | 116,250 | 126,250 | 10,000 | 120,000 | 8.6% |

| 700,000 | 148,750 | 161,250 | 12,500 | 150,000 | 8.4% |

| 800,000 | 181,250 | 196,250 | 15,000 | 180,000 | 8.3% |

| 900,000 | 213,750 | 231,250 | 17,500 | 210,000 | 8.2% |

| 1,000,000 | 246,250 | 266,250 | 20,000 | 240,000 | 8.1% |

| 12,000,000 | 316,250 | 336,250 | 20,000 | 240,000 | 6.3% |

As per the table, you can see the revised rates of taxes and salary chart. According to these Tax Slabs, the change in tax is effective on a salary of 200,000 (Two Hundred Thousand) or above. The revised rates of taxes are not impacting salary from 50,000 to 200,000. Hence, the news of increases in taxes for all salaried individuals is not correct. The Tax increase is only effective on employees with a minimum salary of 200,000 per month.

Comparison of Tax Slabs 2022-23 & 2023-23

If we compare both the year tax slabs we see that there is no impact for the employees whose salaries are less than 2 lacs per month. If the employees had less than 200,000/- pay and allowances before the budget 2023-24 and now their salaries crossed these figures they have to pay more tax. You can see the Income tax Rates slabs 2022-23 for employees and find the difference.

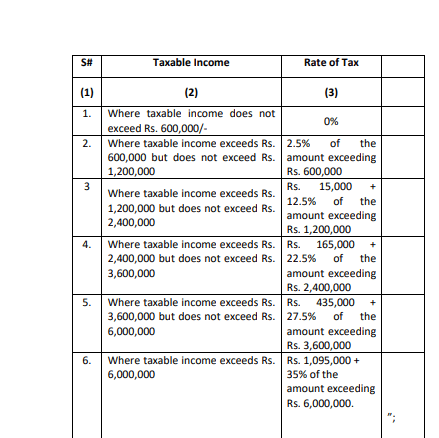

Tax Slabs Gazette Notification

There is a reasonable salary increase as per the budget speech 2023-24 for Federal Employees. A large number of employees’ salaries will go beyond 0.2 million per month. Below is the tax slabs gazette Notification extracted from Finance Bill 2023-24 published in June 2023.