Last Updated on May 28, 2024 by Galaxy World

There is a Proposal of 1% to 5% Tax on Pension in Budget 2024-25. However, this tax on pension will not be for all pensioners. There is a proposal to fix the range to impose a tax on pensions. The details are as follows:

Taxable Pension Proposal 1% to 5% Tax on Pension in Budget 2024-25

As per the news, there is a proposal to impose a tax ranging from 01% to 5% on the pension of the pensioners. The range of pension taxable is as under:

- Minimum 60,000/- per month

- Or 100,000/- per month

Government employees are already paying tax on their salary. The government has already issued the revised income tax slabs 2023-24 for Government employees. As per the resort previous year Governmet employees paid the most tax as compared to other categories of tax payers.

Tax on Duel Pension

The government may impose a tax on pensions for employees taking dual pensions. Here duel pension means the pensioner who is getting pension from two different sources. This pension explains that one employee got a pension from one department/office and got another government job, then he retired from there too, and thus he became eligible for a dual pension. In addition to that, there are some other kinds of dual pensioners. For example, an employee can get the pension of his wife too and this is his own pension. A daughter may get her father’s and mother’s pension too. The government has already issued the Notification of the Child of the deceased pensioner eligible for two pensions simultaneously from both of his parents.

Estimated Amount of Tax per Month

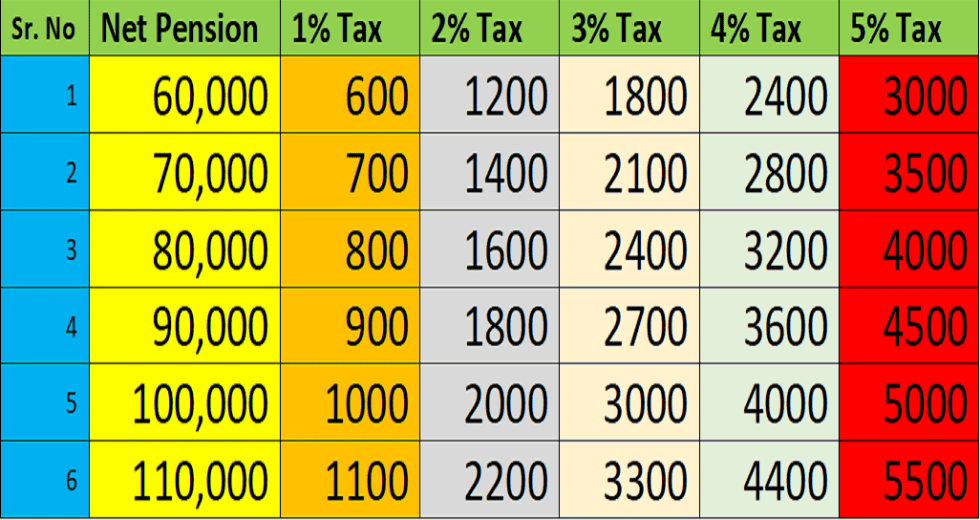

If one of the above proposals government adopts in the coming budget, then some of the calculations of tax are as below:

| Sr. No | Net Pension | 1% Tax | 2% Tax | 3% Tax | 4% Tax | 5% Tax |

| 1 | 60,000 | 600 | 1200 | 1800 | 2400 | 3000 |

| 2 | 70,000 | 700 | 1400 | 2100 | 2800 | 3500 |

| 3 | 80,000 | 800 | 1600 | 2400 | 3200 | 4000 |

| 4 | 90,000 | 900 | 1800 | 2700 | 3600 | 4500 |

| 5 | 100,000 | 1000 | 2000 | 3000 | 4000 | 5000 |

| 6 | 110,000 | 1100 | 2200 | 3300 | 4400 | 5500 |

If we look at the above calculations, there are chances that the Government will not adopt the option of 3, 4, or 5%. And most probably chances Government may recommend the proposal of 1 or 2%. That is a suitable amount of tax for the pensioners.

No Tax on Pension

If the Government fixes the range of a minimum of 60000/- for pension, then the pensioners having less than 60,000/- pension will have to pay no tax on pension. Only the pensioners having more than 60,000/- pension will have to pay the tax. In the same way, if the Government adopts the range of 100000/- then the pensioners having pension less than 1 lac will have to pay no tax. Only the pensioners having a pension of more than 1 lac will have to pay pension tex.