Download Income Tax Slabs and Tax CalculationsI have prepared the Income Tax Calculations 2024-25 and 2023-24 with the help of old Income Tax Slabs and new expected I. Tax slabs. All these calculations depend on the approval of new tax rates with effect from 1st July 2024 as per Budget Speech 2024-25. Still, we are calculating on the basis of the budget speech Copy 2024-25 Federal of the Finance Minister. These calculations are not yet final. However, After approval, these will take effect from 1st July 2024. The Government may make some amendments to it.

Income Tax Calculations 2024-25 and 2023-24 and Income Tax Slabs

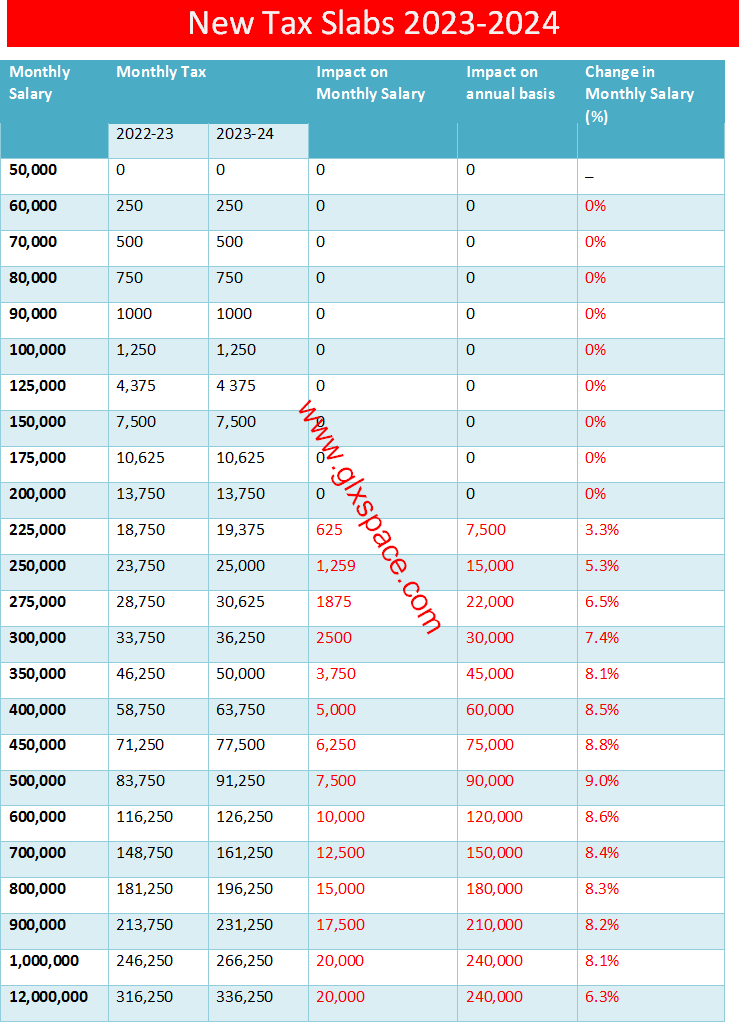

There are changes in the income tax slabs during previous years and this year 2024-25. The Tax slabs for the amount till 22,00,000/- annual income are the same with different tax rates and different lump sum amount tax amount. Employees having monthly income Rs. 50001 to Rs. 100,000/- will have to pay double income tax. The maximum amount of tax increased for this category of employees is Rs. 1250/- per month and the minimum increase is Re.1.

Salaries Persons having annual gross salary from 12,00,001 to 22,00,000/- will have to pay tax with an increase of 1250/- per month (minimum) to 3333/- (maximum). If any employee was paying previously Rs. 11667/- per month then he has to pay now Rs. 15,000/- per month. I have already prepared the Income Tax Calculator 2024-25 for Salaried Persons. You can easily enter your gross amount there and find the tax. However at the request of many employees I have made these calculations on a simple sheet.

Download Income Tax Slabs and Tax Calculations

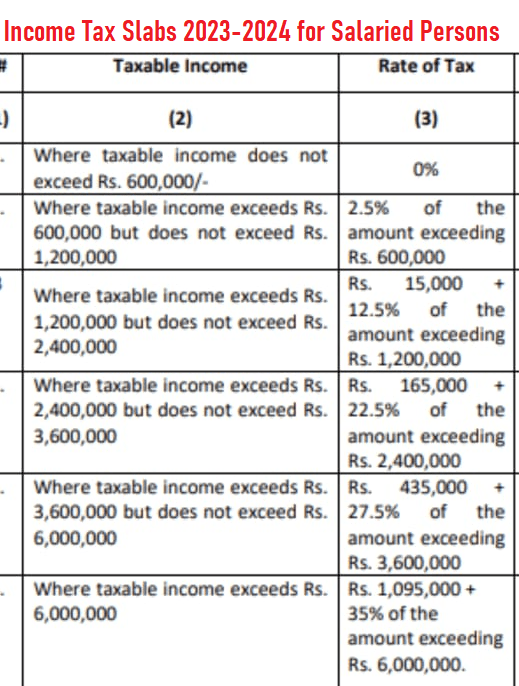

Income Tax Slabs for Salaried Persons 2024-2025 and 2023-2024

I.Tax Slabs 2024-25

| Expected Tax Slabs 2024-2025 | |

| Taxable Annual Income does not exceed Rs. 600,000/- | 0% |

| Taxable Annual Income exceeds Rs. 600,000/- but not more than 12,00,000/- | 5% of the amount exceeding Rs. 600,000/- |

| The Taxable Annual Income exceeds Rs. 12,00,000/- but does not more than 22,00,000/- | Rs. 30,000 + 15% of the amount exceeding Rs. 12,00,000/- |

| Taxable Annual Income exceeds Rs. 22,00,000/- but does not more than 32,00,000/- | Rupees 180,000 + 25% of amount exceeding 22,00,000/- |

| The Taxable Annual Income exceeds. 32,00,000/- but not more than Rs. 41,00,000/- | Rs. 430,000 +30% of the exceeding amount Rs. 32,00,000/- |

| Taxable Annual Income exceeds Rs. 41,00,000/- | Rs. 700,000 + 35% of the exceeding Amount of Rs. 41,00,000/- |

I.Tax Calculators for Different Amounts of Monthly and Annual Gross Salary

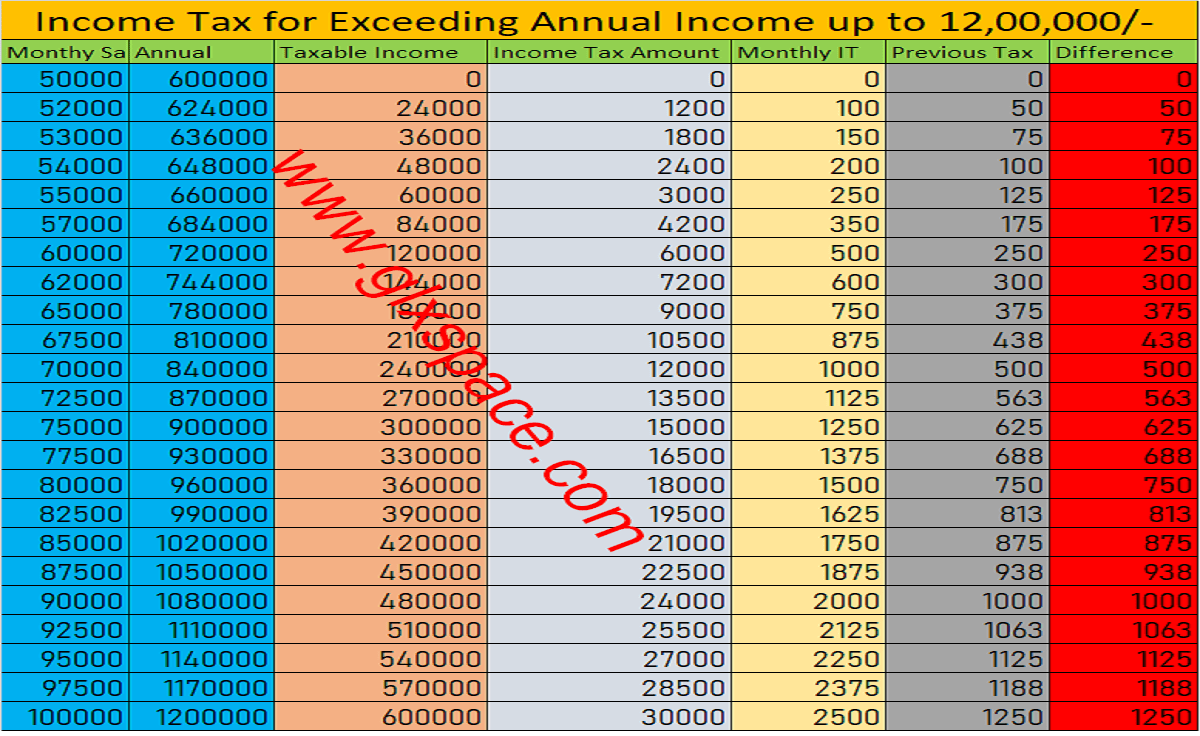

Income Tax for Exceeding Annual Income up to 12,00,000/- |

||||||

| Monthly Salary | Annual | Taxable Income | Income Tax Amount | Monthly IT | Previous Tax | Difference |

| 50000 | 600000 | 0 | 0 | 0 | 0 | 0 |

| 52000 | 624000 | 24000 | 1200 | 100 | 50 | 50 |

| 53000 | 636000 | 36000 | 1800 | 150 | 75 | 75 |

| 54000 | 648000 | 48000 | 2400 | 200 | 100 | 100 |

| 55000 | 660000 | 60000 | 3000 | 250 | 125 | 125 |

| 57000 | 684000 | 84000 | 4200 | 350 | 175 | 175 |

| 60000 | 720000 | 120000 | 6000 | 500 | 250 | 250 |

| 62000 | 744000 | 144000 | 7200 | 600 | 300 | 300 |

| 65000 | 780000 | 180000 | 9000 | 750 | 375 | 375 |

| 67500 | 810000 | 210000 | 10500 | 875 | 438 | 438 |

| 70000 | 840000 | 240000 | 12000 | 1000 | 500 | 500 |

| 72500 | 870000 | 270000 | 13500 | 1125 | 563 | 563 |

| 75000 | 900000 | 300000 | 15000 | 1250 | 625 | 625 |

| 77500 | 930000 | 330000 | 16500 | 1375 | 688 | 688 |

| 80000 | 960000 | 360000 | 18000 | 1500 | 750 | 750 |

| 82500 | 990000 | 390000 | 19500 | 1625 | 813 | 813 |

| 85000 | 1020000 | 420000 | 21000 | 1750 | 875 | 875 |

| 87500 | 1050000 | 450000 | 22500 | 1875 | 938 | 938 |

| 90000 | 1080000 | 480000 | 24000 | 2000 | 1000 | 1000 |

| 92500 | 1110000 | 510000 | 25500 | 2125 | 1063 | 1063 |

| 95000 | 1140000 | 540000 | 27000 | 2250 | 1125 | 1125 |

| 97500 | 1170000 | 570000 | 28500 | 2375 | 1188 | 1188 |

| 100000 | 1200000 | 600000 | 30000 | 2500 | 1250 | 1250 |

The Income Tax for Exceeding Annual Income up to 22,00,000/- |

||||||

| Monthly Salary | Annual | Taxable Income | Income Tax Amount | Monthly IT | Previous Tax | Difference |

| 100001 | 1200012 | 12 | 30002 | 2500 | 1250 | 1250 |

| 105000 | 1260000 | 60000 | 39000 | 3250 | 1875 | 1375 |

| 110000 | 1320000 | 120000 | 48000 | 4000 | 2500 | 1500 |

| 115000 | 1380000 | 180000 | 57000 | 4750 | 3125 | 1625 |

| 120000 | 1440000 | 240000 | 66000 | 5500 | 3750 | 1750 |

| 125000 | 1500000 | 300000 | 75000 | 6250 | 4375 | 1875 |

| 130000 | 1560000 | 360000 | 84000 | 7000 | 5000 | 2000 |

| 135000 | 1620000 | 420000 | 93000 | 7750 | 5625 | 2125 |

| 140000 | 1680000 | 480000 | 102000 | 8500 | 6250 | 2250 |

| 145000 | 1740000 | 540000 | 111000 | 9250 | 6875 | 2375 |

| 150000 | 1800000 | 600000 | 120000 | 10000 | 7500 | 2500 |

| 155000 | 1860000 | 660000 | 129000 | 10750 | 8125 | 2625 |

| 160000 | 1920000 | 720000 | 138000 | 11500 | 8750 | 2750 |

| 165000 | 1980000 | 780000 | 147000 | 12250 | 9375 | 2875 |

| 170000 | 2040000 | 840000 | 156000 | 13000 | 10000 | 3000 |

| 175000 | 2100000 | 900000 | 165000 | 13750 | 10625 | 3125 |

| 180000 | 2160000 | 960000 | 174000 | 14500 | 11250 | 3250 |

| 183333 | 2199996 | 999996 | 179999 | 15000 | 11667 | 3333 |

Income Tax for Exceeding Annual Income up to 32,00,000/- |

||||||

| Monthly Salary | Annual | Taxable Income | Income Tax Amount | Monthly IT | Previous Tax | Difference |

| 183334 | 2200008 | 8 | 180002 | 15000 | 11667 | 3333 |

| 185000 | 2220000 | 20000 | 185000 | 15417 | 11875 | 3542 |

| 190000 | 2280000 | 80000 | 200000 | 16667 | 12500 | 4167 |

| 195000 | 2340000 | 140000 | 215000 | 17917 | 13125 | 4792 |

| 200000 | 2400000 | 200000 | 230000 | 19167 | 13750 | 5417 |

| 205000 | 2460000 | 260000 | 245000 | 20417 | 14875 | 5542 |

| 210000 | 2520000 | 320000 | 260000 | 21667 | 16000 | 5667 |

| 215000 | 2580000 | 380000 | 275000 | 22917 | 17125 | 5792 |

| 220000 | 2640000 | 440000 | 290000 | 24167 | 18250 | 5917 |

| 225000 | 2700000 | 500000 | 305000 | 25417 | 19375 | 6042 |

| 230000 | 2760000 | 560000 | 320000 | 26667 | 20500 | 6167 |

| 235000 | 2820000 | 620000 | 335000 | 27917 | 21625 | 6292 |

| 240000 | 2880000 | 680000 | 350000 | 29167 | 22750 | 6417 |

| 245000 | 2940000 | 740000 | 365000 | 30417 | 23875 | 6542 |

| 250000 | 3000000 | 800000 | 380000 | 31667 | 25000 | 6667 |

| 255000 | 3060000 | 860000 | 395000 | 32917 | 26125 | 6792 |

| 260000 | 3120000 | 920000 | 410000 | 34167 | 27250 | 6917 |

| 265000 | 3180000 | 980000 | 425000 | 35417 | 28375 | 7042 |

| 266500 | 3198000 | 998000 | 429500 | 35792 | 28713 | 7079 |

The Income Tax for Exceeding Annual Income up to 41,00,000/- |

||||||

| Monthly Salary | Annual | Taxable Income | Income Tax Amount | Monthly IT | Previous Tax | Difference |

| 267000 | 3204000 | 4000 | 431200 | 35933 | 28825 | 7108 |

| 270000 | 3240000 | 40000 | 442000 | 36833 | 29500 | 7333 |

| 275000 | 3300000 | 100000 | 460000 | 38333 | 30625 | 7708 |

| 280000 | 3360000 | 160000 | 478000 | 39833 | 31750 | 8083 |

| 285000 | 3420000 | 220000 | 496000 | 41333 | 32875 | 8458 |

| 290000 | 3480000 | 280000 | 514000 | 42833 | 34000 | 8833 |

| 295000 | 3540000 | 340000 | 532000 | 44333 | 35125 | 9208 |

| 300000 | 3600000 | 400000 | 550000 | 45833 | 36250 | 9583 |

| 305000 | 3660000 | 460000 | 568000 | 47333 | 37625 | 9708 |

| 310000 | 3720000 | 520000 | 586000 | 48833 | 39000 | 9833 |

| 315000 | 3780000 | 580000 | 604000 | 50333 | 40375 | 9958 |

| 320000 | 3840000 | 640000 | 622000 | 51833 | 41750 | 10083 |

| 325000 | 3900000 | 700000 | 640000 | 53333 | 43125 | 10208 |

| 330000 | 3960000 | 760000 | 658000 | 54833 | 44500 | 10333 |

| 335000 | 4020000 | 820000 | 676000 | 56333 | 45875 | 10458 |

| 340000 | 4080000 | 880000 | 694000 | 57833 | 47250 | 10583 |

| 341665 | 4099980 | 899980 | 699994 | 58333 | 47708 | 10625 |

Income Tax for Exceeding Annual Income More than 41,00,000/- |

||||||

| Monthly Salary | Annual | Taxable Income | Income Tax Amount | Monthly IT | Previous Tax | Difference |

| 342000 | 4104000 | 4000 | 701400 | 58450 | 47800 | 10650 |

| 345000 | 4140000 | 40000 | 714000 | 59500 | 48625 | 10875 |

| 350000 | 4200000 | 100000 | 735000 | 61250 | 50000 | 11250 |

| 355000 | 4260000 | 160000 | 756000 | 63000 | 51375 | 11625 |

| 360000 | 4320000 | 220000 | 777000 | 64750 | 52750 | 12000 |

| 365000 | 4380000 | 280000 | 798000 | 66500 | 54125 | 12375 |

| 370000 | 4440000 | 340000 | 819000 | 68250 | 55500 | 12750 |

| 375000 | 4500000 | 400000 | 840000 | 70000 | 56875 | 13125 |

| 380000 | 4560000 | 460000 | 861000 | 71750 | 58250 | 13500 |

| 385000 | 4620000 | 520000 | 882000 | 73500 | 59625 | 13875 |

| 390000 | 4680000 | 580000 | 903000 | 75250 | 61000 | 14250 |

| 395000 | 4740000 | 640000 | 924000 | 77000 | 62375 | 14625 |

| 400000 | 4800000 | 700000 | 945000 | 78750 | 63750 | 15000 |

| 405000 | 4860000 | 760000 | 966000 | 80500 | 65125 | 15375 |

| 410000 | 4920000 | 820000 | 987000 | 82250 | 66500 | 15750 |

| 415000 | 4980000 | 880000 | 1008000 | 84000 | 67875 | 16125 |

| 420000 | 5040000 | 940000 | 1029000 | 85750 | 69250 | 16500 |

| 450000 | 5400000 | 1300000 | 1155000 | 96250 | 77500 | 18750 |

| 460000 | 5520000 | 1420000 | 1197000 | 99750 | 80250 | 19500 |

| 465000 | 5580000 | 1480000 | 1218000 | 101500 | 81625 | 19875 |

| 470000 | 5640000 | 1540000 | 1239000 | 103250 | 83000 | 20250 |

| 500000 | 6000000 | 1900000 | 1365000 | 113750 | 91250 | 22500 |

| 600000 | 7200000 | 3100000 | 1785000 | 148750 | 91250 | 57500 |

| 700000 | 8400000 | 4300000 | 2205000 | 183750 | 126250 | 57500 |

| 800000 | 9600000 | 5500000 | 2625000 | 218750 | 161250 | 57500 |

What a joke to salried class having pvt Jobs and with services for more than 55 years .now it’s time that we can get the retirment benifits of entir efforts which they put . But unfortunately rather to giving benifits govt has increased the taxes on us please look in to it and reduce taxes from age 50 and plus.