Last Updated on September 10, 2024 by Galaxy World

Government of Pakistan, Finance Division issued a Notification on 10-09-2024 in connection with Voluntary Retirement Penalties 2024. Employees who will retire before 60 years of age will have to face a penalty of 3% per year but a maximum of 20%. The details are as follows

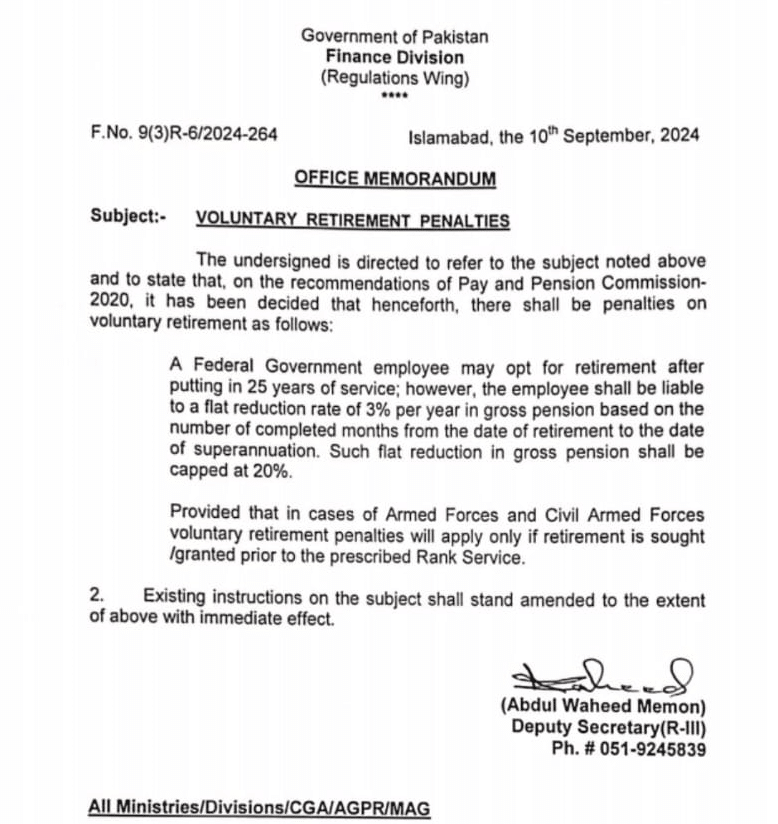

Voluntary Retirement Penalties 2024

The undersigned is directed to refer to the subject noted above and to state that, on the recommendations of Pay and Pension Commission-2020, it has been decided that henceforth, there shall be penalties on Voluntary Retirement as follows:

New Rules of Retirement 2024

A federal Government employee may opt for retirement after putting in 25 years of service. However, the employee shall be liable to a falt reduction rate of 3% per year in gross pension based on the number of completed months from the date of retirement to the date of superannuation. Such flat reduction if gross pension shall have a capping at 20%.

Provided that in cases of Armed Forces and Civil Armed Forces, Voluntary retirement penalties will apply only if retirement is sought/granted prior to the prescribed Rank Service.

Existing instructions on the subject shall stand amended to the extent of above with immediate effect.

Summary:

Superannuation Date:

Here the superannuation date means the date of reaching 60 years of age.

Per Year Penalty After 25 Years Retirement:

3% with capping of 20% maximum

if an employee opt for retirement at the age of 53 three years and 7 years penalty will apply @ 3% per years maximum 20% caped based on numbers of months from retirement to superannuation. Clarification is requested that 20% will be total amount of penalty and reduction will be made on monthly basis or 20% will be reduced during every month till superannuation please

I thins the existing forumal is total emmoluments multiplied by length of service and divded by 30 which means if u go on 30 years service then there will be no penalty. But now as per new amendment the penalty will be imposed even if u opt for early retirement at the age of 59.99 and formula will be total emmoluments multiplied by age divided by 60. For example if a person retires at 59 years of age and he has total emmoluments of Rs.100,000/- then 100,000 will be divided by 59 and divided by 60 and result would come to Rs.98,333.33 which means there will be a penalty of Rs.1666.66. In other words if one goes on early retirment at the age of 59.9 he will pay flat reduction penalty of 3% at gross at once as a final penalty and if u go on retirement at the age of 58 then u will have to pay 4 percent pay and if u go on 57 you will pay 5 percent and so on and so on.

It may be clarify that if an employee has opted for LPR, and that has been accepted by the authority, however, LPR will be started from November 2014, he can withdraw his option for retirement and LPR after issuance of present penalty orders as I think at present OM of 2011 ( in which retirement and LPR option was allowed for withdraw before retirement date) has not been withdrawn.

Please calrify also keeping in the consideration of OM of April 2024 regarding cases of optional retirement after 25 years of service however leave without pay effects their qualify service .

Thanks